Bitcoin takes a wild ride, leaving investors whipsawed

- Share via

A 31% plunge in the morning. A 33% surge in the afternoon.

Such was the wild ride Bitcoin took investors on Wednesday, lopping off billions in value before comments from some prominent proponents helped propel it on a torrid rebound.

The extreme price swings in an asset known for its turbulence caused outages on major crypto exchanges and dominated chatter on Wall Street.

The tumult elicited a tweet from Elon Musk that implied Tesla Inc. wasn’t among the sellers. Justin Sun, a tech entrepreneur who founded the cryptocurrency platform Tron, tweeted that he bought $152 million in Bitcoin for around $37,000 a coin.

Down to within a whisker of $30,000 just after 9 a.m. in New York, the coin pared its loss to 7% and briefly topped $40,000 by 1 p.m. It was down 9.7% near $39,300 as of 4:30 p.m. Ether, the second-biggest coin, sank more than 40% before cutting that loss in half.

“The history of these assets has been littered with aggressive rallies and sickening sell-offs,” said Stephane Ouellette, chief executive and co-founder of FRNT Financial.

Rarely do they happen in a single session.

The volatility dominated Wall Street on a day when stocks and commodities were also under pressure and the Federal Reserve was set to release minutes from its latest rate-policy meeting. Frantic selling sparked outages on some of the biggest exchanges, including Coinbase Global Inc. and Binance.

#Cryptotrading was trending on Twitter, where critics and fans alike were in a tither over the rout.

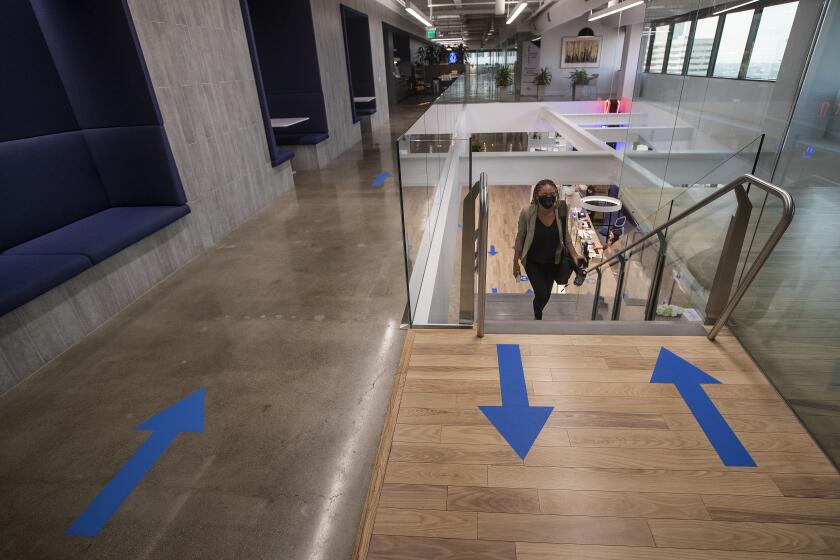

As COVID-19 recedes, California workers are being called back to the office. The office? Who remembers that place? And what will the return look like?

Tesla Chief Executive Musk touched off the wild moves last week. Bitcoin plunged when he announced the carmaker wouldn’t take it as a payment, but then reversed course when he said the company had no plans to sell its corporate crypto holdings. He seemed to imply in a tweet Wednesday that Tesla was not selling into the rout.

A statement from the People’s Bank of China on Tuesday reiterating that digital tokens can’t be used as a form of payment added to the sell-off.

While all were proximate causes for the rout, nothing could explain the frantic selling Wednesday morning, when the coin dropped thousands of dollars in price in a matter of minutes. Selling gave way to more selling as investors lured into crypto in search of a quick buck bolted for the exits. The selling accelerated when Bitcoin fell below its average price for the last 200 days.

Chart watchers pointed to key technical indicators as the coin sold off.

Most people say they aren’t ready to give up working from home. Some bosses are looking at a hybrid model. Others are eager to bring workers back.

Bitcoin bounced off the $30,000 level and many are waiting to see if it can break back above its 200-day moving average line. If it doesn’t, it could potentially retest Wednesday’s lows.

Cryptocurrency-linked stocks also dropped, with shares of Coinbase falling nearly 13% at one point and Marathon Digital Holdings Inc. slumping as much as 16%.

