In landmark decision, judge rules California FAIR Plan’s smoke-damage policy illegal

- Share via

- A Los Angeles County Superior Court Judge said Tuesday that the California FAIR Plan Assn’s policy violates the insurance code because it provides less coverage than what is required by the state’s Standard Form Fire Insurance Policy.

- The FAIR Plan’s handling of smoke-damage claims has angered homeowners who say they were told to try to clean up their properties and given low-ball offers to close their claims.

In a landmark decision, a Los Angeles judge has ruled that California’s home insurer of last resort is violating state law by how it treats smoke damage claims — a policy that homeowners have long complained shortchanges them, including, most recently, victims of the Jan. 7 firestorms.

Los Angeles County Superior Court Judge Stuart Rice on Tuesday said that the California FAIR Plan Assn.’s policy violates the insurance code because it provides less coverage than what is required by the state’s Standard Form Fire Insurance Policy, which provides coverage for all “loss by fire” damage without making any distinction for smoke damage.

Since 2017, the plan has required that fire claims must result in “direct physical loss” as defined by “permanent physical changes” to a property, which owners allege has made it more difficult to be compensated for smoke damage.

The plan issued a notice to its customers that year that said the new definition of direct physical loss “will result in the denial of claims that might have been paid under prior policy wording,” Rice noted in his decision in a case brought by a former Mono County property owner.

“This notice seems to admit that the CFP Policy is less favorable to insureds than the Standard Form Policy,” the judge wrote in declaring the policy illegal.

Two Los Angeles County Superior Court lawsuits accuse dozens of California home insurers of dropping policyholders and forcing them onto the FAIR Plan — the state’s insurer of last resort — where polices cover less and cost more.

Hilary McLean, spokesperson for the FAIR Plan, said the plan is reviewing the decision, but “As the FAIR Plan is in the process of updating its policy language to reflect the manner in which claims have been adjusted since last year, it is unlikely to pursue an appeal.”

“Our goal is to continue providing fair and reasonable coverage for wildfire-related losses while maintaining the financial integrity of the FAIR Plan for all policyholders,” she said.

Rex Frazier, president of the Personal Insurance Federation of California, which represents major property and casualty insurers, said the ruling could lead to untenable increases in costs for the plan.

“If the case stands for the proposition that the FAIR Plan needs to pay for very expensive lab testing in order to deny a smoke claim, then we will all suffer,” Frazier said. “That would dramatically increase claims expenses, which would, without doubt, lead to rate increase needs for the FAIR Plan.”

