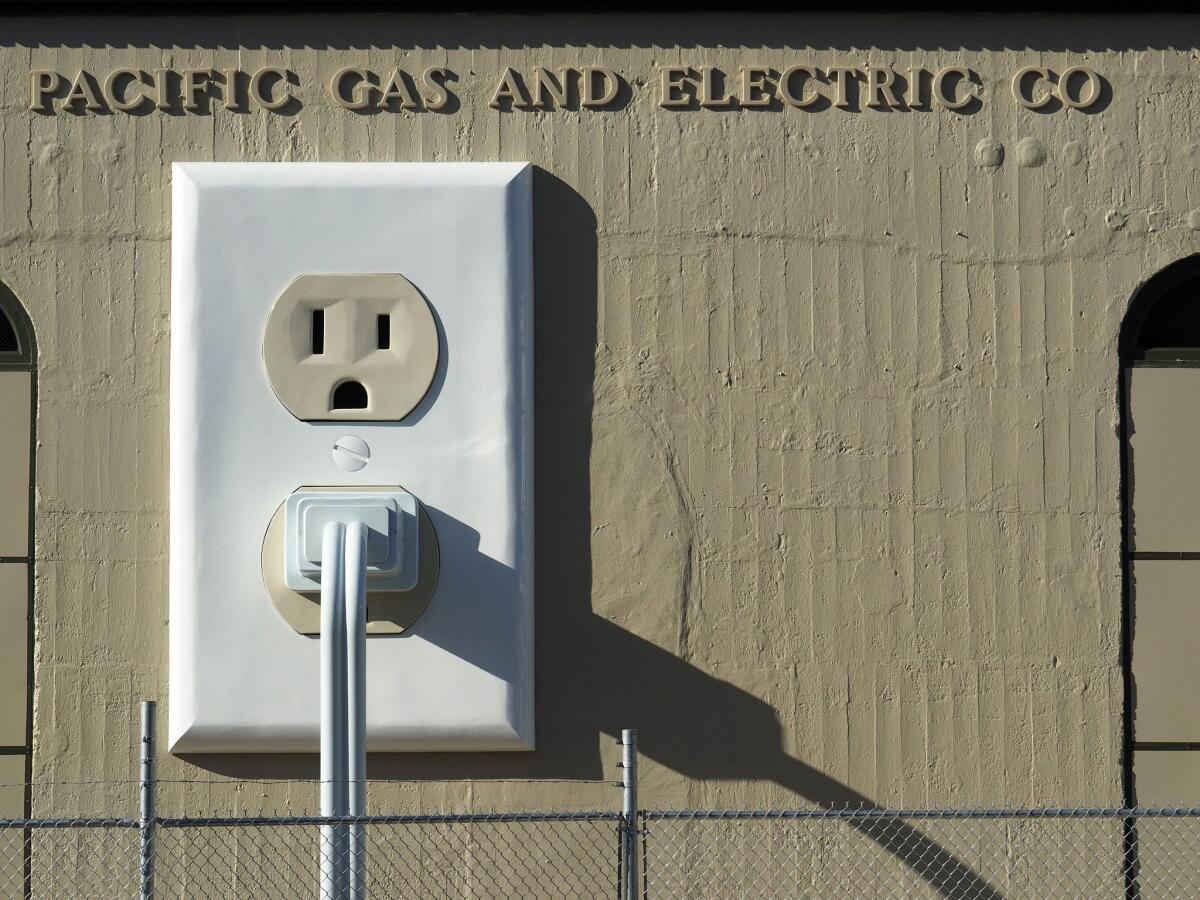

Pressure grows for California governor to allow PG&E takeover

- Share via

For California Gov. Gavin Newsom, sitting back and watching PG&E Corp.’s bankruptcy run its course is no longer an option.

