Bidding wars make buying a house in L.A. a nightmare. These buyers found a way around it

- Share via

“I’m a millennial. Buying a house has always been a life dream,” said Alex Mohajer, an Irvine native and longtime Los Angeles resident.

Buying a house in Los Angeles County, however, was more of a nightmare. “I was getting priced out in real time,” Mohajer said, as values in his target communities of Montecito Heights, City Terrace and East Los Angeles climbed rapidly out of his reach.

He said he started looking there in 2019 because these communities had houses listed in the $500,000 range. That wasn’t exactly “affordable,” he said, but still attainable.

“Fast-forward to the end of 2020 — there were no single-family homes available at that price,” Mohajer said. “If they were available, they were getting offers of $100,000 above asking in cash. I don’t have all that cash laying around.... I would get outbid pretty consistently, because I was a person coming in with a conventional mortgage.”

His story is familiar to anyone who’s joined the home-buying scrum in Southern California lately. Here are just a few other examples.

“We toured one [house] in Eagle Rock with no garage, no storage and the roof felt like it was caving in even though I’m only 5 foot 6,” said Courtney Northrop, who eventually landed in North Hollywood. “The open house felt like Disneyland. It was listed at $865,000 and ended up selling for $1.5 million.”

Five homebuyers tell us how they chose which neighborhood to commit to in Greater Los Angeles — no small feat.

“We looked all over the city but were getting beat by all-cash offers over the asking price,” said Ian Rosenberg. “We were close to buying a place in Highland Park and put in an offer, but someone came in with an all-cash bid that was $85,000 over ours.” He and his husband ended up buying a condominium in Sherman Oaks.

Like Northrop and Rosenberg, Mohajer found a way to prevail — not by outbidding the swarm, but by evading it. His story, and those from a few fellow buyers, offers some pointers for those who are still trying to join the ownership class in Southern California.

As a rule of thumb, home buyers and real estate agents say, you should count on a seller being able to choose from among multiple offers. In fact, they say, agents will sometimes list a house at a below-market price as kindling for an inferno of bids.

“There’s no doubt that price is always the biggest factor when it comes to a sale,” said Edan Amar, a real estate agent with Keller Williams in West Hollywood. “It shouldn’t be in anybody’s expectation that a seller’s going to walk away with less if there’s an opportunity to earn more. It’s just business.”

Watching prices climb ‘in real time’

Mohajer said that his student loan debt had precluded him from even thinking about buying a home until March 2020, when the federal government suspended loan repayments and interest charges because of the COVID-19 pandemic. That opened a window for him to line up financing and start bidding.

Uncommon ways to buy a home

Then reality set in. “Time and time again I would put in an offer, and there would be 15, 16, 17 offers above asking — in cash. Who’s out here with all this flexible cash?” he said. “As a first-time home buyer and as a young person, I found it pretty demoralizing.”

The serial rejections made it clear he was going to be buying a starter home, not his dream home. So he did two things that many home buyers ultimately have to do.

First, he broadened his search, considering less desirable neighborhoods with a longer commute to his office in downtown Los Angeles. And second, when he found a place in his price range in Long Beach, he pounced on it the day it was listed, two weeks before the house could be toured.

The listing didn’t even have pictures of the place, and the relatively low price — $425,000 — could have signaled major structural problems. Plus, it was aging and small, with only 750 square feet of space. But it was cute from the outside, so when Mohajer’s real estate agent suggested he put in an offer sight unseen, he did.

As it happens, the sellers needed to accept an offer in a hurry in order to complete a deal on a new home, Mohajer said. So they accepted his bid, which was the only one on the table. And 45 days later, after an inspection revealed no deal-killing problems and the mortgage was approved, the house was his.

“It was a lot less than I had initially expected, in terms of what kind of a house I was hoping to buy,” Mohajer said. Among other things, it’s smaller than he envisioned and it’s taken a lot of work.

But the house has also appreciated in value quickly, raising his equity to 20%. “In terms of making an investment in my future, I unequivocally think it was a smart choice for me,” he said. “I think my whole generation has struggled building our own wealth.... I’ve put my foot in the door to move up the ladder of homeownership.”

He admits that luck played a big role in his purchase. But he added, “The months of experience leading up to it made me comfortable to act really quickly, even with a blindfold on. It was a risk, but you have to get comfortable taking a risk in a market like this.”

Sellers in a hurry

And in fact, “motivated sellers” are a thing. Anthony (who asked that his last name not be used so he could talk freely about his finances) took a path similar to Mohajer’s en route to landing a house in North Inglewood.

When he started looking in 2019, Anthony said, he was looking at houses around $300,000. “Then everything went crazy in 2020.”

The Great SoCal House Hunt

Late that year, he saw a “coming soon” listing in Inglewood for $350,000 — $25,000 more than what he initially hoped to spend on a house — and told his agent that he wanted to check it out the moment it was open. When the listing published early in 2021, though, the price was up to $400,000, even though “the photos were not great, the description was OK — it ended up not being the most attractive thing,” he said.

They got a chance to see the house on a Sunday, and it was “pretty worn out,” Anthony said. The owners of the two-bedroom, 2½-bathroom home had been there for 30 years, and “they hadn’t really staged anything — you could tell that they were just eager to get out of it.”

