Trump to Social Security: Drop dead

- Share via

As Congress and the White House focus on crafting another rescue measure for Americans struggling with the coronavirus, the most important question may be:

Can’t someone find a way to distract President Trump from his stupid obsession with a payroll tax cut?

We’ve explained before why a payroll tax cut is always an absurd and harmful idea, never more so than in the current crisis.

It would undermine the finances of Social Security and Medicare while failing to deliver succor to the Americans who need it most.

By pushing to cut off the program’s funding stream, President Trump is taking the first step toward dismantling Social Security.

— Max Richtman, National Committee to Preserve Social Security and Medicare

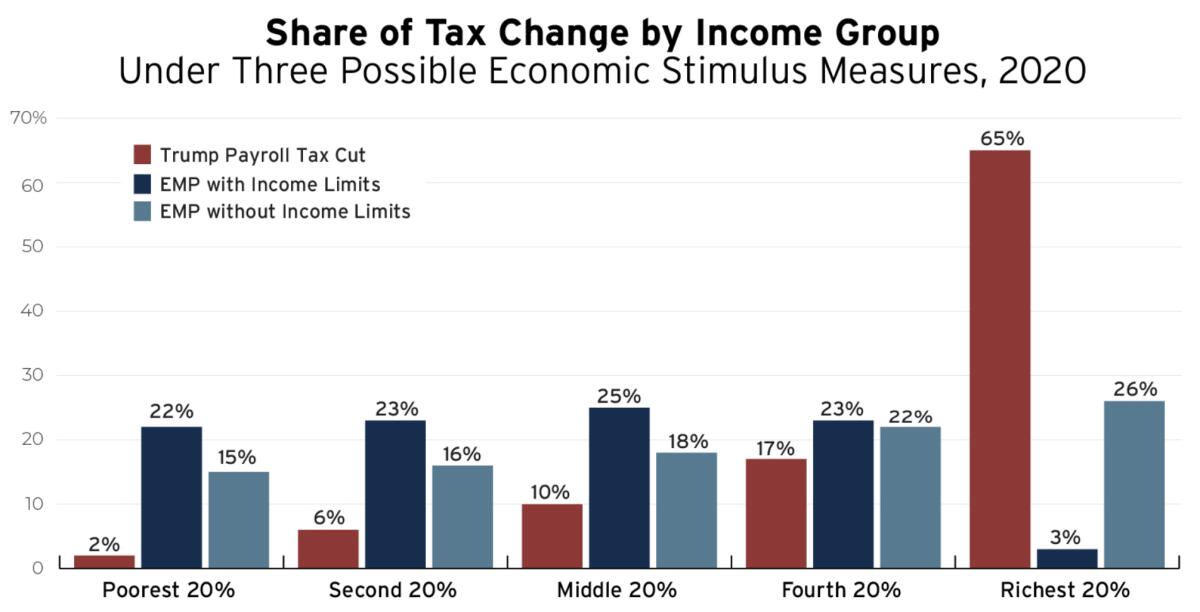

Trump hasn’t been too specific about the cut he demands, but even with a partial reduction in the payroll tax the poorest Americans would receive a few percent of the benefits, and the richest 20% would pocket half to two-thirds of the gains.

Trump has been fixed on this idea virtually since the start of his presidential term. Occasionally he has toyed with the idea of eliminating the payroll tax entirely, which would pile stupidity upon stupidity. Never has he offered a thoughtful, logical rationale for cutting the tax wholly or in part.

That’s true of his reported stance in the latest round of talks about a financial rescue for Americans. Trump has signaled that he won’t sign a rescue bill without a payroll tax cut.

As for why, all the White House has said about it is that “President Trump wants to provide relief to hardworking Americans who have been impacted by this virus and one way of doing that is with a payroll tax holiday,” in the words of White House spokesman Judd Deere. “He’s called on Congress to pass this before and he believes it must be part of any phase four package.”

Officials are ‘exploring’ a plan that allows workers to get up to $10,000, but requires them to pay back funds by deferring Social Security benefits.

Democrats on Capitol Hill are almost certain to treat a payroll tax cut as a nonstarter in negotiations over a rescue package. It isn’t a popular idea even among Senate Republicans, who are wisely tetchy about tampering with Social Security in an election year.

