Stocks close modestly higher after choppy day on Wall Street

- Share via

A choppy day of trading on Wall Street ended with stocks closing higher Wednesday, reversing much of the Standard & Poor’s 500 index’s modest pullback the day before.

The benchmark index ended the day with a gain of nearly 0.2%. Shares of retailers and other companies that rely on consumer spending made solid gains. Communication and financial stocks also helped lift the market. The S&P 500’s gains were tempered by declines in healthcare and technology.

Smaller-company stocks continued to outgain the rest of the market, as they’ve done all year. Treasury yields mostly edged higher.

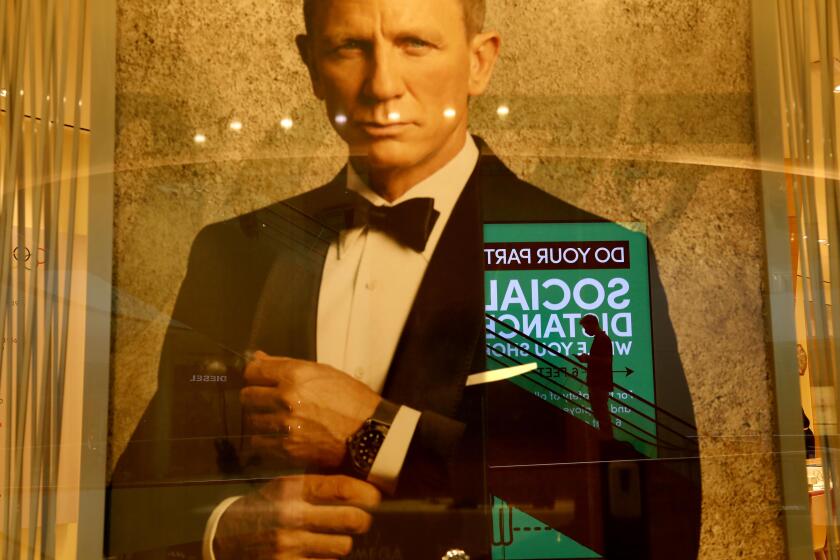

Amazon said it will buy MGM, acquiring popular franchises such as ‘James Bond’ and ‘The Pink Panther.’

Markets have been bumpy over the last few days as investors move past a stellar corporate earnings season and await additional clues on economic growth and inflation, which has been rising.

“That’s just going to be the state of the market environment for some time to come,” said Kristina Hooper, chief global market strategist at Invesco.

The S&P 500 rose 7.86 points to 4,195.99. The Dow Jones industrial average, which turned 125 years old Wednesday, edged up 10.59 points, or less than 0.1%, to 34,323.05. The Nasdaq composite advanced 80.82 points, or 0.6%, to 13,738. The Russell 2000 index of smaller companies climbed 43.52 points, or 2%, to 2,249.27.

The S&P 500 hit an all-time high May 7, then fell for two straight weeks heading into this week. The index is on track for a gain this week of about 1%.

Investors bid up shares in several retailers that delivered strong quarterly reports. Dick’s Sporting Goods jumped 16.9% after the company reported a surge in first-quarter sales and solid earnings as team sports returned. Urban Outfitters climbed 10% and Abercrombie & Fitch rose 7.8% on similarly strong financial results.

Retailers, hotels and cruise lines are poised for growth as more people get back to some semblance of normal with the COVID-19 pandemic’s hold on the United States seemingly easing and vaccinations increasing.

The next key economic update is set for Thursday, when the Commerce Department releases its GDP report for the first quarter. Economists are expecting a huge rebound in 2021.

The growing economy has also raised inflation concerns, though analysts expect that much of the increase will be tied to economic growth and will be digestible. Concern centers on stronger inflation prompting governments and central banks to roll back economic stimulus and raise interest rates. Federal Reserve officials have said that they see no need yet to change course.

Bond yields, which rose sharply this year, remained relatively steady. The yield on the 10-year Treasury rose to 1.58% from 1.56% on Tuesday.

“Investors need to stop worrying about short-term concerns around the Fed and inflation,” Hooper said. “That’s really creating a lot of the churn we’re seeing.”

Online retail giant Amazon is buying MGM — the movie and TV studio behind James Bond, “Legally Blonde” and “Shark Tank” — with the aim of adding movies and shows to its video streaming service. The announcement left Amazon stock little changed.

Markets in Europe were mixed, and markets in Asia were broadly higher.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.