How to debate the ‘undebatable’ falsehoods about Social Security

- Share via

Two founders of Third Way, a Washington think tank that masquerades as a centrist voice but looks and talks more like an arm of Wall Street, surfaced this week on the Wall Street Journal’s editorial page with an attack on Social Security so full of misrepresentations and untruths that it’s amazing the thing didn’t burst into flames while it was still being emailed in.

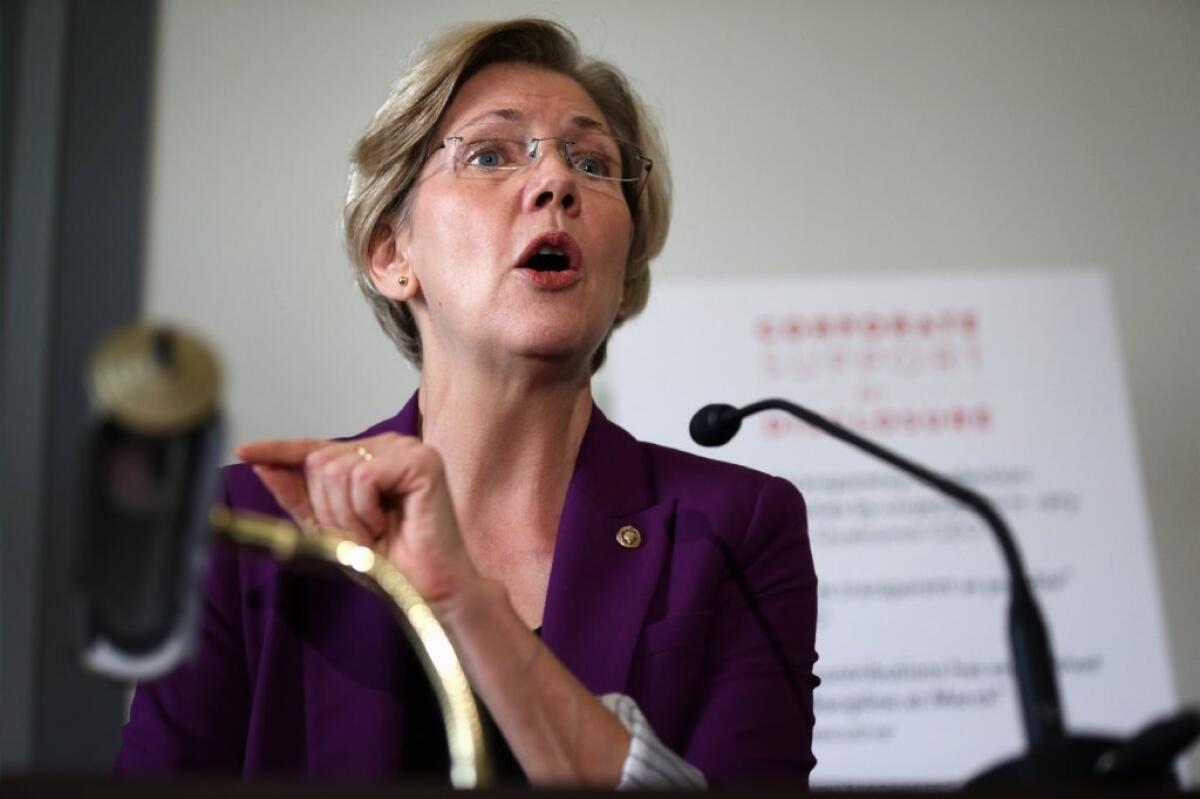

Jon Cowan and Jim Kessler, the authors, promptly got called out by Sen. Elizabeth Warren, D-Mass., a champion of expanding Social Security who was one of the main targets of their piece. “It’s just flatly wrong,” she said of their description of Social Security, which they claim is in an “undebatable solvency crisis.”

Warren is demonstrably correct. Let’s take a look.

Cowan and Kessler start by asserting, “A growing cascade of baby boomers will be retiring in the coming years, and the Social Security formula increases their initial benefits faster than inflation.”

