L.A. County office market perks up as vacancy falls and rents rise

- Share via

Growing companies in Los Angeles County ramped up demand for office space in the fourth quarter, demonstrating that more businesses are confident about their prospects.

The office market dipped in the recession and hit bottom about five years ago, but improvements afterward seemed to come grudgingly as shellshocked companies expanded their offices only with baby steps — until the second half of last year.

“L.A. County is doing extremely well,” Petra Durnin, managing director of research for Cushman & Wakefield, said of year-end office rental statistics. “I would say we are out of the wait-and-see recovery and in growth mode.”

The office market is a lagging economic indicator because leases last for years and companies that reduced staff during the recession had to fill empty desks before renting additional space for new employees. So recent growth in building occupancy suggests recovery is finally touching most of the region.

The workforce cutbacks so common during the economic downturn have slowed dramatically, Durnin said, and many firms are expanding.

“We have organic growth,” she said, particularly among technology and entertainment-related firms.

Los Angeles County had a net gain in office occupancy of 3.8 million square feet in 2014, compared with just 295,000 square feet in 2013, according to Cushman & Wakefield. Overall vacancy in the fourth quarter fell to 16.1%, from 18.2% a year earlier.

Traditionally desirable markets are much tighter: Vacancy in Santa Monica fell below 8% at the end of 2014 and Beverly Hills slid to 7.5%.

When there is less space available, landlords can demand more money.

“There has been a huge bump in asking rental rates,” Durnin said. Overall fourth-quarter rents in L.A. County jumped 5.5% from a year earlier to $2.68 per square foot per month.

Office landlord David Binswanger said his firm, Lincoln Property Co., has been “feeling an uptick in momentum” for the last seven or eight months.

“Space that sat empty for 12 to 36 months suddenly had two or three prospects at the same time,” he said.

Such demand has prompted landlords to ratchet up rents and cut back on offering concessions, such as periods of free rent, to prospective tenants, he said.

Lincoln Property, where Binswanger is an executive vice president, has 13 million square feet of office space in Southern California and intends to build more. Among its planned projects is a mixed-use development on the edge of Old Pasadena with 620,000 square feet of offices that is pending city approval.

Landlords’ positions are stronger in this up-trending office cycle than they have been in past cycles, Binswanger said. Developers have not flooded the market with new buildings the way they did the last two times the office market got hot.

“If demand holds for 18 to 24 months,” he said, “I see the potential for a real run” on rent increases.

Hollywood is one of the few busy markets for new office development with three major projects coming out of the ground, but those properties already have tenants or at least substantial interest from potential occupants.

In the region’s hot markets where real estate conditions are matching pre-recession peaks, building owners no longer mind having empty office space, Binswanger said.

“If you are a landlord in Beverly Hills, Culver City, Santa Monica and even Hollywood, the sun is shining,” he said. “You are enjoying your vacancy today because it will lease for more in a month.”

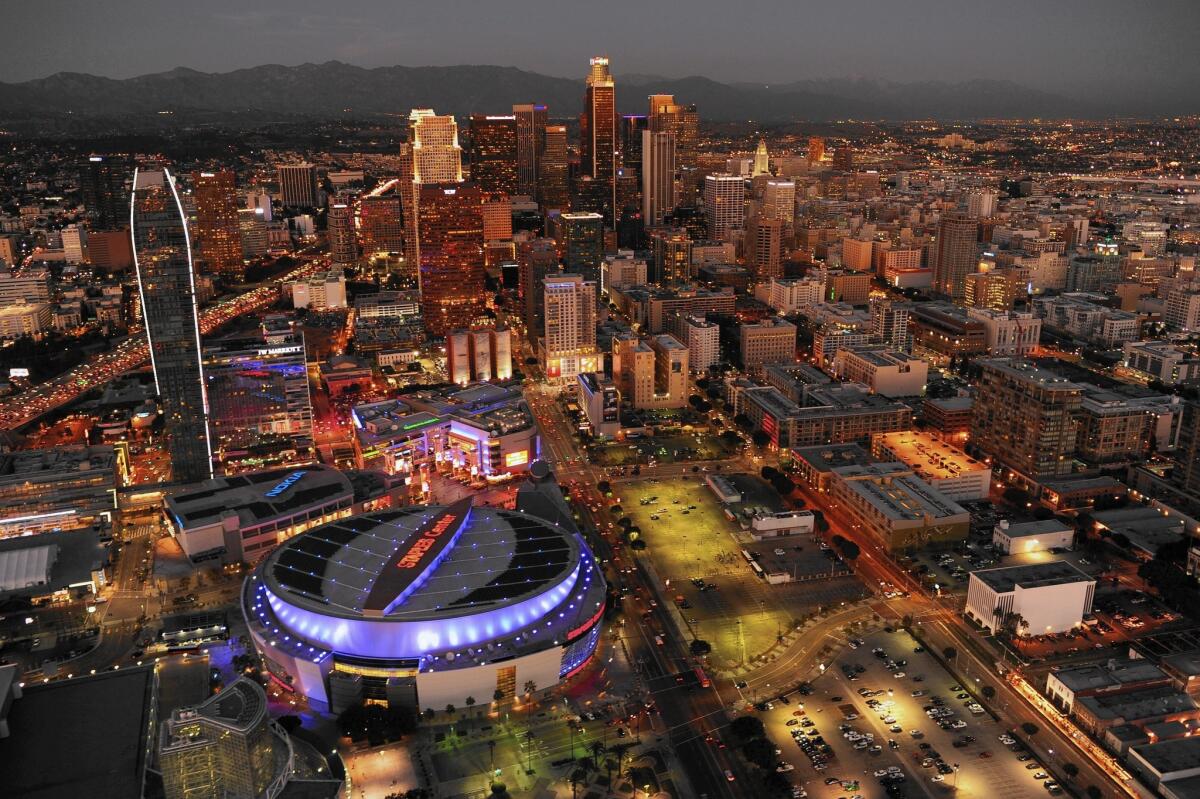

Downtown Los Angeles, the region’s second biggest office market after the Westside, has been overbuilt for decades and has yet to fully join the recovery. Vacancy fell slightly to 20.8% at the end of 2014, from 21.4% a year earlier.

But much of the central business district is controlled by a few landlords who anticipate that a turnaround is near. Fourth-quarter asking rents jumped from $2.99 a foot to $3.24.

Most of the vacancy is in four large buildings, Durnin said, and downtown is seeing robust leasing that resulted in a net gain of more than 200,000 square feet of occupancy for the year.

The central business district could turn the corner if another large tenant chooses to move there, said John McAniff, managing director of brokerage JLL.

“One 100,000-square-foot relocation into downtown has the potential to turn the market overnight,” he said.

Twitter: @rogervincent

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.