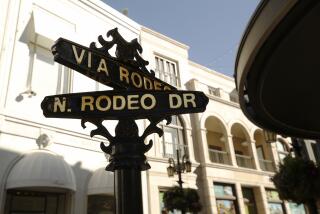

Rents on Rodeo Drive are cheap compared with Hong Kong and New York

- Share via

It costs a lot of money to rent space for a store on Rodeo Drive in Beverly Hills -- about $575 per square foot per year -- but Southern California’s priciest retail real estate is a steal compared with those in other prominent cities such as Hong Kong and New York.

Hong Kong is the world’s most expensive city for shopkeepers by a pretty wide margin, according to CBRE Group Inc. Rents for prime property there averaged $4,328 per foot in the second quarter, a recent report by the real estate brokerage said.

With rising wealth in mainland China and its long standing international appeal, Hong Kong is at the top of the list of cities where top luxury retailers want to have stores, and 51 more of them set up shop there last year, the report said.

Photos: Chimelong’s Ocean Kingdom theme park in China

“Healthy tourist arrivals and lack of available space make finding an adequate unit in Hong Kong’s prime retail locations a major challenge for new and existing retailers,” said Joe Lin of CBRE’s office in the city. “Units in prime locations with reasonable shop fronts and size rarely become available, leaving retailers with few choices.”

The top blocks of New York’s Fifth Avenue came in second on the list with an average rent of $3,050 a foot, a jump of 22% from the second quarter a year ago. Thriving tourism continues to drive sales there.

The high streets of Paris and London were cheaper than New York at just over $1,000 per foot. Filling out the top 10 were Sydney, Australia; Zurich, Switzerland; Tokyo; Melbourne, Australia; Moscow; and Brisbane, Australia.

Beverly Hills ranked 13th according to the brokerage’s report, followed by the popular Union Square district of San Francisco where rents averaged $575 a foot.

ALSO:

China’s ‘visit your parents’ law weighs on many in one-child nation

China’s new college graduates struggle to put their skills to work

Rents for shopkeepers in L.A. head up again after years of decline

roger.vincent@latimes.com

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.