SoftBank settles WeWork lawsuit, leaving embattled co-founder with windfall

- Share via

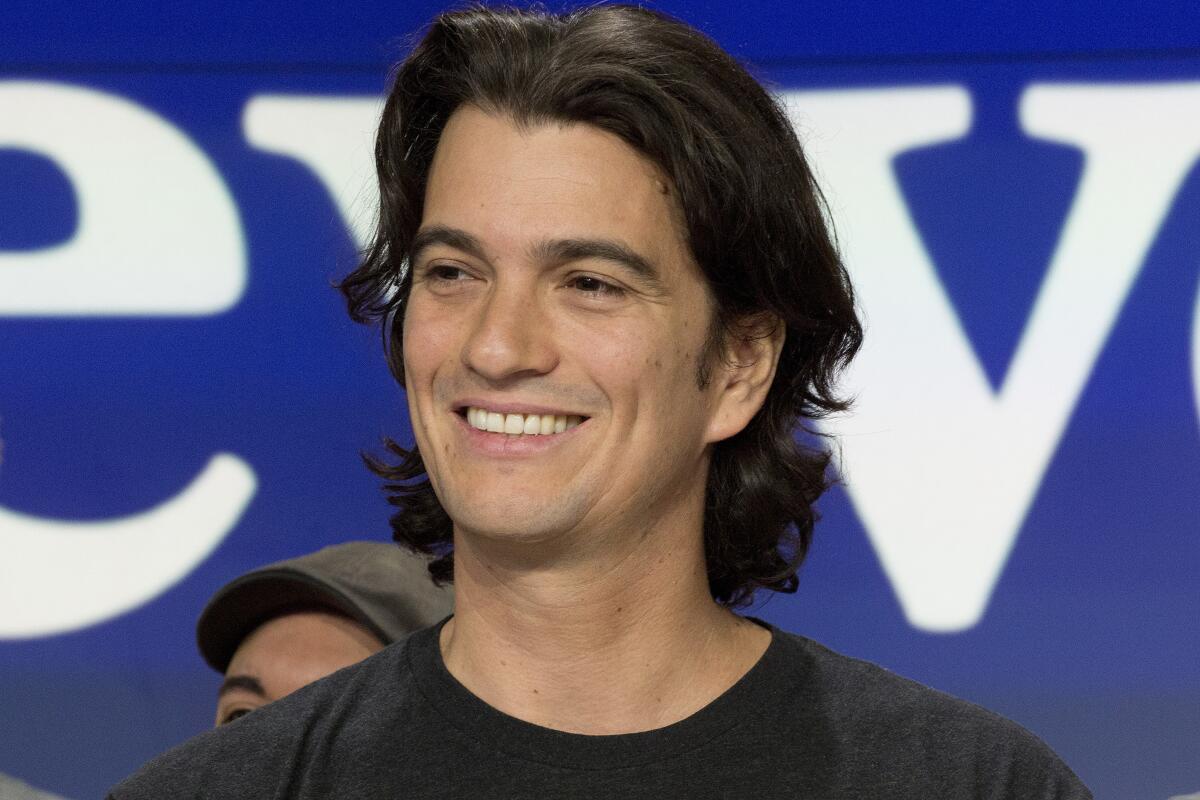

WeWork Cos. and co-founder Adam Neumann reached a legal settlement with SoftBank Group Corp. that will cement control of the embattled real estate start-up with its largest investor and send the former chief executive on his way with a financial windfall.

The pact announced Friday ends a legal fight over a stock transaction that collapsed and eliminates the need for a March 4 trial in Delaware. Terms of the settlement weren’t disclosed.

According to people familiar with the agreement, Neumann will give up for a year his role on the board of the co-working company he helped create, while cashing out roughly $480 million in stock to SoftBank. Additionally, SoftBank will pay Neumann $50 million to cover legal fees and another $50 million as part of a non-compete fee he was previously promised, as well as giving him a five-year extension on a $430-million loan he owes the Japanese investor.

Neumann can ask for a return to the board as an observer or designate someone in his place, but either request would require SoftBank’s approval, Bloomberg previously reported.

Neumann led WeWork to a failed attempt at an initial public offering in 2019 and was ousted shortly afterward. As part of the original bailout effort, SoftBank had agreed to buy $3 billion in stock from WeWork investors, including close to $1 billion from Neumann.

That generous exit offer angered many of his employees, especially when thousands of them were dismissed weeks later. Early last year, SoftBank declined to complete the transaction, even though it secured control of WeWork’s board in the deal, and Neumann and WeWork sued. In the end, SoftBank will buy half of what it initially agreed to purchase, at the same price as in 2019.

SoftBank is settling WeWork directors’ claims the Japanese conglomerate wrongfully reneged on promises to consummate the stock purchase because of “buyer’s remorse” in the wake of the economic havoc tied to the COVID-19 pandemic. SoftBank countered that it pulled out because WeWork couldn’t meet some of the deal’s closing conditions.

The settlement allows WeWork to continue to move beyond its infamous former chief executive. The deal also clears the way for the company to explore a second attempt at going public, potentially by merging with a blank-check company.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.