China’s EV makers plunge on fears that a government-backed bubble is bursting

- Share via

Shares of Chinese electric-vehicle makers and suppliers fell after a worse-than-expected quarterly loss for NIO Inc., the country’s answer to Tesla Inc., exacerbated concerns that a bubble in the world’s largest EV market may be bursting.

BAIC Motor Corp., which BloombergNEF says brought in more than $4 billion in EV revenue last year, saw its stock price drop 1% in Hong Kong, while BYD Co. closed down 4.1%, its biggest loss in over a month. Wuxi Lead Intelligent Equipment Co. retreated 4.5% in Shenzhen.

NIO’s U.S.-listed stock fell as much as 6.9% to $2.02 on Wednesday. The shares have plummeted more than 30% this week as the automaker plagued by cost overruns, vehicle recalls and a pullback in state subsidies for electric-car purchases posted a worse-than-expected loss.

The Chinese electric-vehicle maker has failed to assuage fears that it’s running short on cash. The company is aggressively expanding its sales efforts and taking comprehensive measures to reduce costs, Chief Executive William Li said on an earnings call.

“If a company’s liquidity is measured in weeks, it is definitely very dangerous,” Robin Zhu, an analyst at Sanford C. Bernstein, said by phone. NIO may need to seek government support, which will be difficult to get, he said.

The company is backed by Chinese technology giant Tencent Holdings Ltd. NIO plans to slash its workforce to 7,800 by the end of this month, from more than 9,900 at the start of the year. It’s also raising $200 million from Li and a Tencent affiliate and planning to spin off some non-core businesses by the end of the year.

“People are wondering whether the company can continue to survive,” said Jason Chen, an analyst from Blue Lotus Capital Advisors.

More broadly, the automaker’s struggles lend credence to mounting concerns that China’s state-sponsored support of the industry inflated a bubble that’s poised to pop. The nation’s sales of EVs and “new-energy” vehicles fell for a second straight month in August as the government scaled back subsidies. China accounts for half of the world’s EV sales.

“The latest industry sales and pricing data have not shown improvement, prompting us to fear the anticipated recovery in industry demand in September and 4Q may prove more modest than expected,” JPMorgan analysts Ryan Brinkman and Rebecca Wen wrote in a note, in which they also withdrew their price target on NIO.

The Chinese government started pushing development of electric cars to help eliminate air pollution, reduce oil imports and develop high-technology manufacturing. By 2025, China’s leaders want annual sales of new-energy vehicles — including pure-battery electrics, plug-in hybrids and fuel-cell cars — to reach 7 million units. That’s the equivalent of about 20% of China’s total auto market.

That has spurred billions of dollars in investments by traditional carmakers, startups and titans of the internet, electronics and real estate industries. The rush is on even as the government pulls back on the subsidies that juiced the industry to begin with.

There were 486 EV manufacturers registered in China earlier this year, more than triple the number from two years ago. While sales of passenger EVs are projected to reach a record 1.6 million units this year, that’s likely not enough to keep all those assembly lines humming, prompting warnings that the ballooning EV market could burst and leave behind only a few survivors.

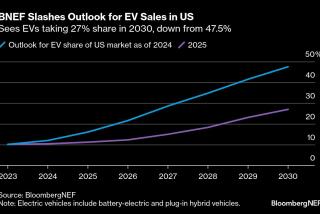

Dozens of startups have entered the global EV business in recent years, raising $18 billion since 2011, according to BloombergNEF. The startups promise to deliver a collective manufacturing capacity of 3.9 million vehicles a year. That’s excluding what some of the world’s biggest automakers are planning.

China’s big, but it’s not that big. Annual sales of passenger EVs only surpassed 1 million units for the first time last year, according to BNEF, spurred by the subsidies that could slice thousands of dollars off the sticker price. Yet EV sales make up just 4% of overall passenger vehicle sales of 23.7 million units, according to the China Assn. of Automobile Manufacturers.

At the same time, sales of traditional cars are currently in a free fall, plunging for the 10th straight month in March as a slowing economy and trade tensions with the U.S. weigh on consumer sentiment.

NIO has accumulated about $6 billion in losses since it was founded in 2014 by Li. Fire risks led to a mass callback of nearly 5,000 vehicles in June, a significant portion of the 17,550 units NIO had sold as of the end of May.

Though revenue surged more than 3,000% from a year earlier, that was a time when the company was just getting started to sell cars. It fell 7.5% from the first quarter.

NIO delivered 11% fewer vehicles compared with the first quarter, but it forecast that third-quarter revenue will rise as much as 10% from the previous three months.

NIO previously scrapped plans for a manufacturing plant in Shanghai after the government decided to provide support to Tesla, which aims to start production in China this year — another challenge for Li’s company. Annual capacity at the Tesla facility could eventually top 1 million vehicles, Chief Executive Elon Musk has said.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.