Newport Builder Agrees to Settle With Creditors

- Share via

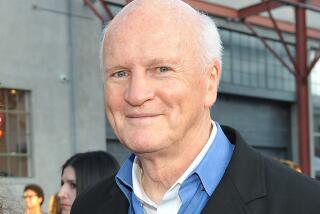

SANTA ANA — Onetime building industry leader Charles J. Diamond, accused of fraud by former friends in a bitter bankruptcy case, tentatively agreed Tuesday to settle his debts to all of his creditors.

Diamond, who also was treasurer of the Newport Harbor Art Museum, agreed to recognize as personal debts several million dollars that his former friends had turned over to him.

The settlement, outlined in U.S. Bankruptcy Court in Santa Ana, would end an emotionally charged case that had pitted longtime friends against Diamond.

Diamond said Tuesday that, while he was glad to see the end near, he was angry that his problems with creditors were publicized, hurting his job prospects.

But his friends, who generally have agreed to cut their claims in half, are angry at what they say is his betrayal of their trust. They asserted that they gave him money as a friend, even though they made checks out to his companies and received interest from them.

“We may have made a settlement in terms of dollars, but we’ll never forget how this was done to us,” said Richard Polonsky, the largest single creditor at $1.375 million. “These scars are going to last forever.”

Court records indicate that about two dozen friends, neighbors and family members entrusted to Diamond a total of $4.5 million, they said, for safekeeping or loans.

But Diamond, a former president of the Building Industry Assn. of Orange County, had denied that he owed them any money. It was invested in his now-worthless companies, he said, and was not his personal debt to repay.

His renunciation had ripped apart the close-knit community of affluent friends and neighbors in Newport Beach, where residents are known to give each other thousands of dollars as unsecured loans or investments on a handshake.

Under the tentative settlement, Diamond agreed to sell his Newport Beach home and turn over the first $75,000 in equity to creditors. He also would sell most of his extensive art collection, the value of which is unknown, and his wine collection, estimated at $10,000.

In addition, he would give creditors the proceeds from a real estate investment trust for the next eight years, about $75,000 to $100,000 annually, as well as half of his annual $75,000 consulting fee with the trust for five years.

His lawyer, Rebecca J. Callahan, declined to estimate the sale proceeds because final calculations are incomplete.

Nanette D. Sanders, a lawyer for the creditors’ committee, said initial estimates indicate that up to $1.5 million could be raised to pay debts that now total about $3 million, the amount owed after some creditors withdrew claims and others cut theirs in half.

The proceeds could give remaining creditors 30 to 50 cents on the dollar after legal fees and costs, Sanders said.

U.S. Bankruptcy Court Judge Lynne Riddle scheduled a hearing for Feb. 20 on the agreement.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.