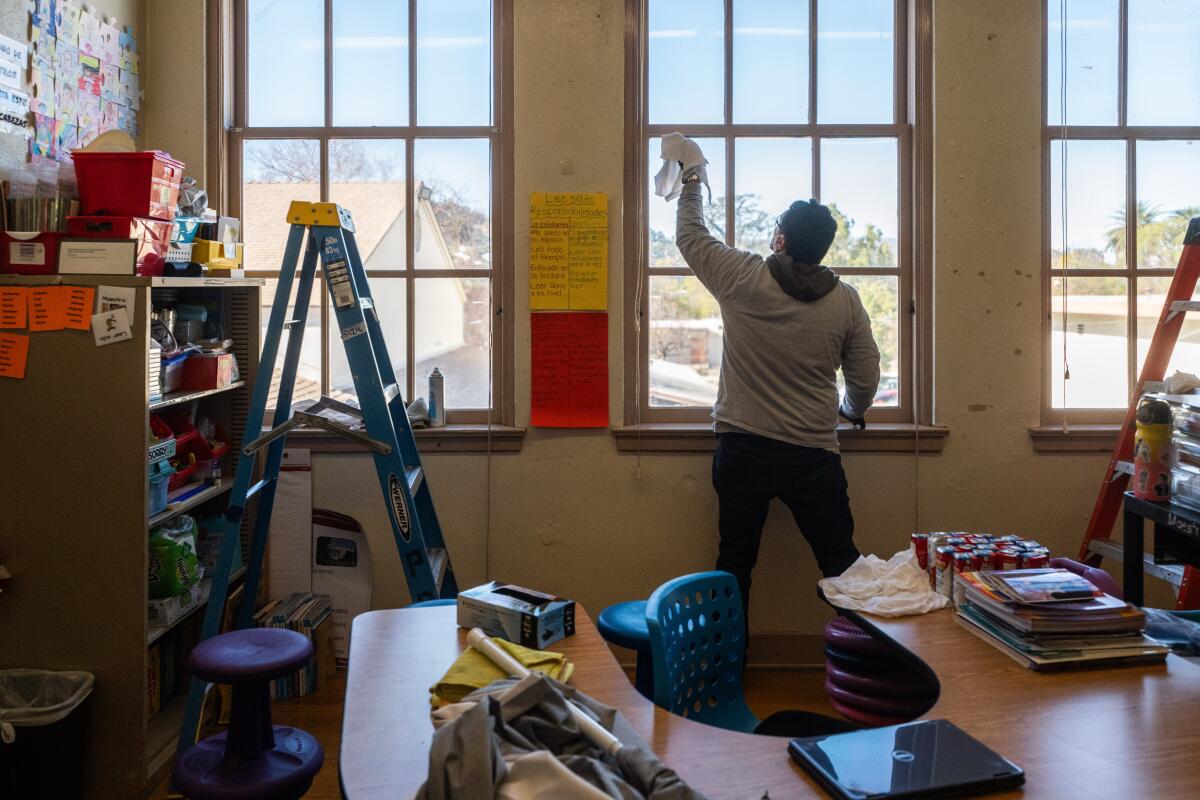

The FAIR Plan’s handling of smoke damage claims has angered homeowners who say that instead of being promptly offered industrial hygienic testing for toxic substances and professional cleaning services — even after homes were infiltrated by soot, ash and other fire debris — they were told to try to clean up their properties and given low-ball offers to close their claims.

The decision is likely to have broad implications given the fast growth of the FAIR Plan, which is based in Los Angeles and operated by the state’s licensed home insurers. Long a minor player in the homeowner market, it has seen its rolls skyrocket in the last several years as insurers have pulled out of California’s home insurance market, citing a growing risk from climate change, resulting in a series of catastrophic fires.

The plan covered less than a quarter-million California homeowners in 2021, but as of March its residential enrollment had reached 556,000. The number of homes on the plan in the Palisades and Eaton fire zones rose nearly 50% last year to 28,440, according to a Times analysis.

“This is a complete game changer,” said attorney Dylan Schaffer, who represents the plaintiff in the case.

He said this is the first time a judge has ruled the plan’s smoke-damage policy illegal. “This decision clearly says you can’t not pay for these claims. You can’t have a policy that doesn’t provide coverage for this kind of damage.”

A couple whose home was damaged in the Palisades fire filed a lawsuit Monday against the California FAIR Plan, the state’s home insurer of last resort, seeking to force the insurer to turn over claims documents.

Rice also struck down the plan’s requirement that smoke damage must be something perceptible rather than detected by laboratory testing. But Schaffer said the plan had abandoned that provision of its policy in June 2024 after a state Supreme Court ruling in another insurance case.

Plaintiff Jay Aliff sued in 2021 after his riverfront cabin south of Lake Tahoe was damaged by the Mountain View fire in November 2020.

The blaze damaged the roof and broke windows, allowing soot and ash to infiltrate the interior. However, the plan agreed to pay only $2,724.03 after subtracting depreciation and his deductible, even though Aliff claims the on-site adjuster estimated the damage at $7,034, according to his lawsuit. Aliff has since sold the property.

The plan amended its fire dwelling policy in 2012, when it added language that said smoke damage must be “visible to the unaided human eye” or capable of being “detected by the unaided nose of an average person” rather than being perceptible “by the subjective senses of (the insured) or by laboratory testing.”

Schaffer said that provision led to the rejections of more smoke claims, a problem that escalated after 2016. That was when the FAIR Plan sought approval from the state Department of Insurance for a new policy form that changed the definition of “direct physical loss” to require “permanent physical changes.”

