In private equity, he is calling big plays

- Share via

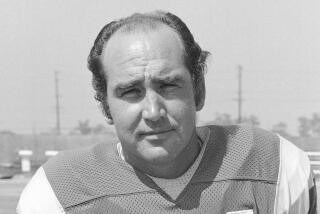

The website of his private equity firm notes that Pat Haden graduated Phi Beta Kappa from USC, was a Rhodes scholar and earned his law degree at Loyola.

Absent is any mention of his standout college and professional football careers.

That’s the way Haden likes it.

“I try to distance myself to a certain extent from my athletic career,” he says. “We’ve all seen athletes who hang on to their glory days a little too long.”

At a time of life when many ex-jocks are reminiscing about their playing days, Haden, 54, is well into his second -- make that third -- career, as a partner at Westwood-based Riordan, Lewis & Haden.

Haden joined in 1987, five years after the firm was founded by former Los Angeles Mayor Richard Riordan and businessman J. Christopher Lewis. It has notched a 29% average annual return over its 25-year history and just raised $265 million for a second fund that is open to institutional investors such as pension funds and endowments.

“This business every single day is different because every single company we look at to invest in is different,” Haden says. “And working with entrepreneurial people is uplifting. They’re generally positive people.”

Growing up in West Covina, Haden was a star quarterback at Bishop Amat Memorial High School in nearby La Puente. Although undersized at 5 feet 11 and 180 pounds, Haden was heavily recruited.

He excelled at USC, quarterbacking the Trojans to three Rose Bowl appearances and two national championships. In 1974, he led the team to one of its most memorable victories, rallying the Trojans from a 24-point deficit to beat archrival Notre Dame.

For four of the six years he spent with the Los Angeles Rams, he attended law school, taking classes two nights a week. He missed a few contract-law classes but had a good excuse: He had to quarterback the Rams on “Monday Night Football.”

Although he figures he could have hung on for a few more years, Haden retired from football in 1982. He had his degree from Loyola Law School and wanted to start the next phase of his life.

Back then, pro football salaries “weren’t anything near what they are today,” he says. “I could do nearly as well financially practicing law as I could playing in the NFL.”

With a job at an L.A. law firm and a part-time gig in sports broadcasting (he currently handles all Notre Dame home games on NBC), he could have been set. But he was tiring of the rote nature of legal work.

When Riordan offered him a job at his law firm, Haden declined and said he had an interest in business. Riordan offered a spot at his investment firm instead, and Haden accepted even though he knew little about how it worked. “I was jumping into the abyss,” Haden says.

These days Haden spends a lot of time scouring for potential investments, companies with annual revenue of $20 million to $250 million whose sales and earnings are rising at least 20% a year. Most are in healthcare, business services, high-end manufacturing and financial services.

Although Haden scrutinizes financial statements, much of his job is building relationships with entrepreneurs and persuading them to sell equity stakes to Riordan Lewis. “What we do is not entirely rocket science,” he says.

Haden says he learned a few lessons in his football career, such as how to stay humble and shake off failure, that have helped him in the private equity business.

By virtue of their gold-plated pedigrees, “there is a great deal of hubris” among private equity executives and many of them deal poorly with failure, he says.

“It’s difficult for these people who have known nothing but 100% success to grapple with” bad investments, Haden says. “In athletic teams, you sometimes lose. I got booed virtually every week -- but I had to show up the next Sunday to play again.”

His name recognition has occasionally given him a leg up in business dealings, he says, though early on it was also sometimes a hindrance.

“When we try to meet entrepreneurs, at least they might recognize my name or Riordan’s name and at least answer our call,” he says. “But on the other hand, some entrepreneur running a successful company would say, ‘What can some ex-football player do to help me?’ ”

Riordan Lewis’ approach is different from that of many larger firms, which typically take on heavy debt to acquire publicly traded companies and pay for their acquisitions through cost cutting and layoffs. By contrast, Riordan Lewis resembles a very late-stage venture capital firm, investing in growing companies that are much likelier to be adding staff than making cutbacks.

As do all private equity firms, Riordan Lewis likes to unload its investments within three to five years. When that doesn’t happen, private equity firms often “will not give you the time of day and will be pushing to get out of the investment,” says Rob Kingsley, former chief executive of Financial Pacific Insurance Group, in which Riordan Lewis held a major stake for 10 years.

But Haden remained friendly and supportive even when an initial public stock offering had to be aborted, Kingsley says. That was “a credit to him in that shark-infested business.”

*

(BEGIN TEXT OF INFOBOX)

A winner

Subject: Pat Haden

Age: 54

Education: Bachelor’s in English from USC; Rhodes scholar at Oxford University; law degree from Loyola Law School

Favorite touchdown pass

(college): Game-winning pass to best friend in 1974 Rose Bowl to win national championship

Favorite touchdown pass

(professional): First-ever pass in rookie season, a 47-yard touchdown against Atlanta Falcons

Worst moment: Threw fourth-quarter interception in 1976 NFC Championship game against Minnesota Vikings and eventually lost game.

Personal: Married with four grown children; one grandchild

More to Read

Fight on! Are you a true Trojans fan?

Get our Times of Troy newsletter for USC insights, news and much more.

You may occasionally receive promotional content from the Los Angeles Times.