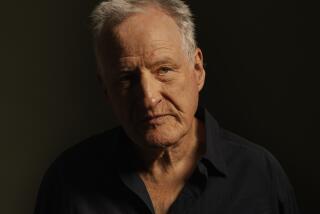

Alfred Mann, the billionaire founder of drug maker MannKind, stepping down

Alfred Mann is resigning as executive chairman and board member of Mannkind Corp., the company said Friday.

- Share via

Struggling Valencia drug maker MannKind Corp. said Friday that the company’s 90-year-old founder and executive chairman Alfred Mann was stepping down.

The move comes as the company has been fending off reports that it is up for sale following the loss of its key partner, pharmaceutical giant Sanofi. The French company announced in January it would stop marketing and distributing MannKind’s only approved drug – Afrezza, an insulin powder that is inhaled but has been a slow seller.

Mann, a physicist and inventor who has launched 17 companies in five decades, will continue to advise the company, said Matthew Pfeffer, MannKind’s chief executive. Mann declined to comment, he said.

Kent Kresa, the former CEO of Northrop Grumman Corp. and a MannKind director since 2004, was named its new chairman.

He will take over as MannKind, which does not have its own sales force or distribution network, explores how to improve sales of Afrezza and boost its financial position.

“MannKind expects to continue to sell Afrezza to the many people who have come to appreciate its unique benefits,” Pfeffer said Friday. “At the same time, we are talking to potential partners for some markets or market segments.”

He added that the company has “plenty of cash” to operate into the second half of this year and is “evaluating alternatives for ensuring cash well beyond that.”

Mann’s departure follows other executive turmoil. About six weeks before the Sanofi announcement, the company’s chief executive suddenly resigned after just 11 months, forcing Mann to become interim chief.

MannKind soon hired a new executive, but later withdrew that offer, saying the executive had signed

a noncompetition agreement with his former employer.

In mid-January the company said Pfeffer, then the financial officer, would replace Mann in the CEO spot.

Keith Markey, an analyst at Griffin Securities who owns MannKind stock, said he did not think Mann, who still owns a significant stake in the company, would be looking to sell.

“His feeling has always been he wanted to get a reasonable value for his companies based on their commercial success,” Markey said.

“I’m sorry to see him go,” he added. “This has been his pet project for the past 15 or 16 years.”

Afrezza, a rapid-acting insulin that is inhaled at the start of each meal, has been difficult to sell.

Because of its safety risks, it cannot be prescribed to patients with asthma and other serious lung ailments, according to requirements set by the Food and Drug Administration. The agency also requires doctors to test patients’ lung function before writing a prescription — and every six months during treatment.

Over the years, Mann’s companies have created many medical advances.

In 2001, Mann sold his company MiniMed Inc., which developed an insulin pump, to Medtronic Inc. for more than $3 billion.

“Al is a true visionary,” Kresa said in a statement.

In June 2014, not long after the FDA approved Afrezza, MannKind shares traded above $10. The stock closed up 7% at 98 cents Friday.

Follow me on Twitter @MelodyPetersen

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.