Irish Justice Official Backs Legalized Civil Unions

- Share via

DUBLIN, Ireland — Ireland should legalize civil partnerships between unmarried couples, including homosexuals, but should not institute gay marriage, Justice Minister Michael McDowell said Saturday.

Ireland became a prominent legal battleground on the matter after a lesbian couple filed a lawsuit this month against the country’s tax collection agency for refusing to recognize their 2003 marriage in Canada.

Married couples in Ireland can claim a special income tax credit.

A committee of lawmakers this month also launched public hearings into possible reforms of family law in Ireland, a predominantly Roman Catholic country where homosexuality was outlawed until 1993.

McDowell declared that the government was “unequivocally in favor of treating gay people as fully equal citizens in our society.” But he said the heavy public focus on whether to extend full marriage rights and responsibilities to gay couples was “too narrow.”

He listed a wide range of committed relationships outside marriage that the state should recognize as likely to require reforms to Irish laws governing taxes, inheritance and pensions.

“There are many cohabiting heterosexual couples. There may be brothers sharing a farm. There may be an elderly parent being supported by a child. These may be people living together who share an economic interdependence without having any sexual aspect to their relationship at all,” he said.

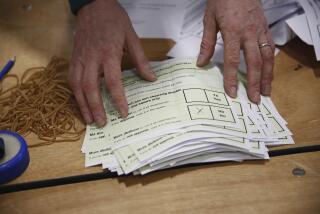

Ireland’s Parliament should pass legal reforms that “formally recognize people who have entered into a civil partnership with each other,” he said, regardless of their sexuality, and allow the surviving half of such partnerships “to acquire next-of-kin status.”

But McDowell said the question of whether unmarried couples should have the full range of financial rights and responsibilities that married couples do involved “detailed and often technical questions not capable of being easily answered.”

He did say that the surviving partner of an unmarried couple should pay no capital gains tax on inherited property, a major focus of discrimination complaints.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.