For Hong Kong’s anxious elite, the U.S. isn’t the top escape route

- Share via

As protests in Hong Kong intensified this summer, Los Angeles lawyer Bernard Wolfsdorf anticipated a new influx of immigration to the U.S. So he traveled to China and met with regional immigration advisors.

They told him not to get excited.

“What I heard is, while many are leaving Hong Kong, the U.S. isn’t the No. 1 destination,” Wolfsdorf said. “The U.S. is simply not seen as the most desirable option presently.”

When things go sideways around the globe, the U.S. has traditionally served as an island of safety and security, particularly for the world’s wealthy. The U.S. is already home to more Hong Kongers than any country outside of mainland China, and recent data suggest that more are looking to leave. Applications for a key emigration document, the “good citizenship card,” are up 54% in the last year, according to official data.

But anti-immigrant political rhetoric, high-profile incidences of gun violence and impending changes to the “investor visa” program have encouraged Hong Kong’s would-be emigres to consider alternatives such as Australia, Canada, Singapore and Taiwan.

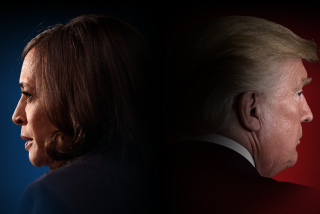

Chinese students and scholars feel targeted, and universities feel the pinch, amid the Trump administration’s crackdown on Beijing.

The street demonstrations, which raise fundamental questions about the future of Hong Kong, escalated this month. Two teenagers were shot as protesters fought with police, and the government used an emergency law for the first time in more than half a century to ban face masks.

Even before the protest movement began, the U.S. was losing luster. In a December survey by Chinese University of Hong Kong, one-third of the city’s citizens said they’d consider leaving. Among them, the most popular destinations were Canada and Australia, with at least 18% of respondents each, followed by Taiwan at 11% and Singapore at 5%. The U.S. was the top choice for 2.9%.

Australia is a favorite for clients of John Hu, founder and principal consultant at John Hu Migration Consulting in Hong Kong. Advantages include a small time difference with China and mild climate. Canada is also popular, Hu said, especially for clients who want to follow family members who previously emigrated there.

Canada last year recorded its biggest influx of immigrants since 1913. Under Prime Minister Justin Trudeau, the country has aggressively wooed immigrants. Its Global Skills Strategy program, for example, offering temporary work permits to applicants in as little as two weeks, has attracted about 40,000 workers and their family members over the last two years.

Mainlanders are willing to give up their freedoms in exchange for stability, development and wealth. That deal doesn’t fly in Hong Kong.

Family ties make the U.S. attractive. So does the EB-5 investor visa program, which offers residency to anyone able and willing to make a $500,000 investment in a business or other project that creates jobs. Applications from Hong Kong citizens are processed separately from filings of investors from the mainland, which means that once an application is considered, it can often be approved with little if any wait.

The price of those visas is about to surge, however. Starting Nov. 21, the minimum investment rises to $900,000, part of changes to the EB-5 program.

Even for those currently in the queue, a bureaucratic backlog means it can take years to get a visa. The U.S. Department of Homeland Security has slowed its handling of paperwork to a crawl, making applicants wait years for an answer to their petitions. The department was buried in 930,311 pending cases of all types at the end of June, government data show, double the number of pending cases from 2015.

The estimated wait for processing investor visas is at least 28.5 months, according to the U.S. Citizenship and Immigration Service.

“EB-5 is not likely an answer to people in Hong Kong who say they need a quick exit strategy,” said H. Ronald Klasko of Klasko Immigration Law Partners in Philadelphia. “It will probably be at least three years before that’s going to get them to the U.S.”

People who don’t want to wait often find other ways to enter and stay in the U.S., including student and visitor visas.

“During these troubles, my clients have been in the U.S. and Canada visiting,” said Carolyn Lee, an immigration attorney based in Ithaca, N.Y.

A less formal immigration status can also overcome another barrier daunting wealthy people who want to move to the U.S.: its unique and costly tax rules. For example, new immigrants must disclose all foreign holdings to the Internal Revenue Service, a level of scrutiny for which many aren’t prepared.

“Many of my Hong Kong-based clients are considering alternatives” to the U.S., said K. Eli Akhavan, a partner at CKR Law in New York. “The tax bite can be quite heavy.”

Hong Kong cracks down on hundreds of students and teens for wearing masks and burning flags, ahead of China’s 70th anniversary.

Hu, the immigration consultant, said American tax rules often take a back seat to quality-of-life issues for families considering the U.S.

“Hong Kong media’s frequent coverage of school shootings in the U.S. has also made people worry about safety,” he said. Another concern for some, he added, is that “racial discrimination is relatively serious in certain areas.”

Still, the U.S. remains a popular place to do business, educate children and park money. And even in the most stable times, the global super-rich often see spreading assets around the world as an important way to protect their fortunes, said Kathryn von Matthiessen, partner at Katten Muchin Rosenman in New York.

“Most families I work with are looking to create dynastic wealth,” she said. “That means they have to manage political volatility and geographic volatility.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.