Lenders in talks for control of Tribune

- Share via

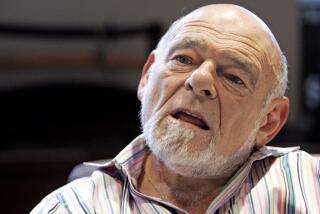

CHICAGO — Tribune Co. and its creditors are in the early stages of negotiating a plan of reorganization in U.S. Bankruptcy Court that sources said probably would transfer control of the troubled media conglomerate from Chicago billionaire Sam Zell to a group of large banks and investors that holds $8.6 billion in senior debt.

The plan is still taking shape, the sources said, and much could change as negotiations continue.

But the general contours of a new capital structure are coming into focus, and the plan centers on a debt-for-equity swap that probably would give the senior lenders a large majority ownership stake in the reorganized Chicago media firm.

A source with knowledge of the situation said the plan would wipe out a $90-million warrant Zell negotiated as part of his $8.2-billion deal to take the company private in 2007. The warrant gives the Tribune chairman the right to buy about 40% of the company for $500 million and is the basis of his control over Tribune, which owns the Los Angeles Times, Chicago Tribune and other papers and broadcast media.

Zell also holds a $250-million note representing a loan he made to the company as part of the going-private transaction. That note, however, is near the bottom of the hierarchy of claims in Tribune’s Chapter 11 bankruptcy case, and the source said it was unlikely the note would retain any value as the reorganization proceeds.

Bankruptcy experts said the plan’s outline raises questions about whether the senior lender group would want to retain Zell and his management team or seek new leadership for the company. It also poses the question of whether Zell would want to stay without a large ongoing stake in the company. Sources close to the creditors and the company said it was too early to make such decisions and Tribune management continues to control the process because it currently can propose whatever reorganization plan it wishes.

But Zell’s team has indicated that it wants to work toward a consensual plan with the company’s creditors, which means issues such as who manages the company and whether those managers are given equity as part of an incentive package will be negotiated over time, experts said.

“It completely depends on whether the new owners see value in keeping Zell,” said Douglas Baird, a corporate reorganization specialist at the University of Chicago Law School. “They have to decide: Is the person at the helm when the company went into the storm the most able person to steer it out?”

Zell was not available for comment, but in a statement, Tribune said Zell and his top managers “remain actively engaged and committed to this company. The restructuring is still in progress, and it is premature to speculate about the final ownership structure.”

Howard Seife, a partner with Chadbourne & Parke in New York, which represents the committee of unsecured creditors in the Tribune case, said negotiations have been “fairly general and not particularly advanced.” The central logic behind the debt-for-equity swap is that Tribune can no longer afford the nearly $13 billion in debt that grew out of Zell’s $8.2-billion deal to take the company private in 2007. With advertising revenue in decline and the company’s cash flow low, the company must shrink its obligations to a more sustainable level while giving creditors enough potential value in return that they agree to the cuts without a fight.

The senior creditors -- a group that includes large banks such as JPMorgan Chase & Co. and Citigroup Inc., as well as institutional investors and funds such as Oaktree Capital Management and Angelo, Gordon & Co. -- have claims worth $8.6 billion. But the senior debt is trading on the open market for about 30 cents on the dollar, suggesting the company may be worth less than $3 billion.

Consequently, sources said, it is generally assumed that the claims of these creditors overwhelm all others, and that it would take a large chunk of equity to satisfy them in a swap, arguably most of it. But since other groups are likely to press their claims anyway, the senior group may agree that creditors lower on the hierarchy should get some consideration in the restructuring so the process doesn’t bog down in court.

There are other complications, including Tribune’s employee stock ownership plan.

Employees own 100% of the company through an S-Corp ESOP. But a tangle of rules would make it difficult to give the senior lenders equity and maintain the S-Corp structure.

--

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.