In seeking approval from the department, the plan told regulators that the new policy language might result in a “broadening” of coverage, according to the Aliff lawsuit. But after receiving complaints about how the plan was handling smoke damage claims, state regulators in 2022 conducted a market conduct examination of the plan’s smoke-policy language and claims procedure.

As insurers withdrew from the L.A. market, more homeowners joined the FAIR Plan. Now Jan. 7 fire victims are battling with the state’s insurer of last resort to get compensated.

The report found that in seeking approval of its new definition of “direct physical loss,” the FAIR Plan “omitted relevant facts and misrepresented revised language as providing broad or broader coverage than the policy provided previously.” The plan denied that its policy was illegal, prompting the department to threaten possible “administrative action.”

The report also found that from Jan. 1, 2017, through March 18, 2021, the plan violated California’s Code of Regulations and Insurance Code 418 times. The violations included issuing fire policies that failed to meet state codes, failing to cover all fires and failing to “diligently pursue a thorough, fair and objective investigation” of claims, including more than 200 involving smoke damage.

Michael Soller, spokesperson for California Insurance Commissioner Ricardo Lara, noted that the department has started an investigation into the plan’s handling of smoke damage claims, including from the Los Angeles area. It also sent a letter to the plan in May, demanding it change its policies and investigate smoke damage claims in a reasonable manner.

“This ruling strongly supports our ongoing efforts,” he said.

Victoria Roach, the plan’s president, defended the insurer’s handling of smoke damage claims during an Assembly Insurance Committee hearing this year. She contended that the policy provides adequate coverage, even though it asks policyholders to first try to clean up their own properties.

“Smoke or ash in a house is not necessarily covered if it hasn’t damaged anything. Now, sometimes smoke, in and of itself, will damage things, right? It’ll damage the walls. It’ll damage porous surfaces, a lot of times, the carpets, the couches, the mattresses, things like that. If it’s beyond repair, we’ll cover it if it needs to be repaired,” she said.

The lawsuit originally sought class-action status but that request was rejected by Rice in December. In his most recent decision, the judge also ruled that the FAIR Plan did not violate the state’s Unfair Competition Law because it was not proved that Aliff had actually suffered any economic loss due to the policy.

Rice admitted this was an “incongruous” result, but said that was only because it was a high legal hurdle to prove such a matter before trial — and that Aliff may eventually win on this issue at trial.

Schaffer said he plans to file additional unfair competition motions with more evidence prior to trial, because a favorable decision on the law would allow him to seek a court injunction forcing the plan to change its smoke damage policy statewide.

That might apply not only to new and outstanding claims, but also to cases closed since 2017, the attorney said. The plan has received thousands of such claims since then, including those from the Jan. 7 fires, he said.

Amy Bach, an attorney and executive director of United Policyholders, a San Francisco insurance advocacy group, said the judge’s decision was “profound” and would force the FAIR Plan to change how it handles smoke damage claims aside from any injunction.

A group of California homeowners filed suit Wednesday against AAA and USAA, alleging that the insurers left them systematically underinsured and unable to rebuild after the Jan. 7 firestorms in Los Angeles County destroyed their homes.

“You have a court of law telling the FAIR Plan what we have been telling them, what people have been telling them, what lawyers have been telling them, what the Department of Insurance told them: ‘Your language is is illegal. You can’t use it, and now you’re going to have to make it right.’”

The losses suffered by Los Angeles County homeowners have spawned multiple lawsuits against insurers and the plan.

Schaffer’s Oakland-based firm Kerley Schaffer has filed lawsuits against the plan over its smoke damage policy dating to 2017, including proposed class actions in Alameda and Butte counties.

Most recently, his firm has teamed up with Edelson, a large Chicago-based law firm, to represent victims of the Palisades and Eaton fires who have filed multiple lawsuits against the plan over its smoke damage policy.

Other law firms have filed lawsuits over the plan’s policies since the Jan. 7 fires. Two lawsuits filed in April accuse hundreds of insurers of colluding to drop policyholders and force them onto the plan, which offers limited policies that typically cost more.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.