Exec Life Trial Begins for Last Defendant

- Share via

And then there was one.

The last defendant in California’s multibillion-dollar lawsuit over the 1991 collapse of Executive Life Insurance Co. went on trial in federal court in Los Angeles on Friday -- six years to the day after the case was filed by then-Insurance Commissioner Chuck Quackenbush.

The state is suing Artemis, a holding company controlled by French billionaire Francois Pinault, over its role in the sale of Executive Life’s assets to a group of French investors.

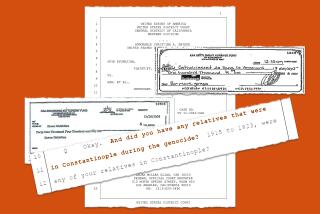

The lawsuit, now being pursued by current Insurance Commissioner John Garamendi, claims that Paris-based banking giant Credit Lyonnais -- controlled at the time by the French government -- used a series of front companies to acquire Executive Life’s huge portfolio of depressed junk bonds in 1991 -- in violation of state and federal laws.

The French government, Credit Lyonnais and other defendants in the case agreed this week to settle with Garamendi for $600 million. Other defendants have either settled or opted not to defend themselves, leaving Artemis as the sole remaining defendant.

The state contends that French investors reaped an estimated $2-billion profit when the Executive Life junk bonds later soared in value. Meanwhile, the Los Angeles-based insurer’s 330,000 policyholders lost billions in the value of their life insurance benefits and annuities over more than a decade.

“This is a case about greed,” Gary Fontana, who is representing Garamendi, said in his opening argument.

Fontana maintained that Artemis, formed in December 1992, was created by Credit Lyonnais solely to conceal from U.S. regulators the bank’s role in the Executive Life deal. Garamendi, who presided over the sale during his first term as insurance commissioner, is seeking about $1 billion from Artemis.

Pinault’s attorney, James P. Clark, told the jury that Garamendi “knew or should have known” that Credit Lyonnais was involved in the Executive Life deal. The relationship was disclosed to the commissioner in memos, Clark said, and was reported by the Los Angeles Times, the New York Times and other publications.

In addition, he noted that Pinault’s firm wasn’t even formed until after the Executive Life deal.

“We are here now because the commissioner wants more -- more from people who weren’t even involved in the sale” of the Executive Life assets, Clark said.

Clark quoted from Garamendi’s own news releases, his deposition and letters he wrote to Barron’s and Forbes magazines in response to news articles in the early 1990s.

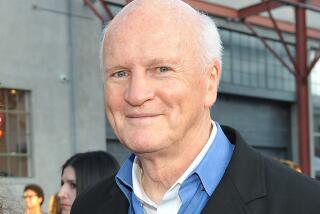

Pinault, 68, who is expected to testify during the trial, was described by his other attorney, Robert Weigel, as a man from humble upbringings, without a high school degree, who clawed his way to the top of the French business world.

The Pinault family empire includes the fashion house Gucci and auctioneer Christie’s. Weigel said Pinault bought the Executive Life junk bonds because he had been “looking to invest outside of France for some time.”

Last year, Artemis agreed to pay a $185-million fine to the Justice Department as part of a larger $770-million deal with France to settle a criminal inquiry into the Executive Life transaction. Artemis and its officers weren’t indicted.

Five former officers of Credit Lyonnais were indicted. One pleaded guilty last year to a felony charge of causing Credit Lyonnais to make false statements to the Federal Reserve.

The Executive Life case is being closely followed by the French media, and several French reporters were in U.S. District Judge Howard Matz’s courtroom Friday.

The seven-man, five-woman jury was given a detailed glossary of the financial terms and French names and phrases that could be used during what is expected to be a 10-week trial.

Garamendi appeared in court for a few hours in the morning. He also is expected to testify.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.