Continent key to luxury firm’s margins

- Share via

Daniel Ngonga doesn’t own any of conglomerate PPR’s Yves Saint Laurent suits or Gucci loafers. Yet the Kenyan is one of millions of Africans fueling growth at the world’s third-largest maker of luxury goods.

Ngonga, 28, often buys amoxicillin, a generic antibiotic imported to Kenya by PPR distribution subsidiary CFAO, which sells such diverse products as cars and pharmaceuticals across the world’s poorest continent.

“I buy this for my daughter,” said Ngonga, who sells CD players at a Nairobi market. “She has a fever. It’s expensive for us, but less than some other drugs. These pills work well.”

PPR’s sales of more computers, cars and medicine across Africa is helping to boost the continent’s economy, which, thanks largely to the expanding oil industry, is forecast to grow next year at three times the pace of the 13 nations that use the euro currency.

Sales at CFAO are expected to rise 11% this year, and the unit is likely to be PPR’s fastest-growing business until at least the end of 2009, according to Natixis Securities, based in Paris. That will help the parent company offset slowing growth in the luxury goods industry.

CFAO is “the cash cow for the PPR Group,” said Natixis analyst Boris Bourdet. “PPR covers practically all African countries, and they don’t have any big competitors. Their margins are very high.”

CFAO accounted for 13% of PPR’s total sales in the first half of 2007 and 18% of operating profit.

The luxury goods industry will grow as little as 6% this year, a slower rate than the 10% of the last two years, according to Natixis.

PPR’s African income, along with its retail chains, protect it as the widening credit crunch damps demand for luxury goods worldwide, said Chief Executive Francois-Henri Pinault.

“We are much more resilient this way,” said Pinault, 45. “People have an image of Africa as risky and volatile. This has never been true of CFAO.”

PPR’s luxury-goods competitors don’t have similar businesses in Africa.

Founded in 1887 to import raw materials and exotic spices from Africa to France, CFAO now distributes goods including Mercedes trucks and Viagra in 34 African countries and six French overseas territories, a market PPR says has 850 million people. The company entered Vietnam this year.

PPR founder Francois Pinault bought CFAO in 1990 and the unit now employs 10,000 people, about 13% of PPR’s total.

Before entering the luxury goods business, Francois Pinault made his fortune trading timber and business materials. He first pushed into upscale retail with the 1992 acquisition of Au Printemps and bought a stake in Gucci Group in 1999, getting into the luxury race with Paris-based LVMH and Geneva-based Richemont.

African economies have been growing faster than 5% on average since 2004, lifted by the reduction of foreign debt and newfound political stability in such countries as Algeria and Kenya. The African economy as a whole will expand 6.5% next year, outpacing the global economy’s 4.8% growth, the International Monetary Fund estimates.

PPR is well-placed to capitalize on the growth, analysts say. “CFAO has no competitor of comparable scale or with similar breadth of operations,” said Sanford C. Bernstein analyst Luca Solca. He called the unit “the most consistently profitable component” of PPR’s non-luxury portfolio.

Cash generated by CFAO helps PPR finance acquisitions, including this year’s $7.7-billion purchase of Puma, Bourdet said.

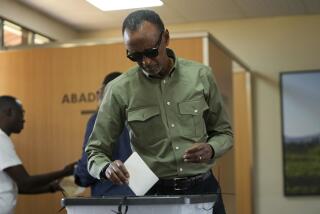

The unit will continue to fuel growth as African economies expand and stabilize, Solca said. CFAO is betting on countries such as Kenya, which held its first multiparty elections in 1992. Voters are now gearing up for a new general election in December.

“Things are better now that we have democracy,” said Faith Kawira, a financial advisor at the British American Insurance company in Nairobi. “People can buy more things. They are much happier.”

Car sales, which have grown 10% a year at CFAO since 2000, will continue to expand as more Africans buy cheaper passenger cars like Renault’s no-frills sedan, and others aspire to more expensive models as status symbols, according to Richard Bielle, the division’s director.

“People look at the kind of car you drive, and they pigeonhole you right away,” said Moffat Kithome, a security officer at an insurance company. Kithome, 40, said he braves congested Nairobi traffic every day in his Mitsubishi RVR even though he could reach his office on foot in half the time. He’s saving up to buy a new car.

It’s not just the higher end of the African income spectrum that can power PPR gains. Its pharmaceutical business accounts for 43% of the drugs distributed in sub-Saharan Africa, and 10% of the unit’s sales are generic drugs, Solca said.

“Cheaper things are not always good,” Ngonga said as he was leaving the pharmacy with a treatment for his daughter. “I try to get the best I can for my family.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.