Bitcoin had embarked on a multimonth rally after Tesla’s February announcement, soaring to its $64,870 peak, in large part because of the company’s embrace.

Wiped out

At the time, Tesla’s acceptance was hailed as a watershed moment for the coin, with many in the crypto world seeing it as yet another step in its evolution.

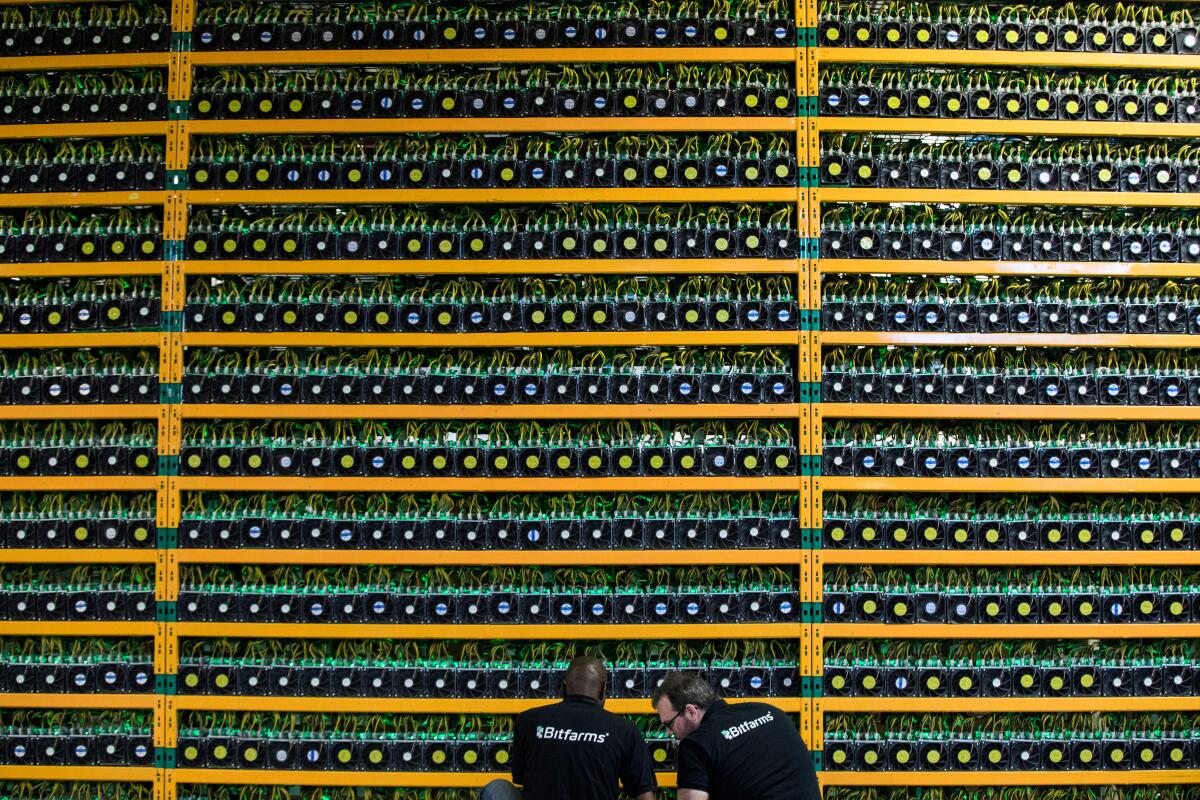

All that has been wiped out after Musk sent investors into a tizzy with a string of tweets that started last week when he criticized Bitcoin’s energy use.

Love remote work? Here are expert tips for how to negotiate a permanent work-from-anywhere arrangement with your boss.

Tesla would suspend car purchases using the token, he announced, calling recent energy consumption trends “insane.” Over the weekend, after insinuating his electric car company might have sold its Bitcoin holdings, he sent out tweets clarifying that it hadn’t. All of which had traders scrambling.

“Realistically, it is not the first time Elon Musk’s tweets have been erratic and, frankly, wrong,” said Ulrik Lykke, executive director at crypto hedge fund ARK36. “The crypto markets are extremely emotionally driven and their participants are prone to overreacting to events they perceive as negative.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.