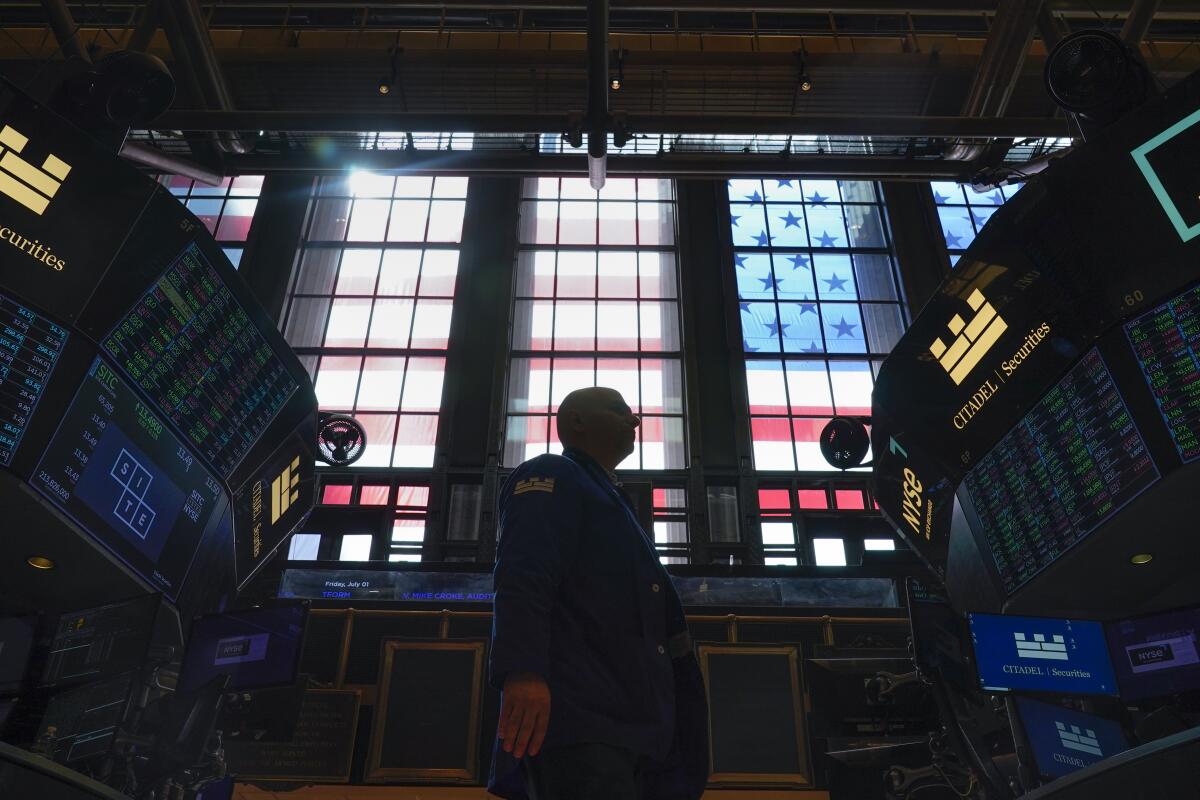

Wall Street ticks higher as U.S. inflation cools further

- Share via

Wall Street closed higher Thursday after a report showed inflation slowed again last month, bolstering hopes that the Federal Reserve may take it easier on the economy through smaller hikes to interest rates.

Although the report on U.S. inflation was clearly encouraging, stocks had already rallied earlier this week in anticipation of exactly such data. The numbers were in line with forecasts on many points, and analysts warned investors not to get carried away by them.

The Standard & Poor’s 500 index rose 13.56 points, or 0.3%, to 3,983.17. The Dow Jones industrial average rose 216.96 points, or 0.6%, to 34,189.97. The Nasdaq rose 69.43 points, or 0.6%, to 11,001.10

Small-company stocks outpaced the broader market. The Russell 2000 rose 32.01 points, or 1.7%, to 1,876.06. Every major index is on track for weekly gains.

Recently, stocks have been rising and bond yields have been falling on hopes that inflation’s cool-down from a summertime peak may get the Fed to ease off its barrage of rate hikes. Such increases can stifle inflation, but they do so by slowing the economy and risk causing a recession. They also hurt investment prices.

In the bond market, Thursday’s inflation report sent shorter-term yields falling further as traders increased bets for the Fed to downsize the size of its next rate increase. They’re now largely forecasting a hike of just 0.25 percentage points next month, down from December’s half-point hike and from four prior increases of 0.75 percentage points.

U.S. consumer inflation slowed again in December to 6.5% over the last year, easing pressure on households and fears of big interest rate hikes.

Many traders are betting on the Fed to follow that with perhaps another quarter-point hike, but to then potentially take a pause, according to data from CME Group.

Analysts cautioned that although Thursday’s inflation report did show inflation at its least debilitating level in more than a year, it still leaves room for continued pressure on the economy from high rates. They warned that markets may still be in for more big swings.

“While we can safely say that we are past peak inflation, it is too early to call victory on the battle against higher inflation,” said Gargi Chaudhuri, head of IShares Investment Strategy Americas.

Analysts also warned investors not to think of slower rate hikes as the same thing as cuts to interest rates, something some investors hope may happen later this year. Such cuts can act like rocket fuel for markets.

Inflation has been easing for six straight months. Even though it slowed to 6.5% last month from its peak of more than 9% in June, it’s still far too high for the Fed’s and U.S. households’ liking. The central bank has been adamant that it plans to continue raising rates this year and that it sees no rate cuts happening until 2024 at the earliest.

Of course, its forecasts have proven to be very wrong in the past, such as when officials called the initial burst of inflation coming out of the pandemic a “transitory” problem.

Some areas of the economy remain strong, threatening to keep up the pressure on inflation. Chief among them is the labor market. A report Thursday showed fewer workers filed for unemployment benefits last week. That’s an indication that layoffs remain low even though some big tech companies have made high-profile announcements on job cuts.

A strong job market is of course good for workers, particularly when their raises have been failing to keep up with inflation. But the Fed has been saying it does not want wage gains to get too high. That could create a vicious cycle in which companies raise prices to cover their higher costs and only worsen inflation.

A report last week showed that workers’ wage gains slowed in December. That report, coupled with the latest inflation data, “paints a strong picture that the Fed is starting to meet its target,” said Peter Essele, head of portfolio management for Commonwealth Financial Network. It also gives Wall Street more hope that the Fed can achieve a ”soft landing,” in which it tames inflation without inflicting severe damage on the economy.

“The likelihood of a soft landing is probably greater now than it was in the past 12 months,” Essele said.

The yield on the 10-year Treasury, which helps set rates for mortgages and other economy-dictating loans, fell to 3.43% from 3.54% late Wednesday. The two-year yield, which tends to more closely track expectations for the Fed, fell to 4.12% from 4.22%.

On Wall Street, stocks of airlines flew to some of the biggest gains after American Airlines said it expects to report stronger revenue and profit than it had earlier forecast for the last three months of 2022. It rose 9.7%, while United Airlines gained 7.5%.

Earnings reporting season is set to kick off in earnest Friday, with JPMorgan Chase and UnitedHealth Group among the day’s headliners. One big worry on Wall Street is that high inflation and a slowing global economy are eating into profits at big companies.

Analysts say this could be the first time earnings per share for S&P 500 companies fall from the year-earlier level since 2020.

AP business writers Yuri Kageyama and Matt Ott contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.