PG&E bondholders and fire victims offer plan that would hit stockholders hard

- Share via

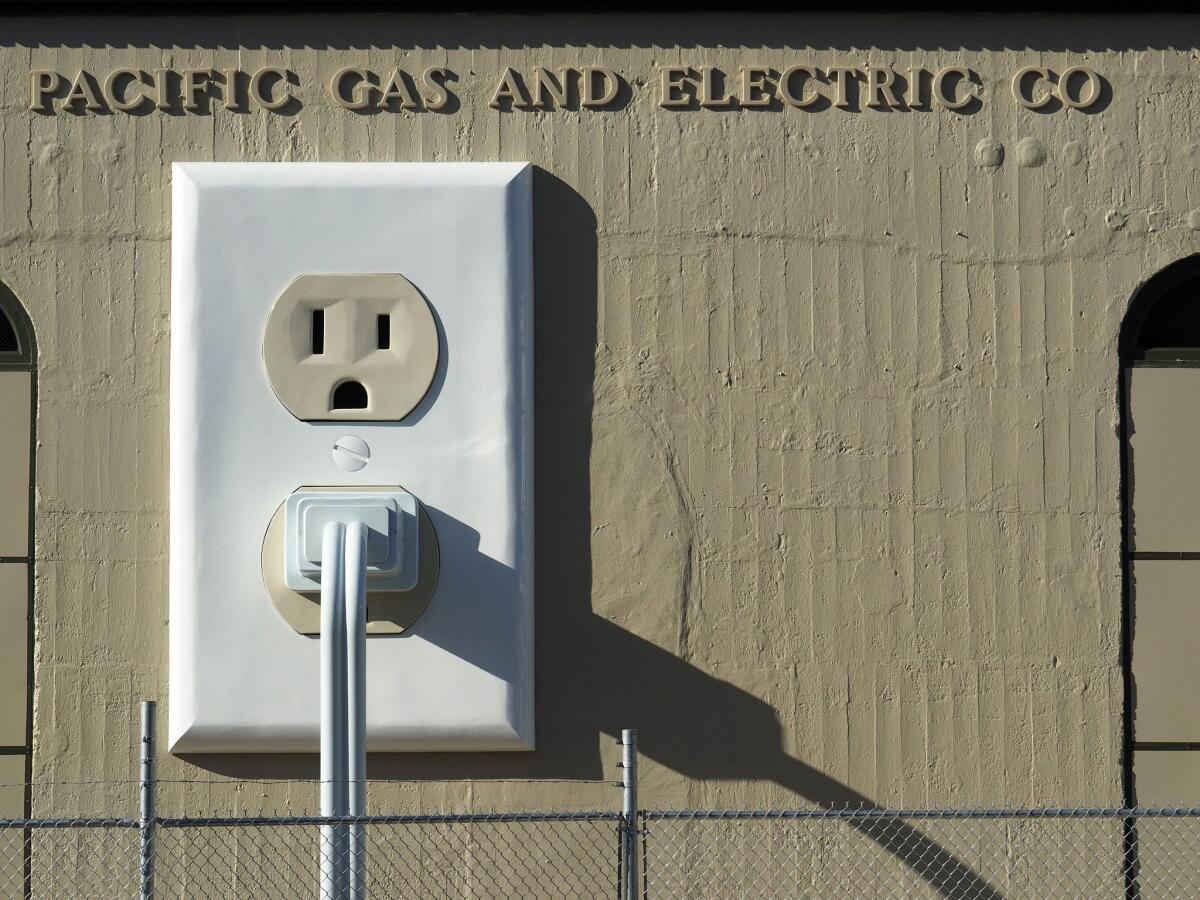

PG&E Corp. bondholders and wildfire victims teamed up to offer a competing bankruptcy recovery plan for the California utility that would all but wipe out its stockholders.

If a judge lets the coalition’s plan go forward, PG&E could lose control of the bankruptcy and its own reorganization plan, which envisions letting stockholders keep a significant stake.

PG&E shares slid 4.9% on Friday. Earlier in the day they were down more than 10%.

The bondholders — including Elliott Management Corp. and Pacific Investment Management Co. — and the committee representing fire victims said their new proposal includes a $24-billion settlement to pay all claims from fires blamed on PG&E’s equipment. That’s billions of dollars more than PG&E, which is the parent of Pacific Gas & Electric, has offered to those who lost loved ones and homes in some of the most destructive fires in California history.

The proposal, filed Thursday, adds new complexity to the biggest utility bankruptcy in U.S. history. The creditors and wildfire victims are seeking to end the San Francisco-based company’s exclusive right to come up with a plan so they can put forth their own.

It’s unusual for a company in bankruptcy to lose that priority, and Judge Dennis Montali rejected an earlier effort to supplant PG&E. But this time the coalition “likely has a good shot at ending the utility’s control,” said Negisa Balluku, a litigation analyst at Bloomberg Intelligence. “The competing plan may more efficiently solve the case’s key objective of compensating wildfire victims,” she wrote in a new report.

The group’s proposal “represents a path forward that recognizes the victims’ losses and puts their interests ahead of shareholders,” Robert Julian, an attorney for the official committee representing fire victims, said in a statement.

A PG&E effort to ask the California Legislature to help the company pay off wildfire claims fell flat this year at the state Capitol.

PG&E rejected the idea and affirmed support for its own proposal.

“The bondholders’ plan is an attempt to pay themselves more than they are entitled to under the law,” Lynsey Paulo, a PG&E spokeswoman, said by email. “Our plan of reorganization sets forth a framework to meet PG&E’s legal obligations in full while prioritizing victims and customers.”

Montali denied the previous request last month from Elliott and the other bondholders to make competing proposals, calling them “a feast for lawyers, accountants, investment bankers and others.” In that Aug. 16 decision, Montali worried rival proposals would spawn litigation fights that “have little or nothing to do with compensating victims.”

Until that August ruling, Montali hinted that he would end PG&E’s exclusive right to develop a plan to pay fire victims and the other creditors. On Friday, Montali set a hearing for Oct. 8 to decide whether to allow the new, competing proposal to go forward, rejecting a request by the official committee and bondholders for a much quicker than normal schedule.

PG&E filed for Chapter 11 bankruptcy protection in January in the face of an estimated $30 billion or more in liabilities from wildfires. Under PG&E’s reorganization plan, claims from individual wildfire victims would be capped at $8.4 billion, while insurers or insurance claim holders would get $11 billion under a settlement announced last week.

The new bondholder proposal offers $28.4 billion in new money in exchange for 58.8% of the equity in the reorganized PG&E. Under an earlier proposal, creditors had offered financing in exchange for an 85% to 95% stake in the new company.

A $24-billion wildfire trust fund would be set up and financed through $12 billion in cash and $12 billion in stock, according to the filing. The trust would have a 39.5% stake in PG&E. Overall, the creditor group and the trust would end up with a combined 98.3% of the equity in PG&E.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.