PASSINGS: Howard B. Schow

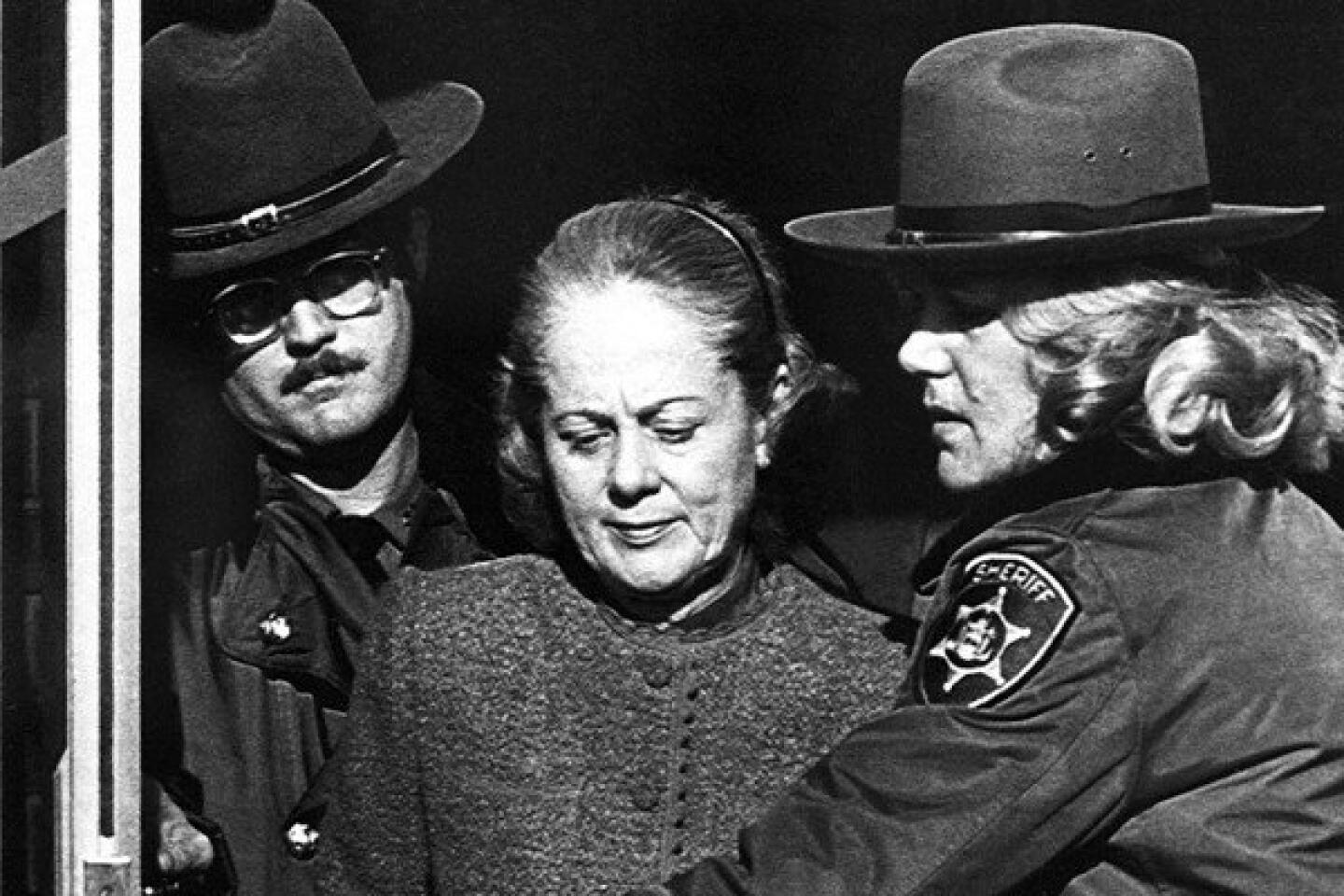

