Companies Have Divergent Management Styles

- Share via

The proposed merger of drug distributor Bergen Brunswig Corp. and pharmaceuticals maker Ivax Corp. brings together two industry giants with wildly divergent management styles--usually a recipe for conflict. Indeed, some analysts say that Ivax founder and chairman Phillip Frost’s entrepreneurial style is so strong that he could overpower Bergen Brunswig Chairman Robert E. Martini once the two men assume co-chairmanship of the merged company, to be called BBI Healthcare Inc.

But while Frost, who has made his mark as a freewheeling deal-maker, is the stronger personality, other industry watchers say the deal is structured specifically to prevent him and his team at Ivax from dominating the $1.4-billion merger.

“It will be more important to look at the Bergen Brunswig people than the Ivax people,” said James Flynn, an industry analyst with New York brokerage Furman Selz.

That’s because Bergen Brunswig’s 63-year-old chairman, who is running a company his father founded and his brother helped build, has made sure that daily control of the new company will rest in the hands of people he has picked.

As dynamic as Frost is, he comes into the deal as a supplicant. Even though Ivax shareholders get a 56% stake in the new company, Bergen Brunswig is supplying the two top operating officers, the co-chairman and a majority of the board of directors.

And it is with 50-year-old Donald R. Roden, Bergen Brunswig’s chief executive-elect and the proposed new chief executive of BBI, that the real power lies.

“The chief executive is the key in these deals,” said David F. Saks, an analyst with Gruntal & Co. brokerage in New York.

Still, the 60-year-old Frost “will have a lot to say about [BBI] operations,” said Thom Brown, an analyst with Philadelphia brokerage Rutherford Brown & Catherwood. “He is not a retiring type, and he owns a lot of Ivax stock, so he’ll own a lot of BBI.”

*

Until lately, Bergen Brunswig seemed to have fallen asleep. Martini acknowledged that last year when he hired longtime health industry executive Roden as president and chief operating officer. Roden, he said, was a person “who could make a difference.” The $9-billion-a-year distribution giant too often found itself taking marching orders from manufacturers who depended on its channels to help sell their goods.

That has changed under Roden, a marketing specialist who Martini chose last month to succeed him as chief executive in January.

In the past year, analysts say, Bergen Brunswig has taken the initiative and used its size to start telling suppliers what it expects them to do rather than following the suppliers’ demands. “Now they are offering suppliers of generic drugs big market position in return for price cuts, and they have achieved significant price cuts,” he said.

Roden ran international publisher Reed Elsevier’s North American medical operations from 1989 through 1993. Before that he spent 12 years as owner and president of Pracon Inc., a Virginia-based management consulting firm for the health-care industry; was vice president of a Bergen Brunswig unit in Northern California for two years, from 1975-1977; and was vice president of a company that managed pharmaceutical benefits programs for employers.

His strengths, analysts say, are in planning and organizing and in marketing the company’s products.

*

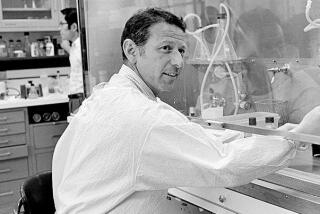

Frost’s strength is in making deals.

A physician who invented medical products, Frost bought a failing drug maker for $50,000 in the mid-1970s and sold it a decade later for $800 million.

He soared into super wealth with Ivax, which he grew from scratch into a $1.3-billion-a-year drug and chemicals company. Frost is on the Forbes 400 list of the nation’s wealthiest people this year with a personal fortune of $490 million--putting him ahead of computer maven Steven Jobs and real estate developer Donald Trump, to name a few.

Both Ivax and Frost’s former company, Key Pharmaceuticals, grew largely because of a string of acquisitions that Frost engineered, analysts said.

But Frost has the entrepreneur’s too-common failure--an inability to focus on organizing his business.

