Hotels Busy Despite Lack of ‘Destination’

- Share via

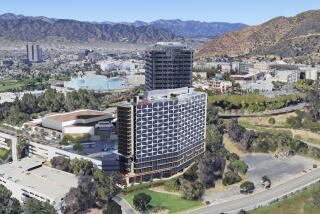

Just a few years ago, the San Fernando Valley looked like it might take a quantum leap in the tourism and hotel industries by becoming what’s known in those industries as a “destination.”

A Universal Studios master plan proposed a considerable expansion of its theme park and more than 3,400 hotel rooms to accommodate demand from that expansion.

Tourism types talked about the Valley becoming a destination in the same sense as Orlando, Fla., where Disney World and the resort hotels surrounding it have become a huge magnet for visitors.

But Universal’s proposal drew strong opposition from community groups, so two years ago the company scaled back the expansion plans and trimmed the number of hotel rooms to 1,200.

Now, with even Universal’s scaled-down plans on hold and promising much less of a boost to the Valley hotel business than the original, the San Fernando Valley doesn’t appear destined to become a destination for the foreseeable future.

Hotel industry observers say the Valley, at least for the time being, will have to be content with the same combination of tourists and business travelers that it has always counted on because there are no likely candidates to come in and build the type of destination resort that Universal’s original plan envisioned.

“The site that the destination hotel was going to occupy is owned by Universal, and it’s a very logical place if you’re going to have a destination resort in the Valley, but I think it would be difficult for anyone else to build there,” said Alan Reay, president of Costa Mesa-based Atlas Hospitality Group, a hotel consulting and brokerage firm. “I have clients who are looking for sites up in that area, but it’s very tough to get them.”

“It looks like things are going to be status quo,” said David Iwata, a consultant for the San Fernando Valley Conference & Visitors Bureau.

Not that the status quo is necessarily bad, Iwata said. It’s just that without a Universal expansion, the Valley hotel business simply won’t grow as much as it might have.

“Obviously, if the expansion program could create a destination like Orlando, it would attract a lot more business here,” Iwata said. “But from the standpoint of the existing hotel business, it’s not going to have a negative impact because we have a growing industry and a balanced base of corporate and leisure travel.

Iwata said Universal’s original, larger hotel plan was tied to a larger theme park expansion. Without the larger park expansion, a huge hotel expansion would make no sense, he said.

Universal officials--widely criticized for trying to overdevelop their property--refused comment.

Michael Collins, executive vice president of the Los Angeles Convention and Visitors Bureau, said the general feeling in the tourism industry was that a destination hotel at Universal would be great for the industry.

“But such a hotel cannot come at the expense of or over the active objections of the people around it. It has to be a plan that accommodates the requirements of the neighborhood,” Collins said. “Regardless of what happens in terms of the expansion, Universal will continue to be a mammoth draw for much of the tourism that comes here anyway.”

In fact, many of those tourists already stay at hotels at or near Universal, where hotel occupancy rates typically run several percentage points higher than those in the Valley as a whole.

“The Universal City-North Hollywood sub-market clearly is the strongest sub-market in the Valley,” said Bruce Baltin, a senior vice president at PKF Consulting. Although PKF does not report occupancy rates for separate sub-markets, Baltin said the company’s studies show hotels in the sub-market run at substantially higher occupancy and room rates than the Valley as a whole.

According to Beverly Garland, owner of Beverly Garland’s Holiday Inn in North Hollywood, the 258-room hotel is achieving occupancy rates of more than 90%, drawing a combination of tourists and business travelers.

“I think this market has plenty of room for everyone, so I don’t think we would be affected by what Universal does,” Garland said. “We all have our niches and they all seem to work.”

Garland, whose family has owned and operated the hotel for 27 years, said both her hotel and the industry in general are enjoying relatively good times after the ups and downs of the past 10 years or so--which included overbuilding in the 1980s, the recession, the Los Angeles riots and the Northridge earthquake.

According to Baltin, the 1980s building binge Garland referred to produced a prodigious number of new hotel rooms, which the Valley and the rest of L.A. have only recently absorbed. PKF estimates about a third of the hotel rooms in L.A. County were built during the ‘80s.

The Northridge earthquake, meanwhile, put some hotels out of business while filling others to capacity with local residents, insurance company adjusters and federal relief officials.

“Every hotel within a 20-mile radius of Northridge was running at 100%,” said Chuck Nester, president of Westlake Village-based Brown Hotel Group, a brokerage, construction and management firm. “We own a hotel in Thousand Oaks that was running in the 55% occupancy range before the earthquake. The day of the earthquake, we went to 100% occupancy and we stayed at 100% for five straight months.”

Even in its recovered state, the Valley hotel industry lags slightly behind the overall L.A. hotel market in occupancy levels, room rates and sales prices.

PKF Consulting figures show the Valley’s hotels operating at 72.5% occupancy through May, with an average daily room rate of $104. By comparison, the L.A. County occupancy rate is 74%, with an average room rate near $112, PKF figures show.

The average price per room paid for San Fernando Valley hotels that sold in 1998 was just under $40,000, compared with more than $48,000 for Los Angeles County, according to Atlas Hospitality Group.

Despite the Valley’s slight lag behind L.A. County as a whole, its numbers are pretty good, according to Baltin, who said hotels usually start making a profit when occupancy approaches 60%.

Baltin pointed out that the hotel industry generally considers a geographic market to be at capacity when the average annual occupancy reaches 75%. That’s because an average annual occupancy of 75% means hotels are probably running between 95% and 100% during peak seasons.

Thus, with an occupancy rate in the 70% range and climbing, the Valley hotel industry is approaching the point where it will need to build more rooms to grow.

That is already occurring in the Calabasas-Westlake Village area, where the growth of high-technology firms has created a demand for rooms targeted at business travelers, Reay said. A 140-room Homestead Village hotel is under construction on Park Sorrento in Calabasas and scheduled to open in March 2000, Reay said.

Reay said general business growth has also boosted demand in Woodland Hills, where a 146-room Extended Stay American hotel is under construction at 20205-20239 Ventura Blvd. and slated to open early next year, and a 142-room Homestead Village hotel is planned at 21055 Ventura Blvd.

Demand is also strong in Burbank, where available land is especially limited, Reay said. A hotel is planned for a 3-acre site on Hollywood Way, but a hotelier hasn’t been chosen, Reay said.

The outlook should remain positive, according to industry consultants, provided the regional economy remains sound.

In addition, the industry could also benefit from the new subway station slated to be completed in North Hollywood next year and from the redevelopment underway in Hollywood, noted hotelier Garland.

But 27 years in the industry have taught Garland to be guarded about the future.

“Our industry is affected by all kinds of events that we can’t control,” she said. “In the 1970s we had the gas crunches. Then, during the 1980s, everybody wanted to build a hotel--and everybody did. Then we had the recession, and then the earthquake and the riots. The business is doing well right now, but you never know what’s going to happen.”

(BEGIN TEXT OF INFOBOX / INFOGRAPHIC)

Hotel Occupancy and Rates

Following are hotel occupancy rates and average daily room rates for the San Fernando Valley and Los Angeles County, 1996 through May 1999.

More to Read

Sign up for The Wild

We’ll help you find the best places to hike, bike and run, as well as the perfect silent spots for meditation and yoga.

You may occasionally receive promotional content from the Los Angeles Times.