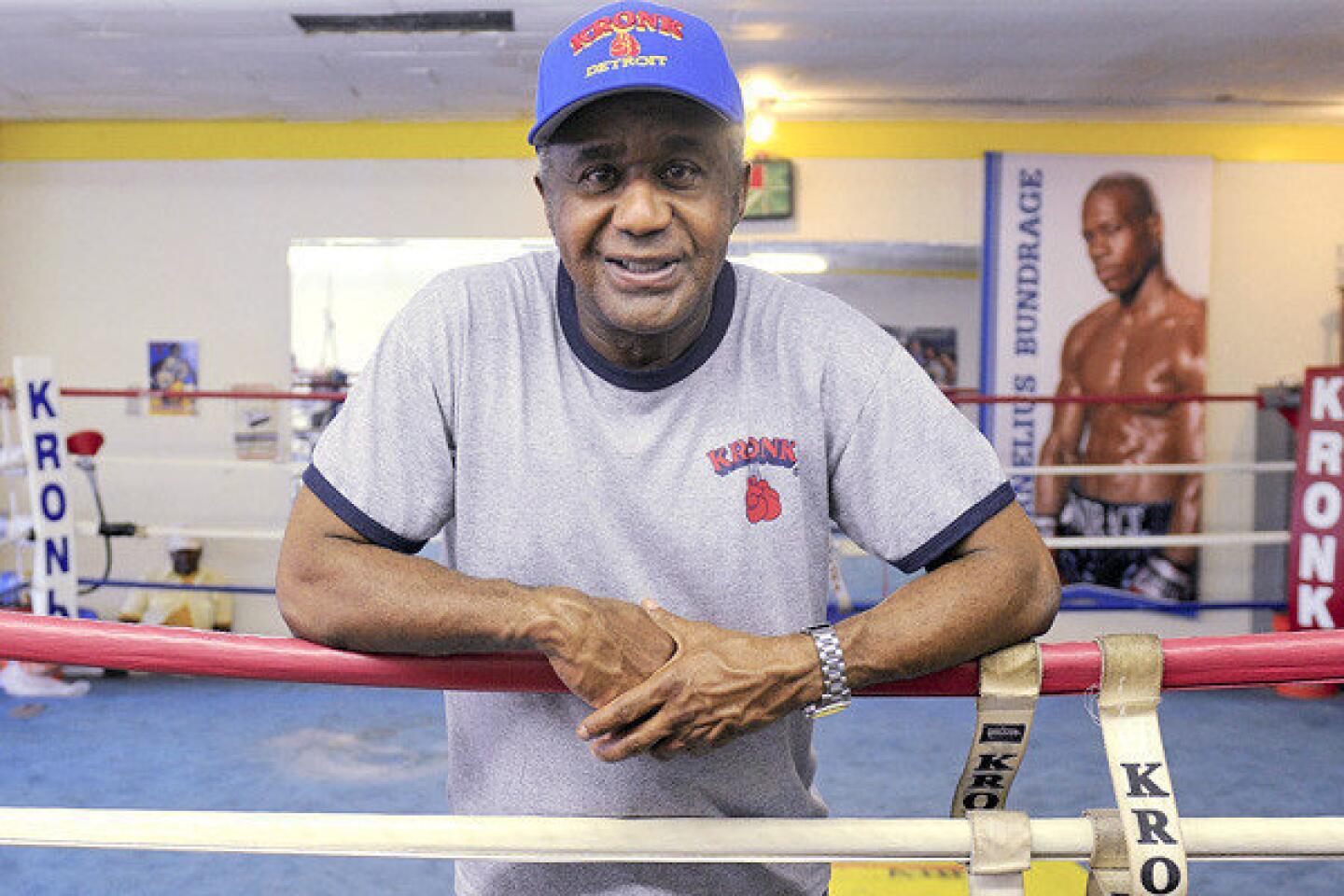