He had some reservations about the place, he said, but a comparable sale suggested that the house was underpriced and “likely to appreciate in value with some TLC.” So he decided to make an offer that evening at $405,000 in the hope of avoiding a bidding war. Four days later, his offer was accepted.

“It turns out they were also buying a place at the same time,” he said, which made them “more willing to just accept an offer so they could just have the money” for their own purchase.

Keep your cool

Amar has gotten a close-up view of the bidding wars from all sides: as a listing agent for sellers, as a buyer of investment properties and as a representative of clients trying to purchase homes. And although buyers have been shouldering some risk in their offers — for example, by tightening deadlines and waiving some contingencies in advance — he says there are some risks that simply aren’t worth taking.

One no-no, Amar said, is waiving the inspection unless you’re planning to tear down the structure. “I would never advise a client, ‘Don’t inspect before you buy,’” he said.

He’s also seen buyers get caught up in the frenzy of the moment, leading them to come in “at a really high price, not necessarily a logical price.” Which, in turn, leads to some soul-searching after the dust settles.

One reason is that a buyer will go to an open house and see other potential competitors there. Then the seller’s agent will say that an offer has already come in, which over the next few days turns into three, four, five or even dozens of offers, Amar said.

“Buyers at times feel like they don’t have time to think,” he explained. “There’s an element of shopper’s exhaustion and pressure to pull the trigger fast,” leading people to pay a price they may come to regret.

But then, that’s the nature of the market here. “When I first started, when you wrote an offer that had aggressive terms or waived contingencies, most listing agents said, ‘You seem very aggressive.’ These days, it’s become the standard.”

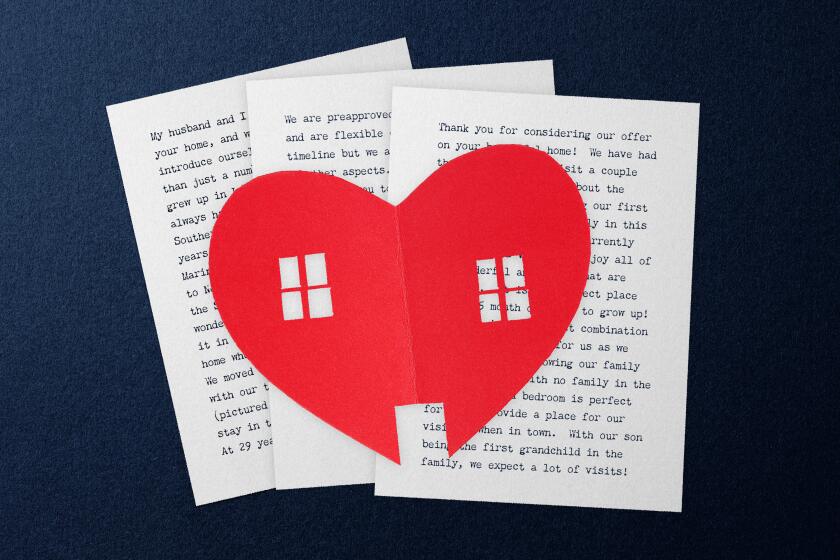

“Buyer interest” letters are common in ultra-competitive housing markets like California’s, even though they raise questions of discrimination.

That shift toward offers with more risk and over-asking bids is hard to accept for some folks who bought their houses years ago.

“At one point, we wrote an offer for $30,000 over the asking price, and my dad asked if our agent was trying to screw us,” said Kaitlynne Sanfilippo, who eventually found a home in Long Beach. “He suggested we write an offer for $1 over asking, but we told him that’s not the world we live in anymore. Like, we’re happy for you and your 30-year mortgage, but we won’t get the house if that’s what we do.”

Buying off the market

Marc Stenchever was no stranger to hot real estate markets, having bought his current home in Seattle in the 1990s. Still, he was taken aback by the bidding wars he encountered when he and his brother Mike went shopping in 2020 for a winter home in Southern California.

What they found was that places were being “pre-listed,” giving real estate agents a preview and priming the pump for bids, said Stenchever, a retired public defender. Then when the homes formally hit the market, they would draw multiple offers the first day, he said.

The brothers found themselves outbid, sometimes dramatically so, even when they came in over the asking price. His takeaway? “It’s insane.”

“We were probably unrealistic when we started out because we thought, based on what we were seeing on Zillow or whatever, that it was possible to get a place for less than what they actually were selling for,” Stenchever said. Making matters worse, he said, prices “probably went up 8 or 10% when we were looking.”

The only way they were able to buy, he said, was because he “sweet-talked a Realtor who was working with a builder on new construction.” The project was a townhome complex in Oceanside about five blocks from the Pacific, and the developer had decided to put only half of the units on the market, Stenchever said. The other half would be sold at a fixed price to people who signed up for them.

Naturally, more people signed up than there were units. “We thought there was no chance we were going to get one of those,” he said. But one Saturday the agent called and said the brothers could have one of the townhomes if they put up the earnest money deposit on Monday, which they did. The 1,500-square-foot three-bedroom, three-bath unit sold for about $820,000, he said — plus the added cost of the flooring, appliances and paint that were needed to finish the home.

Stenchever said that if every unit in the complex had been put on the market, they probably would have sold for more than he paid for his. So he feels lucky to have gotten a home in Southern California.

Many successful buyers would tell you the very same thing.

Step-by-Step Guide

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.