Stocks soar as cooling inflation raises hopes for an end to interest rate hikes

- Share via

Relief washed over Wall Street, and stocks leaped to one of their best days of the year after a surprisingly encouraging report on inflation.

The Standard & Poor’s 500 jumped 1.9% for its best day since April and hit a two-month high. The Dow Jones industrial average rallied 489 points, or 1.4%, and the Nasdaq composite charged 2.4% higher.

The highly anticipated report showed not only that overall inflation slowed last month from September but so did a key underlying figure that economists see as a better indicator of future trends. The slowdown bolstered bets on Wall Street that inflation is cooling enough for the Federal Reserve to finally be done with its market-crunching hikes to interest rates.

Such hopes lifted all kinds of investments, and more than 90% of the stocks in the S&P 500 climbed in a widespread rally.

Technology and other high-growth stocks tend to get some of the biggest boosts from easier rates, and a 2.3% jump for Amazon and 2.1% rise for Nvidia were two of the strongest forces lifting the S&P 500.

Stocks of smaller companies also got a huge boost, with the Russell 2000 index of small stocks surging 5.4% for its best day in a year. Smaller companies are often seen as more dependent on borrowing to grow, which makes them particularly vulnerable to high interest rates.

Inflation in the United States slowed last month in a sign that the Federal Reserve’s interest rate hikes are continuing to cool consumer price spikes.

The inflation data helped to buoy hopes on Wall Street that the Fed may actually pull off the balancing act of slowing the economy and curtailing investment prices just enough to grind down inflation, but not so much as to cause a painful recession. That is still not a certainty, though.

The Fed has yanked its main interest rate to its highest level since 2001, up from virtually zero early last year, in hopes of getting inflation back down to 2%. The moves have already sent shockwaves through the financial system, with stocks still down from their peak in early 2022 and several high-profile U.S. bank failures shaking confidence earlier this year.

Even if it doesn’t hike rates further, the Fed is likely to keep its main rate high for a while.

Still, the inflation report was unequivocally encouraging news for Wall Street. After the report’s release, Treasury yields in the bond market tumbled immediately as traders flooded into bets that the Fed won’t bump up rates again.

Investors also pushed up the expected timetable for the Fed’s first rate cut, which can act like steroids for financial markets and provide oxygen across the financial system.

“Ain’t no reason to believe the last inflation mile will be the most difficult,” said EY chief economist Gregory Daco. “Slower consumer demand, reduced housing rents, lower profit margins, easing wage growth and restrictive monetary policy represent the ideal disinflationary combo heading into 2024.”

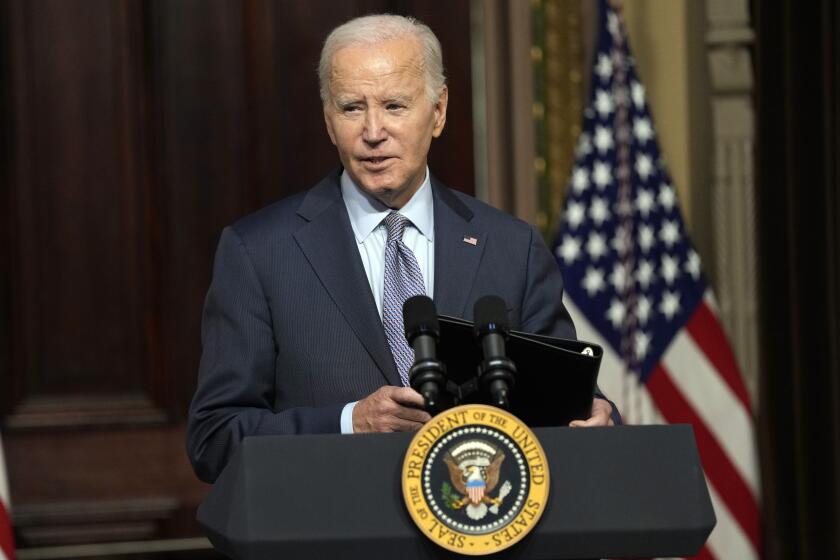

Biden’s economy is much better than Trump’s was, so why does he get lower marks for his economic management?

The yield on the 10-year Treasury tumbled to 4.44% from 4.64% late Monday, which is a significant move for the bond market. Just a few weeks ago, the 10-year yield was above 5% and at its highest level since 2007.

Traders now see zero chance of an increase at the Fed’s next meeting on Dec. 13, down from a 14.5% probability just a day ago, according to data from CME Group.

The prospect of no more rate hikes reverberated across all kinds of financial markets.

Starbucks Workers United says the strike will affect hundreds of locations during a holiday-themed giveaway of reusable red cups.

The value of the U.S. dollar fell against many other currencies, further slowing its strong run since the summer, while the price of gold rose $16.30 to settle at $1,966.50 per ounce. Higher interest rates tend to hurt gold because the metal looks less attractive as an investment when bonds are paying higher yields and gold continues to pay nothing.

On Wall Street, real estate stocks and others beaten down particularly hard by higher rates saw some of the market’s biggest gains.

Alexandria Real Estate Equities jumped 11.7%, for example. It owns mega campuses catering to life sciences companies in hubs around the country.

Real estate investment trusts send out most of their earnings to investors as dividends, which means they typically compete with bonds for the same kind of investors. When rates are rising and bonds are paying higher yields, those investors often turn away from REITs, utility companies and other high-dividend stocks.

Bank stocks were also strong on hopes that a halt to rate hikes will mean less pressure on the financial system. Zions Bancorp jumped 8.1% and Comerica rose 7.8%. Both their stock prices fell sharply earlier this year after the collapses of Silicon Valley Bank and other banks.

Elsewhere on Wall Street, Home Depot rallied 5.4% after it reported stronger profit for the latest quarter than analysts expected.

Target, Walmart and other big retailers will report their results later this week. They’re at the tail end of an earnings reporting season for the summer that has been better than analysts expected. Companies in the S&P 500 are on track to deliver their first overall growth in earnings in a year, according to FactSet.

All told, the S&P 500 rose 84.15 points to 4,495.70. The Dow advanced 489.83 points to 34,827.70, and the Nasdaq climbed 326.64 points to 14,094.38.

In stock markets abroad, indexes were mostly higher across Europe and Asia.

Associated Press writers Yuri Kageyama and Matt Ott contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.