Tech company gains help push S&P 500 to record high

- Share via

Wall Street capped another week of gains with more milestones Friday, as strength in technology and healthcare stocks helped push the S&P 500 and Dow Jones industrial average to all-time highs.

The Standard & Poor’s 500 rose 0.8% for its fourth record high this week and third straight weekly gain. The Dow’s latest milestone followed an all-time high on Monday.

Stocks have benefited this week as bond yields, which had been steadily ticking higher, retreated from highs hit earlier in the month. Higher yields can slow down the economy by pushing up interest rates, making it more expensive for people and businesses to borrow money. Bond yields rose Friday, but that didn’t weigh on stocks.

A late-afternoon burst of buying pushed the major stock indexes higher. The S&P 500 rose 31.63 points to 4,128.80. The Dow gained 297.03 points, or 0.9%, to 33,800.60. The Nasdaq composite picked up 70.88 points, or 0.5%, to 13,900.19.

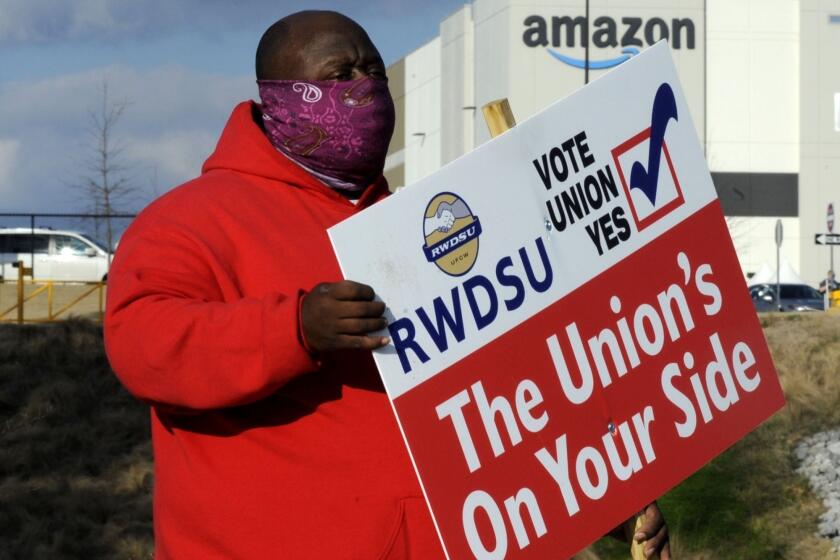

Amazon workers in Bessemer, Ala., vote against unionizing. It is the closest Amazon workers anywhere in the U.S. have come to a union.

Small-company stocks, which have outgained the broader market this year, lagged on Friday. The Russell 2000 index of smaller companies inched up 0.88 point, or less than 0.1%, to 2,243.47. Still, the index is up 13.6% so far this year, while the S&P 500, which tracks large companies, is up 9.9%.

Big Tech stocks were among the better performers. Apple rose 2%, Microsoft gained 1% and Intel added 1.8%. Healthcare companies also helped lift the market. UnitedHealth climbed 3.1% and Cigna rose 3.3%.

Financial companies also rose, aided by the rise in bond yields, which translates into higher interest rates lenders can charge on mortgages and other loans. State Street gained 2.4% and Wells Fargo added 1.2%.

The yield on the 10-year U.S. Treasury note, which influences interest rates on mortgages and other loans, rose to 1.66% from 1.63% late Thursday. It had been as high as 1.75% on Monday.

The market’s latest gains are in line with the upward trend this week as investors weigh concerns about the virus tripping up a steady economic recovery.

Developer Ricardo Pagan vows the pandemic won’t halt plans to build Angels Landing in downtown L.A., with condos, apartments, hotels, restaurants and possibly a school.

Investors are showing cautious optimism about the recovery, especially in the U.S., where vaccine distribution has been ramping up and President Biden has advanced the deadline for states to make doses available to all adults to April 19.

But it’s clear the recovery has a long way to go. The number of Americans who filed for unemployment benefits rose again last week, as many businesses remain shut down or partially closed because of the pandemic.

In remarks to the International Monetary Fund on Thursday, Federal Reserve Chairman Jerome H. Powell said a number of factors are putting the nation “on track to allow a full reopening of the economy fairly soon.”

Investors will turn their attention to quarterly results next week, when earnings season gets underway. The major banks are among the first to report their results, including JPMorgan, Wells Fargo and Bank of America. Analysts polled by FactSet have hiked their profit forecasts during the quarter. They expect growth of just over 24%, compared with the view back in September that companies in the S&P 500 would see 13% growth.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.