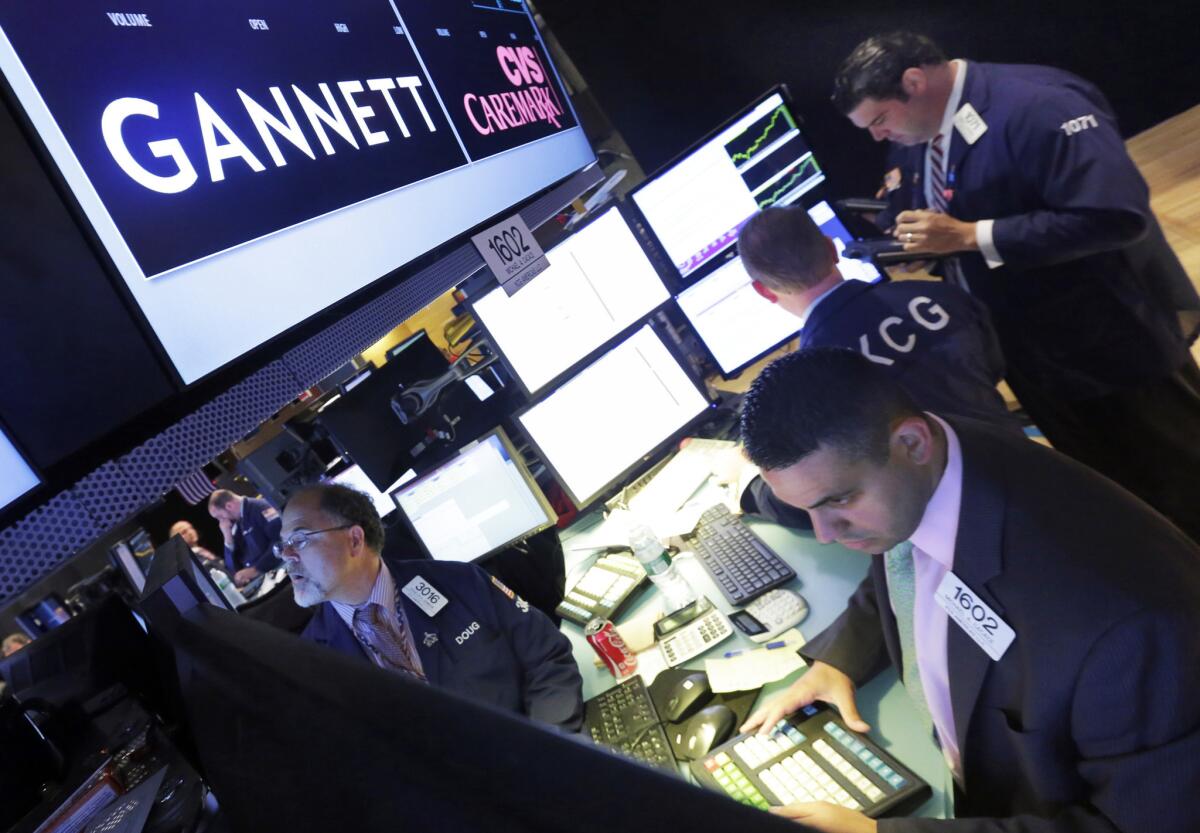

Tribune Publishing renames itself Tronc as its dispute with Gannett continues

- Share via

The owner of the Los Angeles Times has a new name and a newly elected board, but it’s still dealing with some old business: dissatisfaction from some shareholders with its decision to spurn a buyout offer from rival Gannett Co.

Although precise numbers weren’t available, a sizable percentage of Tribune shareholders – perhaps close to 40% -- voiced disapproval with the company by withholding votes from its slate of board candidates, according to Gannett. One investor filed a lawsuit Wednesday saying the company’s board has failed to act in shareholder interests.

Meanwhile, the war of words between the two companies continued, with Tribune blasting Gannett’s “symbolic” and “feeble” campaign to sway shareholders to withhold votes. Tribune said its board was elected with support from the majority of shareholders.

