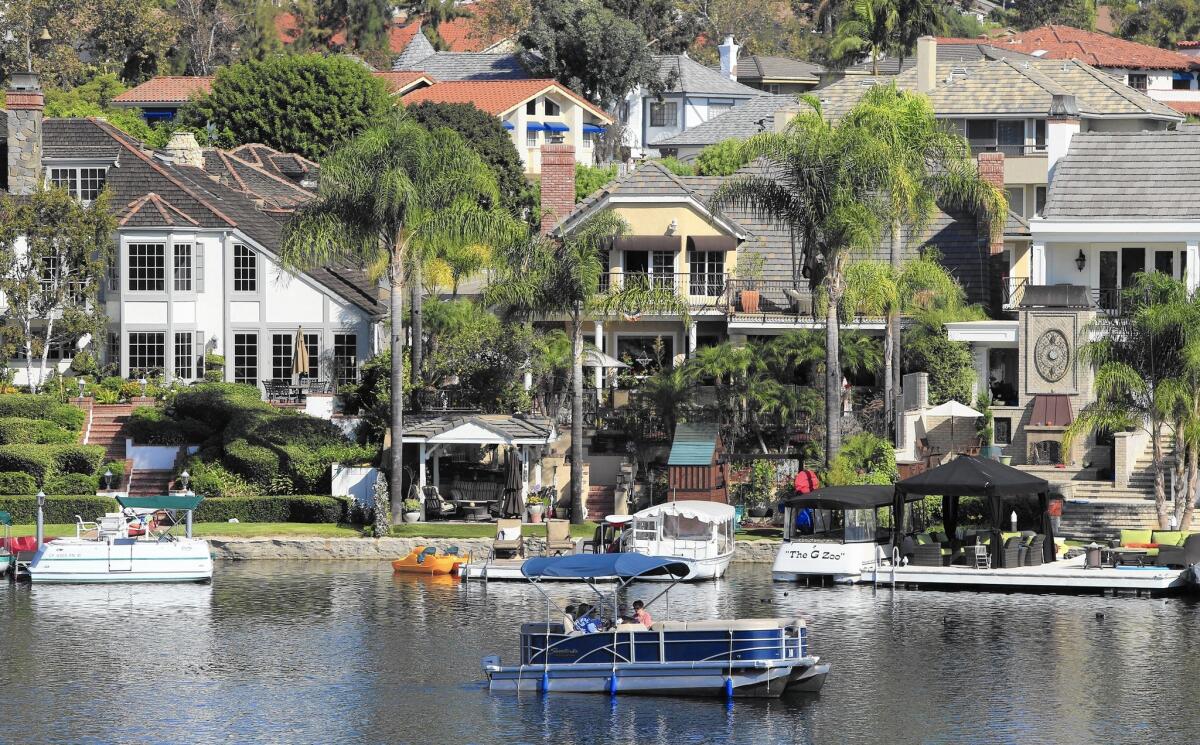

More owners tapping home equity lines of credit

- Share via

Reporting from washington — If you’re thinking about taking out a home equity line, you’re hardly alone. Credit lines tied to home equity — popularly known as HELOCs — are one of the fastest-growing segments in the mortgage market. Volume during the first half of 2014 is up by an extraordinary 21% compared with the same period last year, according to data collected by credit bureau Equifax.

The main reasons: Owners’ equity holdings nationwide are up sharply — the Federal Reserve estimates gains at nearly $4.5 trillion since 2011 — and interest rates are near historical lows. Owners borrowed $66 billion against those fattened equity stakes during the first half of this year, a six-year high. Banks and other lenders extended 670,000 new HELOCs during the same period, also a six-year high, according to Equifax.

What are these people doing with their sudden access to ready cash, and how much are they pulling out? A new national survey, based on a representative sample of 1,364 homeowners with HELOCs, offers some important answers. The study was conducted last month by research firm Vision Critical for TD Bank.

The No. 1 finding: Most people aren’t spending their home equity line money on dumb stuff. There’s no evidence of a repeat of the wacky days of the last decade when houses morphed into ATMs and credit lines paid for groceries and nights out on the town.

Slightly more than half of current borrowers say they are using or have used their draw-downs for projects that are likely to increase the market value of their properties — updating kitchens, adding bathrooms, putting on a new roof and similar remodelings.

An additional 29% have used their HELOC money to take advantage of today’s wide gaps in interest rates among financial products. They are consolidating debts — paying off credit card balances with interest rates in the double digits using equity line funds borrowed at rates in the low single digits.

Nearly a quarter of borrowers say they’ve used some of the equity line dollars as a form of insurance against unforeseen “emergency” expenses — paying off bills for events that popped up without warning and might have been otherwise unaffordable.

Other major uses, according to the survey: Buying new autos (27% of borrowers); paying medical bills (18%); spending on kids’ and adults’ education costs (15%): travel (15%); and small-business investments (13%). Relatively few owners (13%) say they use their equity line dollars for day-to-day expenses.

Michael Kinane, TD Bank’s head of consumer and mortgage lending, says that he interprets the strong recent surges in home equity borrowing as a delayed reaction by owners who have put off home improvements and other expenditures for years because they were unsure about the economy, their jobs and where real estate values were headed.

“Now they’re stepping back in,” he told me. “They’ve got more confidence” in the economy and they’ve seen their property values increase to the point where they can responsibly pull out some cash secured by their equity.

Home equity lines as a financial product “are much safer” in 2014 — for borrowers and lenders alike — than they were a decade ago, Kinane believes. Most banks now limit the combined loan-to-value ratio — the total of the primary mortgage balance plus the maximum draw amount on the new credit line compared with the home value — to 80%. And full documentation of income, employment, credit and property values is the rule, not the exception.

In 2005 and 2006, by contrast, 100% ratios were readily available with minimal underwriting and documentation. Some lenders, including TD Bank, now allow select customers to borrow more (TD’s ceiling is 89%) but only those applicants with pristine credit reports, high FICO scores, lots of income and plentiful financial reserves.

Today’s rates and fees on HELOCs generally are as good as or better than they were at the height of the boom. A quick search of deals offered on Bankrate.com last week turned up rates from the low 3% range to 4% and up, depending on the dollar limit on the line and applicants’ credit scores. Some credit unions and banks offer special rates — below 3% — for existing customers or members with solid credit.

Bottom line: HELOCs are hot. If you’ve got the need, the equity and the capacity to handle one, now might be a good time to check them out.

Distributed by Washington Post Writers Group.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.