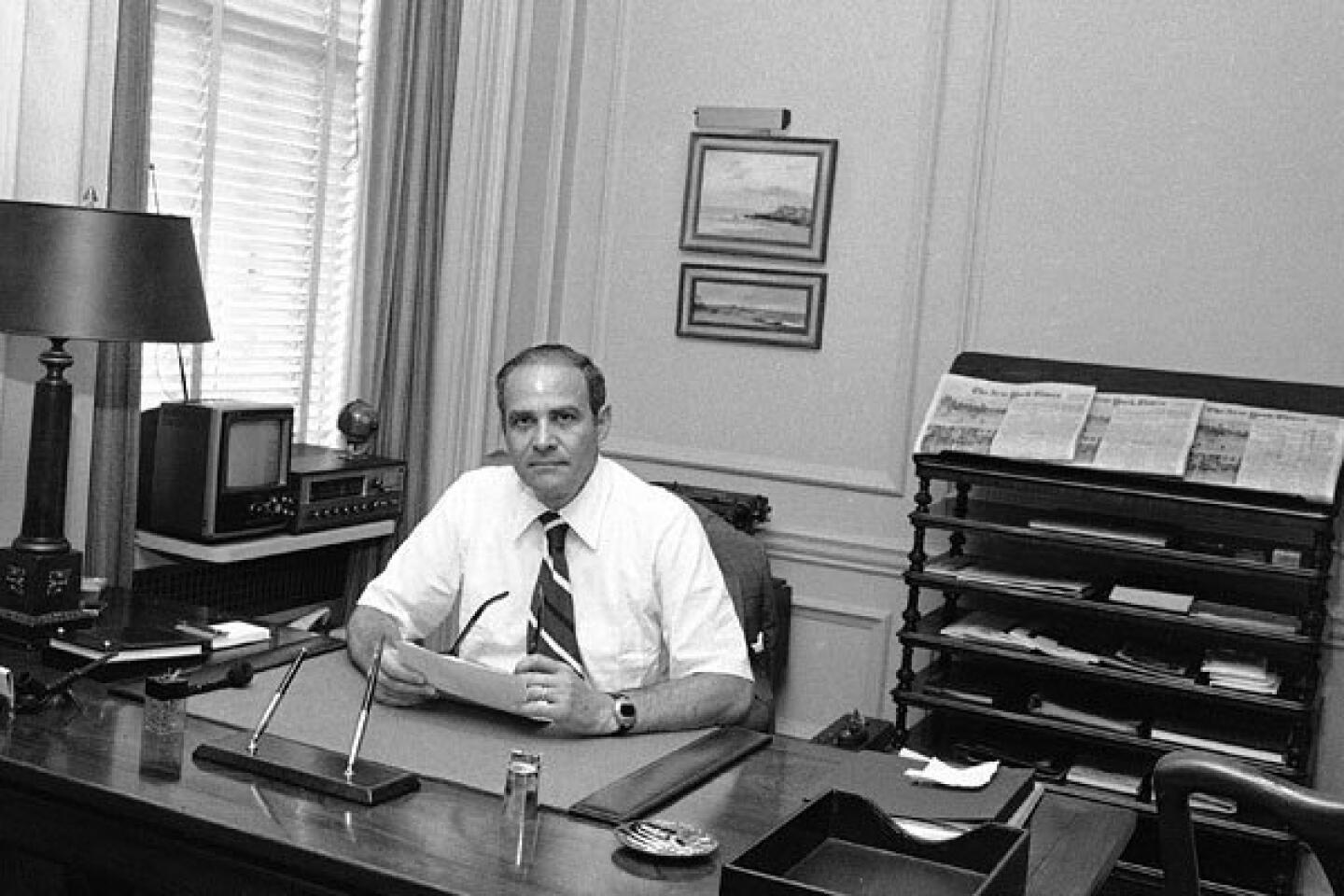

Notable deaths of 2012 (Ron Frehm / Associated Press)

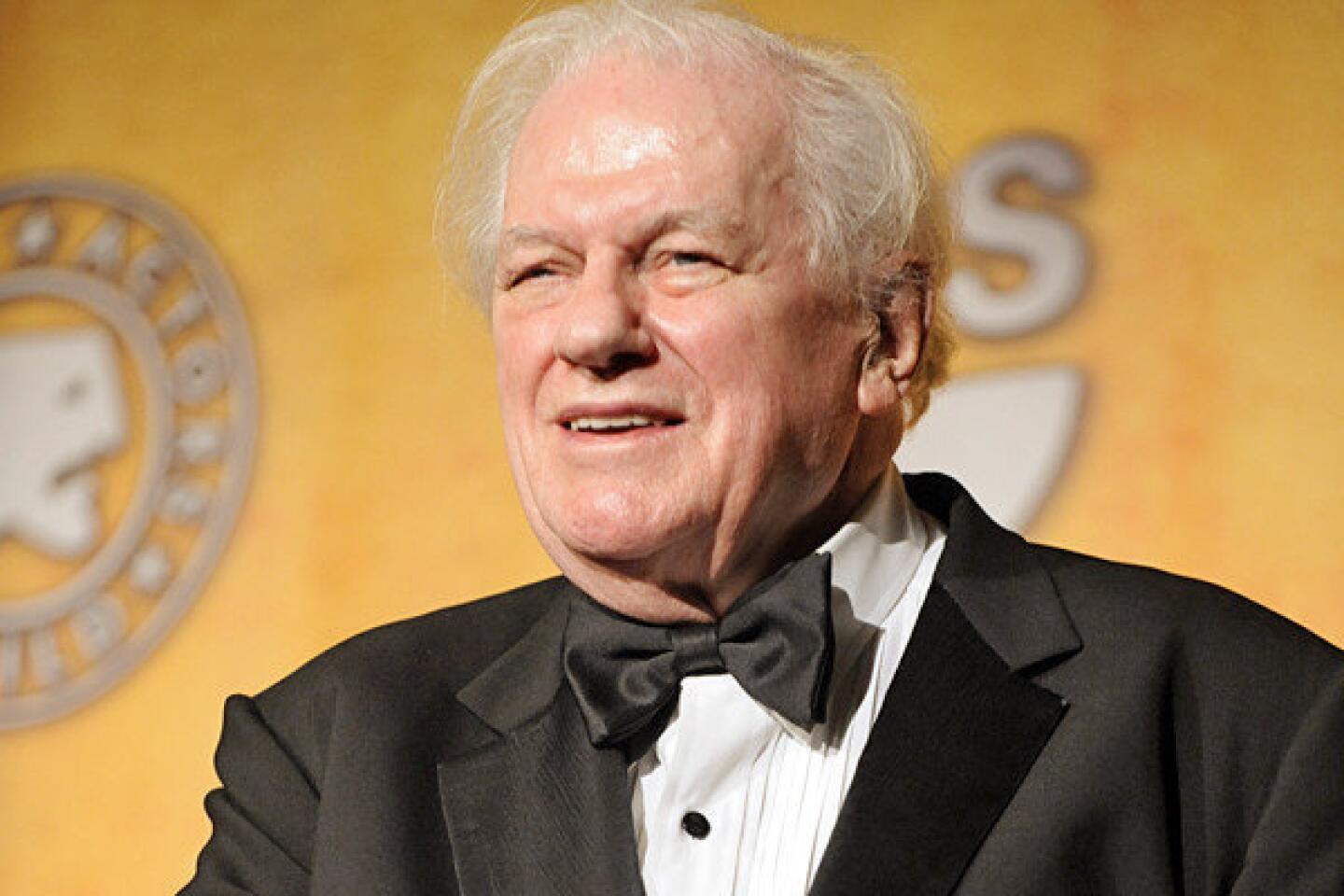