Following the vote, Tribune Publishing, the Chicago company that owns The Times, the Chicago Tribune and several other daily newspapers, said Thursday that it would change its name to Tronc Inc., taking the name from technology that executives have said will be crucial to the company’s turnaround strategy.

See the most-read stories this hour >>

The name change, an acronym for Tribune online content, will take effect June 20, the same day that Tribune Publishing stock will transfer from the New York Stock Exchange to the Nasdaq and start trading under the ticker symbol TRNC.

At Thursday’s shareholder meeting held in downtown Los Angeles, a Gannett executive made an in-person appeal for the company to reconsider its takeover offer.

“Can Tribune navigate these challenges alone?” asked Gannett’s vice president of investor relations, Michael Dickerson, referring to the transition of newspapers from print to digital. “We do not believe so. Gannett continues to have faith in the value of all of Tribune’s assets as part of Gannett.”

Gannett said it is still reviewing whether to proceed with its bid to buy Tribune Publishing.

But Lloyd Greif, chief executive of downtown L.A. investment bank Greif & Co., said Gannett’s shareholder campaign appears to have fallen short, probably spelling the end of the company’s fight to buy Tribune.

“If it had been more than half of all shareholders, it would have been a much more compelling statement,” he said. “They’re scrambling to put a good face on it.”

The Tribune board must also contend with a lawsuit filed late Wednesday by Capital Structures Realty Advisors, a small shareholder in San Diego who alleged that the board failed to act in shareholders’ interests when it rejected two offers from Gannett. Those offers, of $12.25 and $15 per share, represented a huge premium over the company’s stock price, which had been near $7.50 before the bid.

The lawsuit had also been widely expected after two large shareholders publicly criticized Tribune’s decision to reject those offers.

The suit also targets L.A. biotech billionaire Patrick Soon-Shiong for “aiding and abetting” the board’s conduct.

SIGN UP for the free California Inc. business newsletter >>

Last month, Soon-Shiong’s firm Nant Capital invested $70.5 million for a 12.92% stake in Tribune in a move that appeared to be aimed at diminishing the influence of Oaktree Capital Management, a major Tribune shareholder that had publicly pushed Tribune to sell to Gannett. The case seeks to undo the stock sale to Soon-Shiong and unspecified damages from Tribune’s board of directors.

Tribune Publishing spokeswoman Dana Meyer said the company was reviewing the complaint.

“The stock sales to Merrick Media and Nant Capital were approved by the Board of Directors and will provide valuable growth capital to allow the company to execute on its new value-creating business plan,” she said in a statement.

Three firms that advise public company shareholders have issued reports saying it appeared that Tribune’s board gave Gannett’s offers a serious look before turning them down.

Greif said those reports, and the results of Thursday’s shareholder vote, mean that the suit has little chance of moving forward, though the plaintiff may be able to squeeze a settlement out of Tribune.

“This kind of litigation can be costly and distracting,” he said. “At some point, it gets less expensive to write a check to the plaintiff than to litigate.”

Capital Structures is not listed among Tribune’s major shareholders and has made no public filings indicating an ownership stake in the newspaper company. In its legal filing, the company said it has been a Tribune shareholder since before Gannett first offered to buy Tribune in April.

Representatives for Soon-Shiong did not immediately respond to requests for comment.

Tribune Publishing stock closed Thursday at $11.38, down about 2% for the day.

Times staff writer Meg James contributed to this report.

ALSO

Shares jump on IPO for Soon-Shiong start-up NantHealth

Tribune Publishing’s No.2 shareholder pushes for sale

Twitter: @jrkoren

UPDATES:

3:15 p.m.: This article has been updated throughout.

2:20 p.m.: This article has been updated with Tribune Publishing’s new name, more details about the shareholder vote and the closing stock price.

12:20 p.m.: This article has been updated with details from the shareholder meeting.

11:12 a.m.: This article has been updated with additional background.

This article was originally published at 10:28 a.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.