Agencies Make a Play for Black Talent

- Share via

After years of toiling on the fringes of Madison Avenue, ad agencies specializing in the black American market are suddenly hot properties.

Seeking to bolster their multicultural marketing expertise, general-market agencies are aggressively courting black-advertising talent.

In the last three months, two of the industry’s top three shops--No. 1 ranked Burrell Communications Group of Chicago and No. 3 Don Coleman Advertising of Southfield, Mich.--have cut deals with general-market ad organizations.

No. 2 ranked UniWorld Group Inc. of New York in May acknowledged it was negotiating a deal with Young & Rubicam Inc. Although no announcement has been made, word on the street is that the deal has fallen apart, but other suitors reportedly are waiting in the wings.

According to rankings by Black Enterprise magazine, the three shops control more than half the billings at the top 20 black-owned agencies.

“This is not about selling out, nor should it be seen as an act of desperation on the part of black-owned ad agencies,” said Ken Smikle, president of Target Market News, a Chicago-based research firm. “This trend represents how important African American market expertise has become to the success of all businesses. And the so-called general-market agencies are responding to the demand from clients to become more involved in targeting black consumers.”

While such recognition might be long overdue, some executives from black-owned ad agencies fear investments from general-market agencies could mean the end of wholly owned, independent black agencies. Currently, general-market advertising agencies control the lion’s share of the $1.1 billion spent annually on marketing to black Americans, with black-owned ad agencies getting less than one-third of that sum, Smikle said.

Driving the interest in targeting minorities is their growing buying power, which has doubled during the last 10 years to more than $1.4 trillion. Black American, Latino and Asian American populations are growing at seven times the rate of the general market and are expected to account for 32% of all Americans by 2010. Yet of the $206 billion spent by advertisers on U.S. media last year, just more than 1% went to ethnic media.

“The traditional advertising holding companies have come to the conclusion that ethnic marketing is becoming a rapidly growing segment and they should be participating in it,” said Bob Huntington, managing director of AdMedia Partners Inc., a New York-based firm specializing in ad-related mergers and acquisitions. “I think, over time, the major agency organizations will be very involved in this marketplace.”

Although many general-market agencies invested in or acquired Latino and Asian agencies during the last decade, most black-owned agencies have remained independent. However, in June, Thomas Burrell broke that barrier by selling a 49% stake in his agency to Paris-based Publicis. “We had lots of choices, and we were very careful in deciding where we would go,” Burrell said in a telephone interview. “We are not just interested in being resources for a multicultural agency to call on when they need to show a prospective client they have multicultural capabilities,” he said. “We are on a very aggressive growth strategy.”

In addition to increasing its share of ad spending targeting black Americans, Burrell said, he hopes to begin winning general-market accounts in which the audiences are largely influenced by black culture. “We are looking to expand the box, instead of just get into it,” he said.

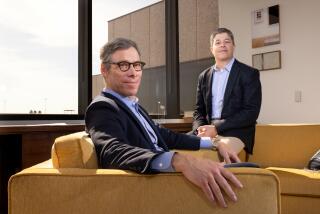

Don Coleman Advertising, which last month sold a 49% stake of its agency to True North Communications Inc., might already be on the verge of that kind of expansion. The agency, which has been handling black American advertising for Domino’s Pizza, this month participated in the pitch for the Ann Arbor, Mich.-based chain’s entire $120-million general-market account. Although it did not emerge as a finalist, Coleman’s presence in the review is noteworthy.

“It may be the first time that this has happened,” said Valentine Zammit, president and chief executive of True North Diversified Cos.

As part of his deal, agency President and founder Don Coleman becomes chief executive of New America Strategies Group, True North’s multicultural agency network. As such, he oversees True North’s interests in his own agency, as well as Latino agency SiboneyUSA; Imada Wong Communications Group, a non-equity affiliate serving the Asian market; and black American shop Stedman Graham & Partners, in which True North holds a minority stake.

“This is not about buying black or Hispanic talent,” Zammit said. “This is about forming a partnership with talent for a cause. And the cause is to produce the best advertising to generate the best returns on investment for the client as possible.”

Zammit said True North will consider additional investments in multicultural shops. “We’ve just begun,” he said. “We’ve made a commitment that we’re going to significantly invest in this area.”

Adolfo Aguilar Jr., president of the Assn. of Hispanic Advertising Agencies, said the activity among black American shops echoes the activity in the Latino market a decade ago.

“What happened to Hispanic agencies 10 years ago is what’s happening now on the African American side,” he said, predicting another wave of investment in Latino agencies in the next few years.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.