As Tesla taps capital markets for cash, share price could top $100

- Share via

Tesla Motors shares are trading at about $90 and could easily top $100, buoyed by its ability to tap capital markets for about $1 billion through its announced sale of stock and convertible notes.

It is an impressive performance that will help the Palo Alto-based electric car company expand sales abroad, develop its Model X, a sport utility, and start work on a less expensive vehicle that would extend its customer base and manufacturing volumes, analysts said.

It will also use the money to pay off a $465-million Department of Energy loan that became a political hot potato after the 2011 bankruptcy of Solyndra, the Fremont, Calif., solar panel maker, that cost taxpayers more than $400 million.

“What Tesla has accomplished isn’t luck, it’s real,” said Adam Jonas, an analyst with Morgan Stanley Research.

“The Model S is a damn good car,” Jonas wrote in report to investors. “Each day that goes by where Tesla delivers 60 units without images of flaming Model S’s on YouTube offers incremental validation for what it has accomplished.”

The Model S starts at about $62,000 and can top $100,000, depending on trim level and options. The car is stylish and fast, boasting a zero-to-60 mph acceleration of less than six seconds.

Even with the dilution of the current stock offering, Tesla shares could reach $109, Jonas said.

“The auto industry may be in for a shock,” Jonas said. “While Tesla has a long way go, and tremendous risks remain, we may be witnessing an interplay of technology, industrial strategy and capital not unlike Cornelius Vanderbilt and the railroads, or Thomas Edison and electrical distribution.”

Analysts said Teslahas to make sure no technical flaws upend the car’s safety or reliability.Tesla also has to survive a continuing battle with the various auto dealer groups that are contesting its direct-to-the-customer sales model that bypasses car franchises.

Earlier this month, Tesla said brisk sales of its Model S luxury sedan had yielded a first-quarter profit of $11.2 million, compared with a year-earlier loss of $89.9 million.

For the quarter, Tesla was the top seller of rechargeable cars in North America, surging past Nissan Motor Co.’s 3,695 deliveries of the Leaf and General Motors Co.’s 4,421 sales of the Volt plug-in hybrid.

But special California environmental rules, which allowed Tesla to garner $68 million from selling so-called zero-emission vehicle credits to rival automakers, also was a big driver of the profit.

ALSO:

