Wall Street climbs to erase almost all its losses for the week so far

- Share via

Wall Street bounced back Thursday and recouped almost all the losses it suffered earlier in the week.

The Standard & Poor’s 500 rose 41.73 points, or 0.9%, to 4,780.94 after back-to-back drops that kicked off this holiday-shortened week. The Dow Jones industrial average gained 201.94 points, or 0.5%, to close at 37,468.61, and the Nasdaq composite jumped 200.03 points, or 1.3%, to 15,055.65.

Big Tech stocks led the way, including Apple, which rose 3.3% to flip its loss for the week so far into a gain.

Chip companies were also strong after chipmaker Taiwan Semiconductor Manufacturing Co. gave a forecast for revenue in 2024 that analysts said was higher than they were expecting. Broadcom gained 3.6%, while TSMC’s stock that trades in the United States jumped 9.8%.

They helped offset a warning from Humana about how higher medical costs would eat into its profit. The insurer’s stock tumbled 8%.

Stocks were broadly steadier as Treasury yields in the bond market slowed their jump from earlier in the week. Yields had been climbing as traders pushed back their forecasts for how soon the Federal Reserve will begin cutting interest rates. Higher yields in turn undercut prices for stocks and raise the pressure on the economy.

The Fed has indicated it will probably cut rates several times in 2024 because inflation has been cooling since its peak two summers ago, meaning it may not need as tight a leash on the economy and financial system. But critics said Wall Street’s expectations went overboard in how many cuts the Fed would deliver this year and how soon it would begin. That in turn may have sent stock prices too high and Treasury yields too low since their big moves began last autumn.

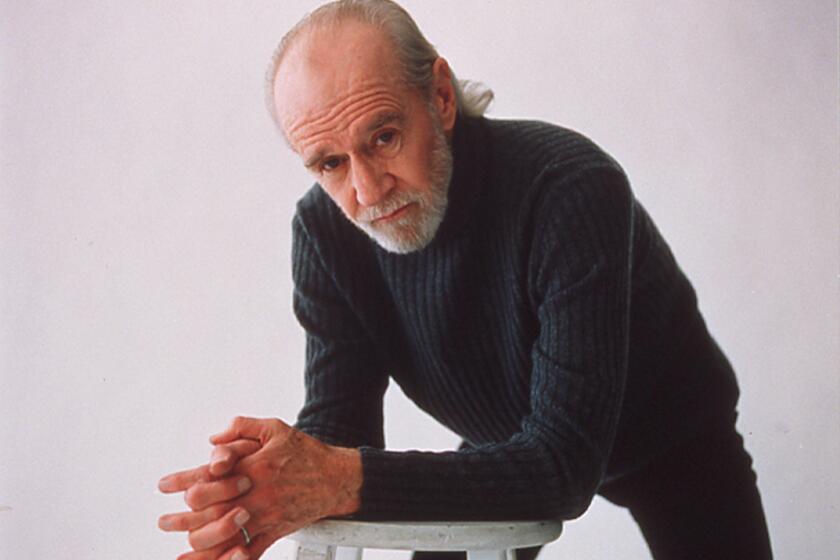

Column: The George Carlin auto-generated comedy special is everything that’s wrong with AI right now

To a meaningful degree, the entire AI industry right now is one opaquely sourced fake George Carlin comedy special: a crass stunt whose only purpose is to serve as an advertisement for itself.

The yield on the 10-year Treasury rose again Thursday, to 4.13% from 4.11% late Wednesday. But the move was milder than earlier in the week, when it jumped up from 3.95%.

The yield on the two-year Treasury, which moves more on expectations for Fed action, held at 4.36%, where it was late Wednesday. But even there was hesitation.

Treasury yields swung up and down in the minutes after a report Thursday morning showed the number of U.S. workers applying for unemployment benefits fell last week to its lowest level since September 2022. That’s good news for workers and for the economy overall, which has so far powered through predictions for a recession.

But a stronger-than-expected job market could also keep upward pressure on inflation. That would lessen the chances of the Federal Reserve cutting rates as soon as its March meeting. Traders are now betting on a roughly 55% chance of that, down from 73% a week ago, according to data from CME Group.

“The story this week continues to be robust economic data, and how it may keep rate cuts on ice for a while,” said Chris Larkin, managing director of trading and investing at E-Trade from Morgan Stanley.

Following a tradition of know-nothing pronouncements at the World Economic Forum, JPMorgan CEO Jamie Dimon declares Trump right about immigration, tax cuts, NATO and the economy.

Other reports on the economy were mixed Thursday. One showed manufacturing in the mid-Atlantic region is contracting by more than economists expected. Another said home builders broke ground on more projects last month than economists expected, even if it was weaker than November’s level.

On the losing end of Wall Street were several financial companies that reported weaker results for the end of 2023 than analysts expected. Discover Financial Services fell 10.8%, and KeyCorp lost 4.6% after both reported profits that fell well short of Wall Street’s forecasts, though their revenues topped expectations.

Helping to offset them was Fastenal, which jumped 7.2% for the biggest gain in the S&P 500. The distributor of safety supplies, fasteners and other products reported a bigger quarterly profit than analysts expected.

In stock markets abroad, indexes were higher across much of Europe and Asia to trim their losses for the week so far.

AP writers Yuri Kageyama and Matt Ott contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.