Wall Street pushes higher as earnings season ramps up

- Share via

Wall Street pushed higher Monday ahead of a week full of updates about where profits for big U.S. companies are heading.

The Standard & Poor’s 500 index rose 17.37 points, or 0.4%, to 4,522.79 and its highest closing level in 15 months. The Dow Jones industrial average gained 76.32 points, or 0.2%, to 34,585.35, and the Nasdaq composite climbed 131.25 points, or 0.9%, to 14,244.95.

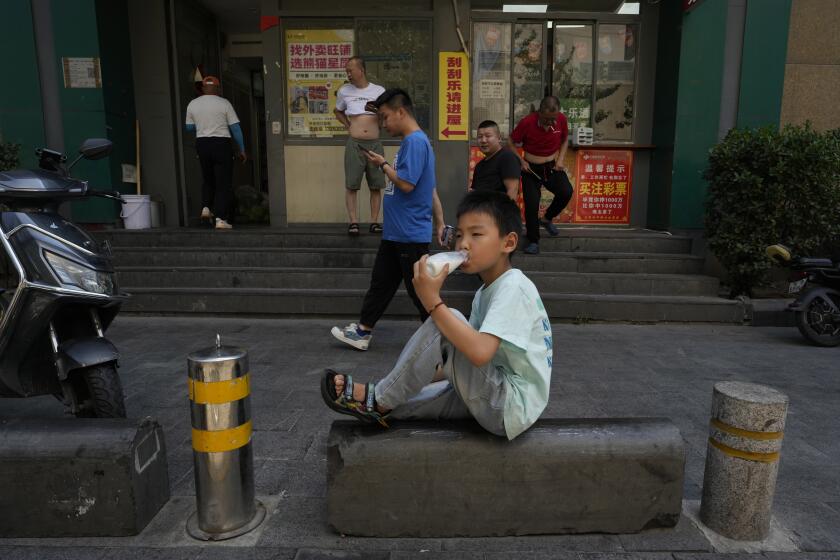

Stocks elsewhere around the world slipped after China reported weaker economic growth for the spring than economists expected. Its recovery following the removal of anti-COVID restrictions has fallen short of forecasts. Although that’s helped to limit inflation globally, it’s also diluted a main engine of growth for the world’s economy.

The weak data from the world’s second-largest economy helped send crude prices lower. Benchmark U.S. oil dropped $1.27 to $74.15 per barrel. Brent crude, the international standard, declined $1.37 to $78.50 per barrel. The hope among investors is that the disappointing figures will push Chinese authorities to approve more stimulus for their economy.

In the United States, the economy has remained resilient even though an expected boost from a Chinese recovery has yet to materialize. It’s managed to avoid a long-predicted recession despite much higher interest rates meant to push down high inflation.

China’s economic growth missed forecasts in the second quarter of the year amid a slowdown in consumer spending and weakening global demand.

A survey showed Monday that manufacturing in New York state unexpectedly grew, beating economists’ expectations for a contraction. Manufacturing has been one of the U.S. economy’s worse performing areas.

This week will offer more details on how that mix has affected companies as corporate earnings season ramps up. Nearly 60 companies in the S&P 500 are scheduled to report this week on how much profit they made from April through June.

Expectations broadly are low. Analysts are forecasting the worst drop for earnings per share among S&P 500 companies since the pandemic was pummeling the economy in the spring of 2020, according to FactSet. They’re also forecasting a third straight quarter of declines in profits.

Several banks and Delta Air Lines helped kick off the reporting season last week with results that were better than feared. This week will feature reports from Bank of America, Netflix and Tesla, among others.

Although last week’s earnings reports offer just a small sample size, the season’s start is encouraging because of how strong corporate forecasts have generally been for future results, according to strategists at Bank of America.

“We expect the momentum to continue,” the strategists led by Savita Subramanian wrote in a BofA Global Research report. They expect earnings declines for S&P 500 companies to bottom out this reporting season.

Also coming up this week will be the latest monthly update on sales at U.S. retailers. Strong spending by U.S. consumers has been one of the main reasons for the economy’s resilience, driven by a remarkably sturdy job market.

Any stigma of buying fashion secondhand is gone. Shoppers are running mini resale businesses as the investment value of certain luxury brands has soared.

Such resilient data, dovetailed with inflation that’s recently been on the decline, have helped launch Wall Street higher this year. The hope among investors is that all of ittogether will push the Federal Reserve to soon put a halt to its blistering campaign to raise interest rates.

The stock market’s big run also has critics warning that it’s gotten too sure of itself. It’s still not a certainty yet that the economy will avoid a recession, that inflation will continue to coast lower and that corporate profit growth will indeed recover.

The wide expectation is for the Fed to raise rates at its meeting next week, which would take the federal funds rate to its highest level since 2001. But the hope is that will be the final hike of this cycle.

Easier interest rates help all kinds of stocks, but investors see big technology and other high-growth stocks as some of the biggest beneficiaries.

Several led the market Monday, including Tesla, which climbed 3.2%. Tesla also said over the weekend that its first production Cybertruck electric pickup has rolled off the assembly line, but that was nearly two years behind the original schedule.

Activision Blizzard rose 3.5% after a U.S. appeals court late Friday rejected a bid by regulators to block the video game maker’s $68.7-billion purchase by Microsoft. Microsoft also said Sunday that it agreed with Sony to keep the “Call of Duty” series on the PlayStation console after its acquisition of Activision Blizzard, a move that could help ease regulators’ worries about the deal.

Microsoft‘s stock added 0.1%.

A U.S. appeals court has rejected a bid by federal regulators to block Microsoft from closing its $68.7-billion deal to buy video game maker Activision Blizzard.

On the losing end was Ford, which fell 5.9%. It cut the sticker price on its F-150 Lightning electric pickup by thousands of dollars.

In markets abroad, stocks in Shanghai slipped 0.9% following the weak Chinese economic data, and South Korea’s Kospi lost 0.4%. Markets in Japan were closed for a holiday and Hong Kong’s market was shuttered due to a typhoon.

In Europe, the losses were modest outside of a 1.1% drop for France’s CAC 40.

In the bond market, Treasury yields fell modestly. The yield on the 10-year Treasury slipped to 3.80% from 3.84% late Friday.

AP writers Matt Ott and Elaine Kurtenbach contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.