See compact SUVs crunched in crash test video

New multispeed transmissions drive road to fuel economy

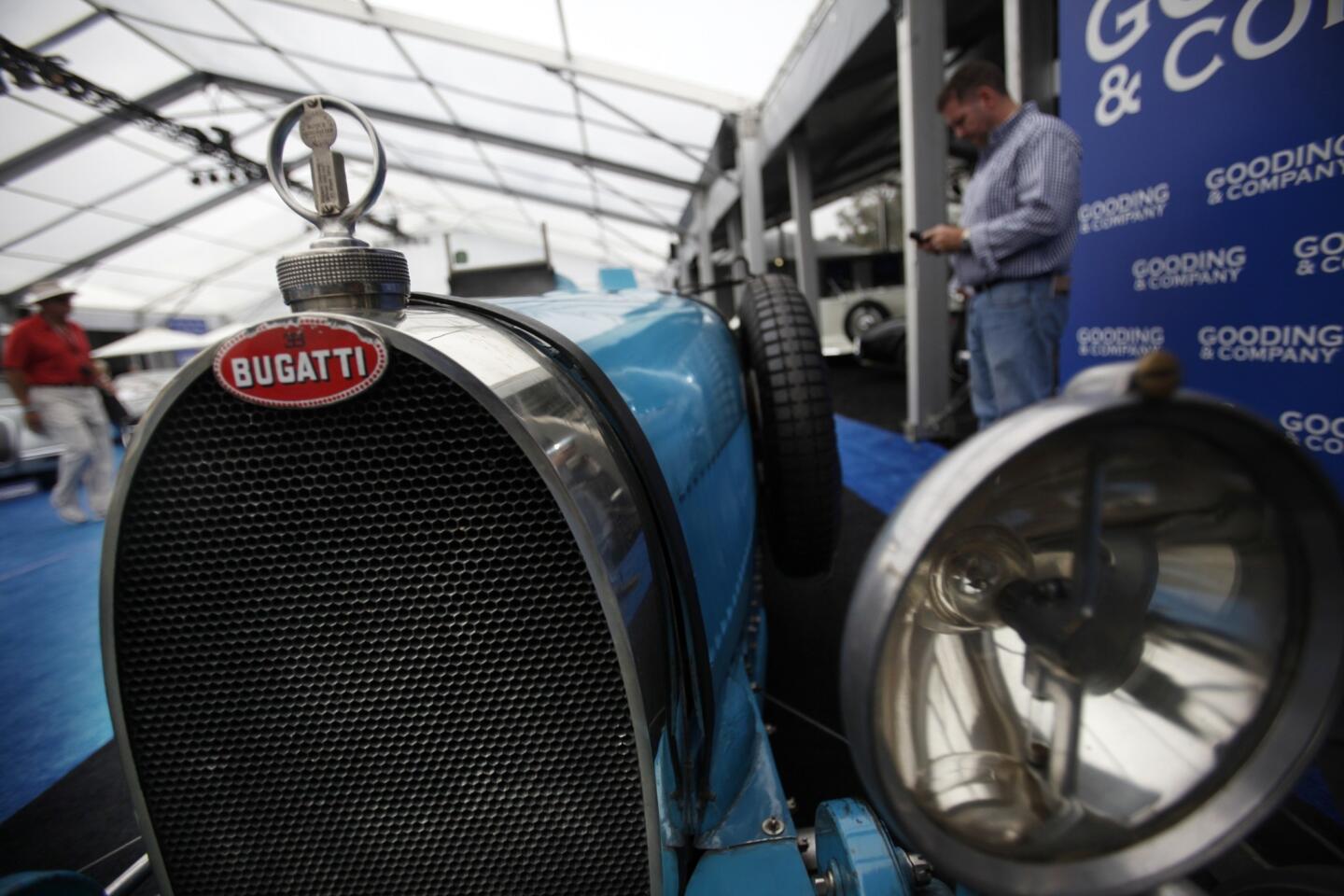

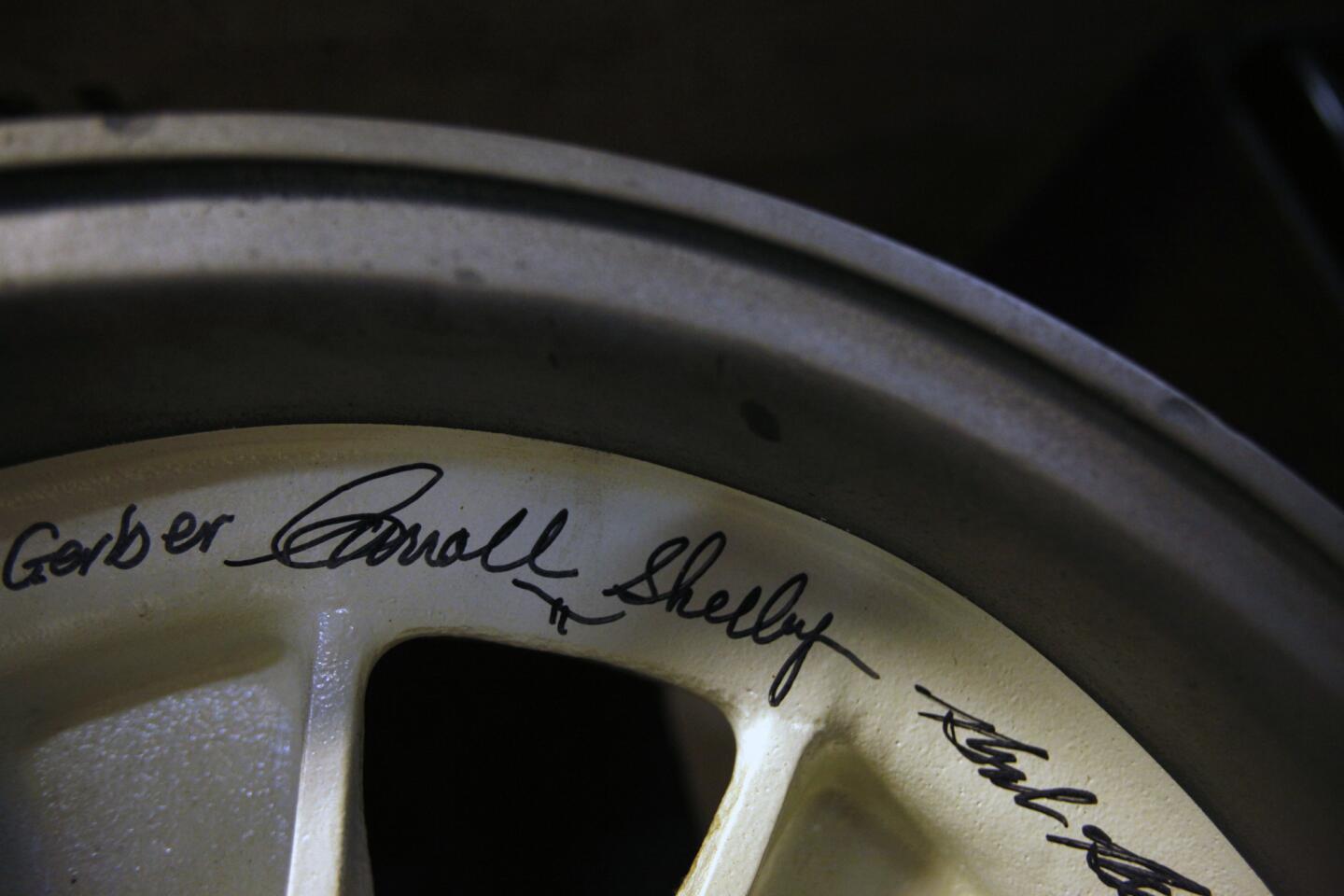

Check out the classic automobiles of ‘The Great Gatsby’ era

Follow me on Twitter (@LATimesJerry), Facebook and Google+.