The mayors of 22 cities are pressing him to turn the beleaguered power giant into a customer-owned cooperative. San Francisco, the city he once served as mayor, wants to take over the company’s local wires. On Wednesday, a board member of a statewide consumer group sent Newsom a proposal that would have the state run Pacific Gas & Electric like a massive municipal utility. And the former chief of California’s Public Utilities Commission joined a coalition of groups to similarly press him for public control.

“It is time for California to take over PG&E and stop letting profits stand in the way of a safe, clean energy future we all need and deserve,” the coalition, including former PUC President Loretta Lynch, said in its letter to Newsom on Thursday.

The proposals reflect a groundswell of anger against PG&E after years of deadly wildfires sparked by the company’s power lines, and most recently, deliberate mass blackouts that plunged millions of Californians into darkness four times last month. They also underscore the growing pressure that Newsom, who took office just weeks before PG&E filed for bankruptcy, is facing to step in and fix the troubled power company.

“He will be judged — and he’s already being judged — by how he manages this transition,” said Katie Bays, co-founder of consulting firm Sandhill Strategy.

Newsom’s office didn’t respond to a request for comment.

The municipal utility proposal submitted Wednesday envisions turning PG&E into a public agency governed by a board that could either be elected or appointed. It doesn’t spell out exactly how the state would finance such a plan but says PG&E’s power plants could be sold and its transmission lines spun off into a separate not-for-profit entity. The new board would “facilitate” efforts by San Francisco and other communities to buy pieces of PG&E.

“PG&E will never again be able” to provide “safe and reliable service at just and reasonable rates,” wrote Jeff Shields, a former public power executive who repeatedly tried to buy part of PG&E’s grid when he led an irrigation district in California’s Central Valley. He now serves on the board of the Utility Reform Network consumer group.

“Their culture of criminal conduct and repeated disregard for public safety must end under your leadership,” Shields said.

In some ways, Newsom has already involved himself in PG&E’s reorganization. He has called on companies and cities to make bids on PG&E’s assets, saying he was unimpressed with the restructuring plans that had been presented in its Chapter 11 bankruptcy case. He pulled stakeholders, including PG&E Chief Executive Bill Johnson, into a closed-door meeting to press for a quick exit from bankruptcy. He’s fighting PG&E’s plan to pay wildfire insurers $11 billion and has threatened a state takeover if the company fails to act soon.

If he makes good on that threat, he’ll have options. Backers of both the co-op and municipal utility ideas say their proposals would establish a new PG&E capable of regaining the public’s trust. And more pitches may follow.

“We all just need to work together to create a different model, because the current model of a PG&E driven by Wall Street and dividends, it just doesn’t work,” state Sen. Scott Wiener (D-San Francisco) said in an interview. Wiener is working on a bill to be introduced by February that would convert PG&E into a public utility. He said he’s still hashing out the details.

Even those on Wall Street are looking to state leaders to do more about power line-sparked wildfires and mass blackouts before they wreak long-term havoc on California’s economy. Already, the combined effect of this year’s fires and power shutoffs — estimated at as much as $11.5 billion — could put such a large dent in California’s economic output that the state might underperform the U.S. economy for the first time since 2010, said Scott Anderson, chief economist at Bank of the West.

“The earlier an enduring policy solution is implemented, the less risk to the state’s long-term credit,” Wells Fargo Securities senior analysts Randy Gerardes and George Huang wrote in a report.

Any effort to remake PG&E would be complex. The company serves 16 million people spread across 70,000 square miles, including mountains, farmland and dense cities.

The cooperative proposal would leave the company relatively intact but change its governance and business model. As a co-op, the new PG&E would have lower financing costs than the investor-owned company does, said Dan Richard, a former PG&E senior vice president of public policy who helped draft the cities’ plan. The company would issue bonds to pay off its debts, which Richard said conservatively range from $45 billion to $50 billion.

Whatever Newsom does must turn PG&E into a dramatically different institution with new governance, Bays said, because Californians won’t stand for anything less. “The governor absolutely pays consequences for allowing that to happen,” she said.

Baker and Varghese write for Bloomberg.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.