It’s possible that this is just Trumpian blather, and that once a bill is on his desk he’ll sign it, payroll tax holiday or not. Let’s hope so, and let’s explain why.

As we’ve observed, in all his references to a payroll tax cut, Trump has never shown a sign that he understands the payroll tax, what it’s used for, or why as a tool to get cash into the hands of Americans it would be worse than any other option.

As a reminder, the Social Security payroll tax comes to 12.4% of workers’ wage income up to an annually adjusted wage cap (this year: $137,700). Half comes directly out of workers’ paychecks, and half is paid by employers.

Economists generally attribute the employer portion to employees, on the rather idealistic reasoning that if employers didn’t pay it, worker wages would be commensurately higher.

An additional 2.9% of wages is deducted for Medicare, also split 50-50 between worker and employer, with no wage cap.

Trump again demands a payroll tax cut, but it makes no sense.

A payroll tax cut, therefore, would do nothing to help Americans who need the most help. To benefit from the cut, a worker must be paying the payroll tax. That’s not happening for the roughly 32 million Americans who have filed for unemployment benefits in the last few months because of the pandemic, because by definition they’re no longer on a payroll.

The tax cut would have zero benefit for millions of Americans who don’t pay into Social Security, including many state and local workers who aren’t covered by the system and seniors already receiving Social Security benefits, who are no longer paying the tax.

Moreover, even for many workers still receiving paychecks, the tax cut would be relatively trivial. If the payroll tax of 6.2% were to be cut in half, that would give a household collecting $50,000 a year in wages a benefit this year of $1,550, or about $30 a week.

Households earning the maximum in Social Security-covered wages would receive $4,269, or $82 a week.

Labor economists frown on paycheck-based stimulus because it only gets dribbled into household budgets paycheck by paycheck. They prefer the method of stimulus programs in 2001 and 2008 and the CARES Act enacted in March. The CARES Act gave most American households up to $1,200 per adult and $500 per child, with the sums phased out for higher-income families.

Studies of the earlier stimulus programs found that recipients pumped as much as 90% of the lump sum payments into the economy within three months.

By contrast, paycheck-based programs such as the Obama-era Making Work Pay delivered such small amounts per week or month that many taxpayers weren’t even aware they existed. Therefore, the payments barely affected their spending.

“Stimulus that is not seen or recognized by individuals is unlikely to affect their sentiment,” former Federal Reserve Governor Claudia Sahm observed.

That explains why a payroll tax cut is disdained by economists across the political spectrum. They include Michael R. Strain, director of economic policy studies at the pro-business American Enterprise Institute.

Strain wrote in March — the last time Trump was tub-thumping for a payroll tax cut — that the best way to deliver financial relief was by “sending checks to low-income households in areas with a severe coronavirus outbreak, or who are otherwise economically vulnerable to the virus.”

A payroll tax cut was a bad idea in President Obama’s time, and even worse now.

The worst downside to a payroll tax cut is its potential to undermine Social Security. “By pushing to cut off the program’s funding stream, President Trump is taking the first step toward dismantling Social Security,” Max Richtman, chief executive of the National Committee to Preserve Social Security and Medicare, warned in May.

The program will receive nearly 90% of its $1.1 trillion in revenue this year from the payroll tax.

That’s a dedicated income stream independent of the U.S. Treasury, which was the point of creating the payroll tax. As happened during the Obama administration, when Republicans last insisted on delivering financial assistance to Americans via a payroll tax cut, the lost revenue would presumably be backstopped by transfers from the Treasury.

But that’s a dangerous change, because it would erode Social Security’s fiscal independence and make it easier for the program’s enemies to cut benefits. Melding Social Security’s dedicated income with that of the federal government at large facilitates no one’s goals except those who want to see the edifice pulled down.

That includes Trump, who has spoken openly about cutting “entitlements” such as Social Security and Medicare benefits. He’s echoing threats made by Republicans such as Senate Majority Leader Mitch McConnell (R-Ky.), who has portrayed Social Security and Medicare as the cause of the federal deficit, even after he enacted a multibillion-dollar tax cut for corporations and the wealthy in 2017.

Need anything more be said? A payroll tax cut has nothing to recommend it, and a multitude of drawbacks. That Trump can’t get the idea out of his head may be the best evidence that it makes no sense.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.