Expect more shipping chaos thanks to the Omicron variant

- Share via

From seafarers refusing to get back on ships to truck drivers whose concern over COVID-related border closures trumps the lure of higher pay, the transport industry is bracing for another roller-coaster year of supply chain disruptions.

As Omicron infections surge and governments tighten restrictions, logistics companies around the world, from global giants to small businesses, can’t find enough staff. According to the International Road Transport Union, about one-fifth of all professional truck-driving jobs are unfilled, despite many employers offering increased wages. Some pockets of shipping are also sounding the warning bell about hiring prospects.

“2022 is shaping up to be another year of severe disruption, under supply and extreme cost for cargo owners,” said Simon Heaney, an analyst at maritime research consultancy Drewry. “The virus is once again showing it’s in charge,” he said, predicting 12 more months of stretched labor and healthcare-related red tape.

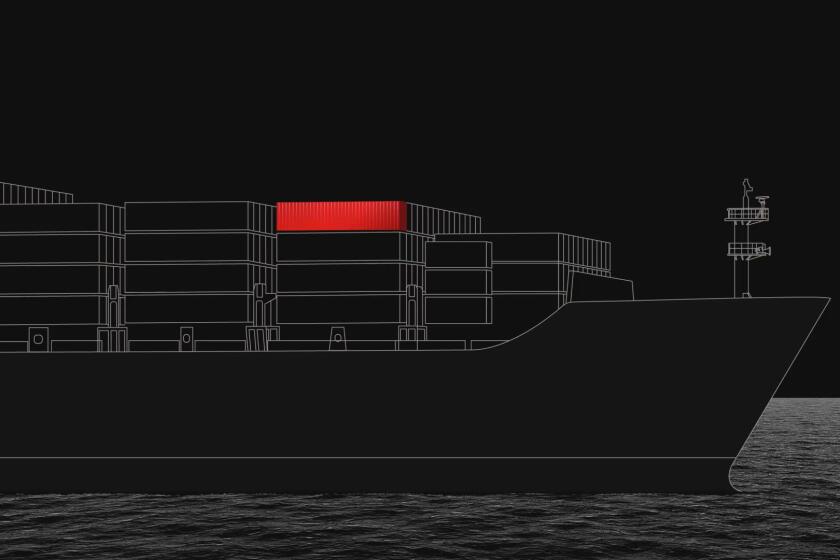

Follow a container of board games from China to St. Louis to see all the delays it encounters along the way.

As the Omicron variant takes hold, workers who deliver goods on ships and trucks are shouldering the brunt of a supply chain infrastructure still mired in chaos. Faced with long weeks of quarantine combined with the precarious nature of crossing borders and fears of getting sick, some people are refusing contracts while others are looking for work elsewhere, companies say.

In Romania, many truck drivers don’t want to accept long-haul jobs into other parts of Europe, stung by last year’s 30-mile traffic jams and waits of up to 18 hours at European Union borders. Countries where infections are surging are particularly problematic, according to Alex Constantinescu, chief executive of Alex International Transport 94 SRL, which operates 130 trucks that deliver pharmaceutical and food products throughout the continent.

Already faced with a driver shortage before the pandemic, the trucking industry’s labor crisis has become more acute, he said. The company has had to raise wages by about 30% over the last three years.

“Long hours on the road, sleeping in the cab and now not knowing if the people you interact with have the virus — truck driving isn’t very attractive anymore,” said Constantinescu, who founded the company 27 years ago. “I look behind me and I can’t see any new generation of drivers. The pandemic has made this work very unattractive.”

In Britain, the ranks of heavy goods vehicle drivers slumped by 23%, or about 72,000 people, in the second quarter compared to 2019, data from Logistics UK show. In China, the fear of quarantines is keeping drivers away. Just last week, the entire western city of Xi’an, population 13 million, went into a snap lockdown after 127 cases.

“China has very strict policy measures to control flare-ups and that’s making truck drivers unwilling to go to some areas where they might be quarantined,” said Salmon Aidan Lee of the energy consultancy Wood Mackenzie. “These harsh measures have further contributed to supply chain issues, and some polyester factories have had to shut.”

The shipping industry is facing similar labor challenges.

Though the crisis that prevented seafarers from getting home and being replaced with fresh mariners has mostly eased — fewer than 5% of seafarers were onboard ships beyond the expiry of their contracts in mid-November, a drop from 9% in mid-July, according to the Neptune Declaration Crew Change Indicator — now companies can’t entice them back.

They’ve been stuck for months on cargo ships now floating off Southern California. They’re desperate

On ships caught in the huge floating traffic jam off L.A., seafarers with scant access to vaccines have been stuck in limbo for months. Unions tell of despair and violence.

Western Shipping Pte Ltd., a Singapore-based tanker operator, said about 20% of its some 1,000 mariners don’t want to get back onto ships. About 5% of Anglo-Eastern Univan Group’s 30,000 mariners had indicated as of last month they aren’t interested in a new contract.

Western Shipping is having to hire seafarers from other companies and offer them good bonuses to boot, according to Managing Director Belal Ahmed, who also chairs the International Maritime Employers’ Council.

Some of those delaying going back to sea are senior crew members, such as officers with experience and tenure, said Bjorn Hojgaard, chief executive officer of ship manager Anglo-Eastern Univan.

“Even before COVID it was hard to get the right person with the right experience and training on a ship,” said Hojgaard, who is also chairman of the Hong Kong Shipowners Assn. “Today, we have to compromise. That worries me we’re not doing anything good for the safety of ships.”

The shortage may worsen as shipowners and charterers request only vaccinated crew be hired. And with Omicron requiring more booster shots, the dearth is intensifying. Less than 30% of seafarers from India and the Philippines, among the top countries providing mariners, were fully inoculated as of mid-November, according to the Neptune Declaration indicator.

“We can’t dictate that seafarers take the vaccination but customers are stating they’ll only use fully vaccinated crew,” Columbia Shipmanagement Ltd. Chief Executive Officer Mark O’Neil said. “It’s been a challenge keeping these huge cargo ships moving.”

Bloomberg writers Jack Wittels, Claire Jiao and Andreo Calonzo contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.