Wall Street bounces back after a big loss, and S&P 500 again nears record

- Share via

Wall Street rebounded Thursday to claw back much of its sharp drop from the prior day, which was its first significant step back since a rally began in late October.

The Standard & Poor’s 500 index climbed 1% and is back within 1% of its all-time high, a day after its worst tumble in nearly three months. The Dow Jones industrial average rose 0.9% and came close to setting a record for the sixth time in the last seven days. The Nasdaq composite jumped 1.3%.

Micron Technology leaped 8.6% for one of the market’s biggest gains after reporting stronger results for the latest quarter than analysts expected and saying it sees business conditions improving throughout its fiscal year.

CarMax rose 5.2% after it beat profit expectations despite what it called “persistent widespread pressures in the used car industry.” And cruise operator Carnival steamed 6.2% higher after reporting better quarterly results than expected.

The trio helped lead a widespread rally in which more than 90% of the stocks in the S&P 500 climbed.

In the bond market, Treasury yields were mixed following a suite of reports on the economy. Mostly falling yields have been one of the main reasons the stock market has charged so high in the last two months. They relax the pressure on the financial system, encourage borrowing and boost prices for investments.

After falling in the morning, the yield on the 10-year Treasury edged up to 3.88% from 3.86% late Wednesday. In October, it had been above 5% and weighing heavily on markets.

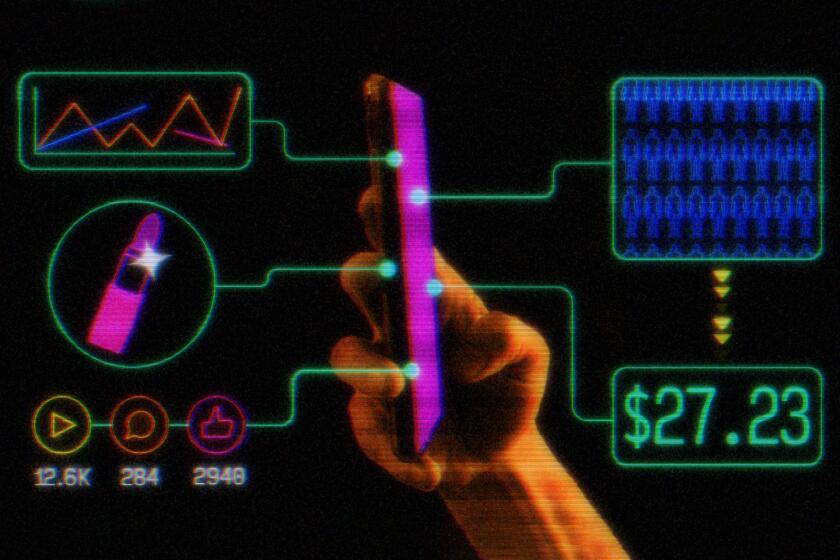

Flip, which competes with TikTok Shop and Amazon Inspire, bills itself as the only marketplace with honest reviews. It will pay you — and your friends — cash to check it out.

Yields have been dropping on hopes that inflation has cooled enough for the Federal Reserve to not only halt its hikes to interest rates but also to begin cutting them sharply next year. The Fed has hiked its main rate to the highest level in more than two decades, but officials released projections last week showing they see some cuts to rates coming in 2024.

Reports on Thursday painted a mixed picture of whether the Fed can indeed pull off the long-odds tightrope walk that Wall Street is hoping for: a slowdown in the economy powerful enough to conquer high inflation but not so strong that it causes a recession.

One report showed that slightly more U.S. workers applied for unemployment benefits last week, but the number was still below expectations and low relative to history. The hope at the Fed and on Wall Street is that the job market can cool by just the right amount so that it doesn’t cause mass layoffs but likewise doesn’t add upward pressure on inflation.

Another report showed manufacturing in the mid-Atlantic region is weakening by much more than expected. Manufacturing has been one of the hardest-hit areas of the economy. And a third report said the U.S. economy’s growth during the summer wasn’t quite as powerful as earlier estimated.

They “weren’t earth-shattering numbers, but they were still in line with the narrative that a cooling economy will keep the Fed on track to cut rates in the not-too-distant future,” said Chris Larkin, managing director of trading and investing at E-Trade from Morgan Stanley.

2023 was a brutal year for the likes of Elon Musk, Sam Bankman-Fried, book banners, anti-union managements and more

“Right or wrong, that sentiment has played a big role in the market’s recent surge, even though the Fed has been doing its best to temper expectations.”

Wall Street has been ebullient about hopes that a slew of rate cuts and a resilient economy will support stock prices. The S&P 500 has charged roughly 15% higher since just before Halloween, and it’s on track for an eighth straight week of gains.

That’s despite Fed officials having penciled in far fewer rate cuts than Wall Street has for 2024. Critics also say the number of rate cuts that traders are expecting is unlikely unless the economy falls into a recession, which some on Wall Street still see as an inevitable consequence of all the big rate hikes already instituted by the Fed.

That’s raised criticism that stocks have simply gone too far, too fast and become too expensive relative to profits that companies are earning. Even before Wednesday’s 1.5% drop for the S&P 500, several strategists on Wall Street were forecasting at least a pause in the rally in the short term.

On Thursday, the S&P 500 rose 48.40 points to claw back more than two thirds of that loss and closed at 4,746.75. The Dow gained 322.35 points to 37,404.35, and the Nasdaq jumped 185.92 points to 14,963.87.

In stock markets abroad, indexes were mostly lower in Europe and Asia. China was an exception, with stocks ticking 0.6% higher in Shanghai to trim its loss for the year by a bit. It’s one of the few markets globally that has not climbed sharply in 2023 amid hopes for easing inflation.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.