Today, many of Ivax’s units don’t mesh well and few have been fully integrated, making the company more a mishmash than a corporation, analysts say. The company comes into the merger with a string of losses and plummeting stock value.

So Frost’s superheated entrepreneurial style is not likely to cancel out Bergen Brunswig’s decidedly more corporate approach to business.

“That’s the only way the deal makes sense,” analyst Flynn said. “They need Bergen Brunswig’s efficiency because they haven’t done a good job of integrating and streamlining their operations, and Bergen Brunswig has done that very well.”

And Frost knows that Martini is doing him a favor by buying Ivax, Brown said. “Ivax is really sick, and this is giving Frost a base of operations from which he has much better financing” to fix the company’s ills once it is assimilated into BBI, he said.

*

Jone Pearce, a UC Irvine management professor specializing in organizational behavior, says that mergers in which the top people in the two companies have vastly divergent personalities “don’t work. One side wins and absorbs the other.”

But if one set of personalities is willing to take the back seat, such a marriage can be successful, she said. “The entrepreneur may want bring in a tight management structure and be happy to have someone else come in and run his creation,” she said.

That, says independent health-care industry analyst Hemant Shah, is likely what is happening here.

“Mergers of this size usually only happen on a friendly basis if there already is agreement about management styles and the roles people will play,” he said. “Otherwise, you have unfriendly takeovers.”

(BEGIN TEXT OF INFOBOX / INFOGRAPHIC)

Medical Marriage

The merger of Bergen Brunswig Corp. and Ivax Corp. combines distribution with manufacturing. It also ties a consistent earner, Bergen, with a company that has lost nearly $200 million in two quarters. Share prices for both were down Monday, Ivax at its 52-week low. A look at both companies:

Bergen Brunswig at a Glance

Headquarters: Orange

Chairman/CEO: Robert E. Martini

President and CEO-elect: Donald R. Roden

Employees: 4,770, including about 650 in Orange County

Business: Distributes pharmaceutical, medical and surgical supplies

Fiscal 1996 sales: $10 billion

Fiscal 1996 net income: $74 million

52-week high: $33 on Oct. 24, 1996

52-week low: $23.50 on Nov. 14, 1995

Sales and Earnings

Fiscal quarterly sales and net income, in millions:

Sales

Net income

Share Price

Bergen’s stock dropped 16% to $27.63 after Monday’s merger announcement. Daily closing stock prices:

Monday’s close: $27.63

Ivax Corp. at a Glance

Headquarters: Miami, Fla.

Chairman/CEO: Phillip Frost, M.D.

Employees: 7,893

Business: Generic drug manufacturer

Sale price: $1.4 billion in stock

1995 sales: $1.3 billion

1995 net income: $115 million

52-week high: $31 on April 29, 1996

52-week low: $12.50 on Nov. 11, 1996

Sales and Earnings

Calendar sales and net income/loss, in millions:

Sales

Net income/loss

Share Price

Daily closing stock prices:

Monday’s close: $12.50

Brand to Beat

Generic prescription drugs are slowly gaining market share against the better-known brand-name items. Brands, though, still control a huge segment of the market. Ivax Corp. is the nation’s largest generic manufacturer:

Brands vs. Generics

Sales / Market Share

1993

Brand-name: $45,693 / 93%

Generic: 3,524 / 7

1994

Brand-name: $47,376 / 90%

Generic: 5,277 / 10

1995

Brand-name: $51,787 / 89%

Generic: 6,423 / 11

Top of the Generics

Top generic drug manufacturers, 1995 sales in millions:

Rank Company / Sales

1. Ivax Corp.: $1,260

2. Mylan: 631

3. Zenith/Goldline: 337

4. Geneva Pharmaceuticals: 336

5. Rugby Group: 315

Sources: Bergen Brunswig, Bloomberg Business News, IMS America, Times reports; Researched by JANICE L. JONES / Los Angeles Times

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.