Auto tariffs seen hiking car prices by nearly $2,000 per vehicle

- Share via

Car buyers will bear the brunt of the $30-billion cost of President Trump’s tariffs, driving up already high U.S. auto prices by almost $2,000 per vehicle, according to consultant AlixPartners.

The firm expects auto companies to pass along 80% of the cost of Trump’s tariffs — which it calculates as $1,760 more per car. AlixPartners, as part of its annual global automotive outlook, also cautioned that the administration’s anti-electric vehicle policies risk relegating American automakers to bit players in the global EV market.

“These tariffs bring a big wall of cost,” Mark Wakefield, global auto market lead for AlixPartners, told reporters in an online briefing. We see “consumers taking the majority of the hit.”

General Motors Co. and Ford Motor Co. have already said they expect a $5-billion and $2.5-billion tariff impact this year, respectively, though they say they will find offsets in part through price adjustments.

Those higher prices will result in about 1 million fewer vehicles sold in the U.S. over the next three years, Wakefield said. But the consultant expects U.S. auto sales to reach 17 million in 2030, 1 million more than last year, as the effect of tariffs abates.

Economic experts and analysts expect the tariffs will increase the price of cars.

AlixPartners’ predicted sales hit is more muted than some other projections because the firm sees tariff rates falling as the U.S. negotiates trade deals with other countries. It forecasts the 25% auto tariff will ultimately fall to 7.5% on assembled autos, 5% on parts and even lower on cars and parts that are compliant with the U.S.-Mexico-Canada trade agreement.

“This tariff wall is not likely to last forever,” Wakefield said.

What’s likely to have a longer-lasting effect is the Trump administration’s move to reduce and eliminate incentives to spur the sale of electric vehicles, such as the $7,500 consumer tax credit for purchasing a battery-powered model, he said.

That will steer car buyers away from EVs as they “follow their pocketbook” and buy traditional gasoline-fueled vehicles, Wakefield said.

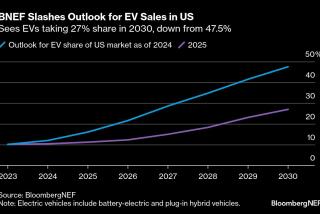

AlixPartners slashed its forecast for EV sales in the U.S. by nearly half. It now sees battery electric vehicles making up just 17% of U.S. auto sales in 2030, down from a previous prediction that EVs would make up 31% of sales by then.

Traditional internal combustion engine vehicles will account for half of U.S. sales in 2030, up from AlixPartners’ previous prediction that they would make up only about one-third of sales.

The consultant sees traditional hybrids accounting for 27% of the U.S. market in 2030, up from its prior forecast of 24%, while plug-in hybrids and extended-range electric vehicles will account for just 6% of U.S. auto sales by then, down from a previous prediction of 10%.

That will hurt U.S. automakers’ competitiveness and perhaps even leave them dependent on global EV leader China, Wakefield said.

“It makes it much more likely that they end up licensing or joint venturing or otherwise using platforms and EV technologies from China,” he said in an interview.

The “aggressive take-down of support” for EVs will leave American automakers with the dubious distinction of being the world leader in big, gas-guzzling engines, a century-old technology that’s in decline, Wakefield said.

“They’ll have the world’s best V8 engines by 2028,” Wakefield said of American automakers. “They’ll probably also have the world’s only V8 engines by 2028.”

Naughton writes for Bloomberg.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.