No More Economic Blame Games

- Share via

Playing the blame game can be a no-win contest. That’s especially true when the wrong culprit is blamed. Asia, which only a few years ago seemed to have economies that could do no wrong, has been viewed as largely responsible for its own current predicament. But the world’s fundamental economic worries transcend any one region’s problems or mistakes. Understanding this reality is the key to charting a way out of the crisis.

Until relatively recently, Asia’s secretive financing practices and clandestine corporate ways had been universally regarded as the root cause of the Asian financial crisis. No more. Except for Indonesia, Asia was probably no worse in this regard than any other place. In fact, troubled South Korea actually had better than average economic transparency. And much-maligned Malaysia had in place accountancy standards tighter than those of many European economies. So, was widespread Asian cronyism the big factor behind the roiling failures that began in the summer of 1997? Not really, concludes a provocative recent report on the crisis by the United Nations’ International Labor Office: “In fact there is no clear evidence that there had been an increase in the extent of cronyism or market interventionism in the years immediately prior to the crisis. If these failings had always been present and compatible with high growth in the pre-crisis period, then it needs to be explained why, other things being equal, they should have provoked the crisis.”

There is no disputing that many Asian economies needed a makeover. And the crisis has triggered many needed reforms, especially in Thailand and South Korea. At the same time, as World Bank chief economist Joseph Stiglitz has said, unceasing Western efforts to demonize Asia have a distinctly self-serving feel about them. “Why is transparency such a focal point?” he asked a private audience at the World Bank in Washington late last year. “It is easier to blame the Asian countries and their banking systems for lack of transparency than to question the policies of Western lenders. There is a lot of hypocrisy.”

Rather than trying to lay all the blame on Asia, says MIT professor Paul Krugman in the current Foreign Affairs, try instead to understand the current turmoil this way: There has been a bad accident on the freeway, and, yes, the perpetrator had a prior speeding conviction on his record. But hundreds of other drivers also have had accidents on this very turn in the freeway, so there must be something basically wrong with the construction design, too. “From this analogy,” said Stiglitz, who agrees with Krugman on this point, “looking at the large number of financial crises in the past decades, it seems that the existing international financial architecture is having a lot of crashes.”

Were Asian economies really any more transparent, any less given to crony capitalism in the 1980s, when all was chugging along so nicely, than in the ‘90s, when many of them hit the wall? “To spell it out,” concluded Krugman, if America or Europe should get into trouble next year or the year after, we can be sure that in retrospect analysts will find equally damning things to say about Western values and institutions.”

Nowadays, there is too much money flowing across borders, too much capital volatility. Or within troubled economies, investment money slows to a trickle as the International Monetary Fund imposes anti-inflation and austerity policies that dry up domestic demand. As markets fail to generate adequate demand, the world slides further into recession.

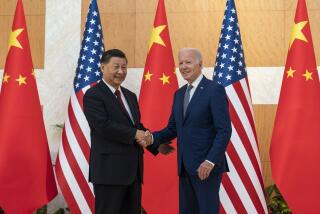

Blaming Asia for the financial crisis creates serious problems. One is economic: Misguided hostility can divert attention from what must be done to avoid serious problems both this year and next. Worldwide demand must be stimulated to avoid the spread of more recession, or worse. A new international system to buffer the most frightening effects of excessive short-term capital flows must be devised quickly. In Latin America right now, both Mexico and Brazil have been rocked by short-term capital flight. There is also a political cost. The blame game exacerbates tensions between Asia and America and could even make China’s resistance to currency convertibility and avoidance of monetary devaluation look positively Confucian in its wisdom.

Krugman, who was among the first to sense the coming of the Asian crisis and then was among the first to sense that Asia could overcome it, is underwhelmed by America’s current superficial prosperity. Despite record stock market increases and record unemployment lows, he finds parallels between today’s economic uncertainty and the onset of the Great Depression: “There is a definite whiff of the 1930s in the air.” And when it comes to our increasingly interdependent world economic system, whether in Asia or America, we all breathe that same air. Asian nations have by and large accepted the need for internal reform. America must accept the need to rein in certain free-market orthodoxies, including unfettered short-term capital flows and growth-suffocating anti-inflation demands. If both sides seek a position of understanding, the no-win blame game can become a win-win situation.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.