They’re wrong about the formula. Initial Social Security benefits are indexed to wage inflation. This is a measure that tracks the standard of living prevailing at the time people retire, which generally improves over the course of their working lives. Wage inflation generally, though not invariably, rises at about 1% a year faster than the consumer price index used to calculate annual cost of living increases for retirees--after their initial benefit.

Why is indexing the initial benefit to wage inflation important? Think of it this way: if that hadn’t been done, people retiring today might receive a benefit based on the standard of living four decades earlier. For Cowan and Kessler not to know the facts about the initial benefit, or to know it and not disclose it, pretty much disqualifies them as Social Security analysts. But that’s not all.

“Since 2010,” they write, “Social Security payouts to seniors have exceeded payroll taxes collected from workers.” This is misleading at best and a gross misrepresentation at worst.

Social Security has three traditional sources of revenue: current payroll taxes, income taxes charged on Social Security benefits, and interest earned by the Social Security trust funds. It’s important to remember that the trust funds themselves are derived from payroll taxes--excess taxes levied on workers since 1983, largely to pre-pay the baby boom generation’s benefits. So the interest is itself derived from payroll taxes lent to the government through the purchase of Treasury bonds.

From 2010 to 2013 there was a fourth source: a general fund reimbursement for the payroll tax holiday of two percentage points enacted as an economic stimulus measure. The point is that Social Security was credited for the full 6.2% payroll tax levied on employees as payroll tax--just that 2% of it was to be suspended for a few years so workers could have a bit more in their pockets.

Since 2010, payouts to seniors have been more than covered by all these payroll tax-related sources. In 2010, benefits were $695.4 billion, the payroll tax, interest, and general fund payback came to $765.2 billion; in 2011 the program paid out $719.5 billion and collected $775.7 billion, and last year the payout was $762.3 billion and income was $810.3 billion.

As for the “undebatable solvency crisis,” Cowan and Kessler should tell that to the Social Security trustees, because the trustees sure debate it. The trustees in their annual reports caution every year against drawing firm conclusions about the program’s future solvency from the financial projections they publish looking decades in the future.

In fact, they publish three main projections--a best-case, worst-case, and middle-of-the-road scenario. all these are based on more than a dozen demographic and economic assumptions, none of which can be projected for certain, and all of which interact with each other in indeterminate ways. The trustees warn that “significant uncertainties surround the intermediate assumptions,” which are largely the basis for the Cowan/Kessler claims. Does that sound like the trustees think they’re “undebatable”?

Cowan and Kessler are also misleading about Warren’s proposal, which involves raising the cap on wages subject to payroll taxes. (The cap is $117,000 for 2014.) They say “her approach requires a $750 billion tax hike over the next 10 years that hits mostly Millennials and Gen Xers, plus another $750 billion tax on the businesses that employ them.”

That makes it sound as though she’s proposing to tax young people just starting out on their careers, doesn’t it? She’s not--she’s proposing to increase payroll taxes on all people earning $117,000, or whatever the cap is each year (it rises with inflation). Since taxes levied in the future naturally will be paid by today’s millennials and GenXers, Cowan and Kessler are sort of right. But unbelievably deceptive.

The real goal of the Cowan/Kessler piece was to discourage Democrats from following Warren and Bill de Blasio, the new progressive mayor-elect of New York. Their op-ed was headlined “Economic Populism is a Dead End for Democrats,” and blamed Warren and de Blasio for encouraging a “left-wing...fantasy.” What the authors don’t seem to acknowledge is that both Warren and de Blasio won elections. They already have followers, and among the reasons for their victories is they’re willing to stand up for economic policies that don’t leave the average person in the dust.

That may not be to Cowan’s or Kessler’s taste, or to that of the current and former executives of Warburg Pincus, Goldman Sachs, and the other corporations and investment firms on Third Way’s board. But for all their chattering about Social Security’s insolvency, it’s their arguments that were bankrupt.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.