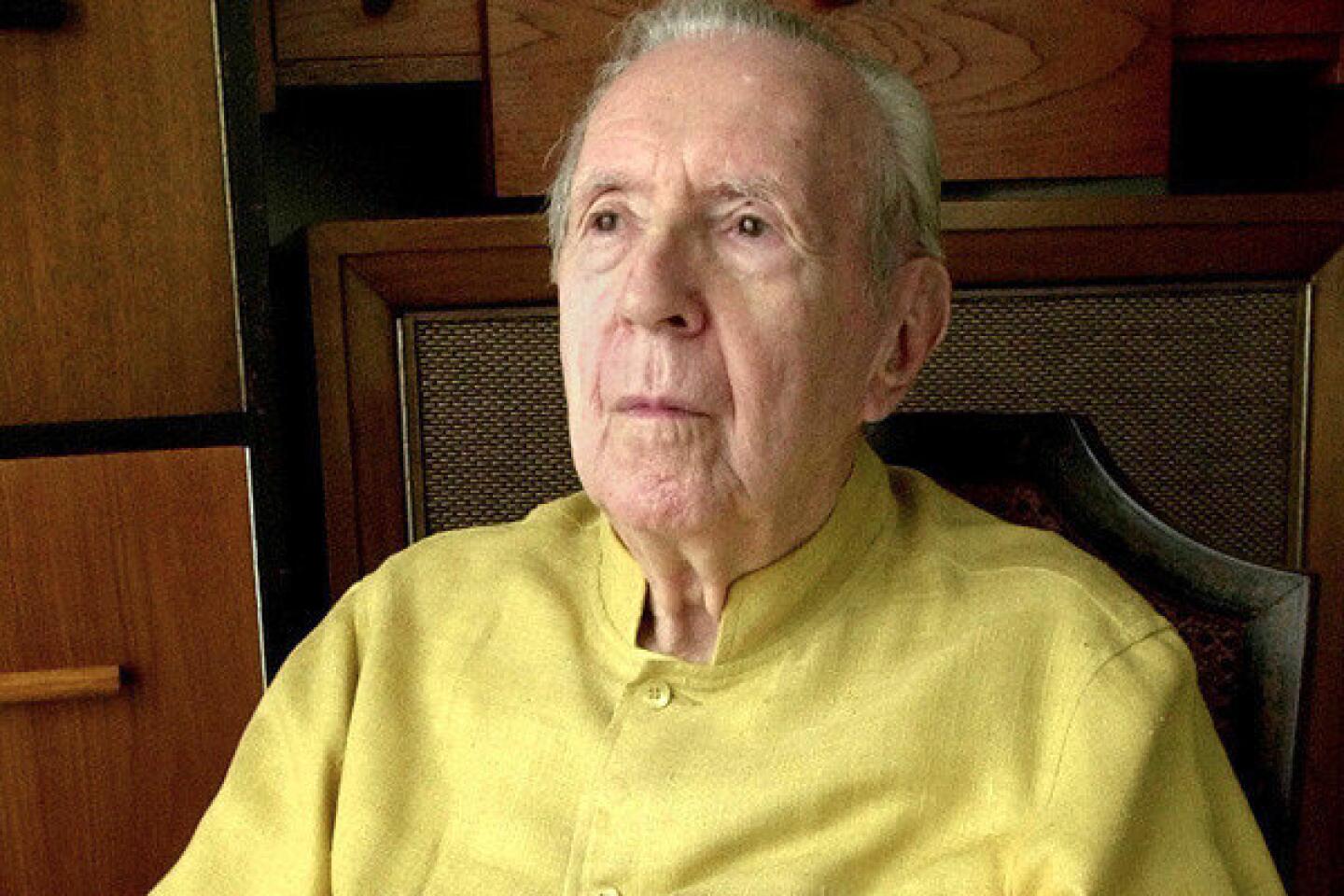

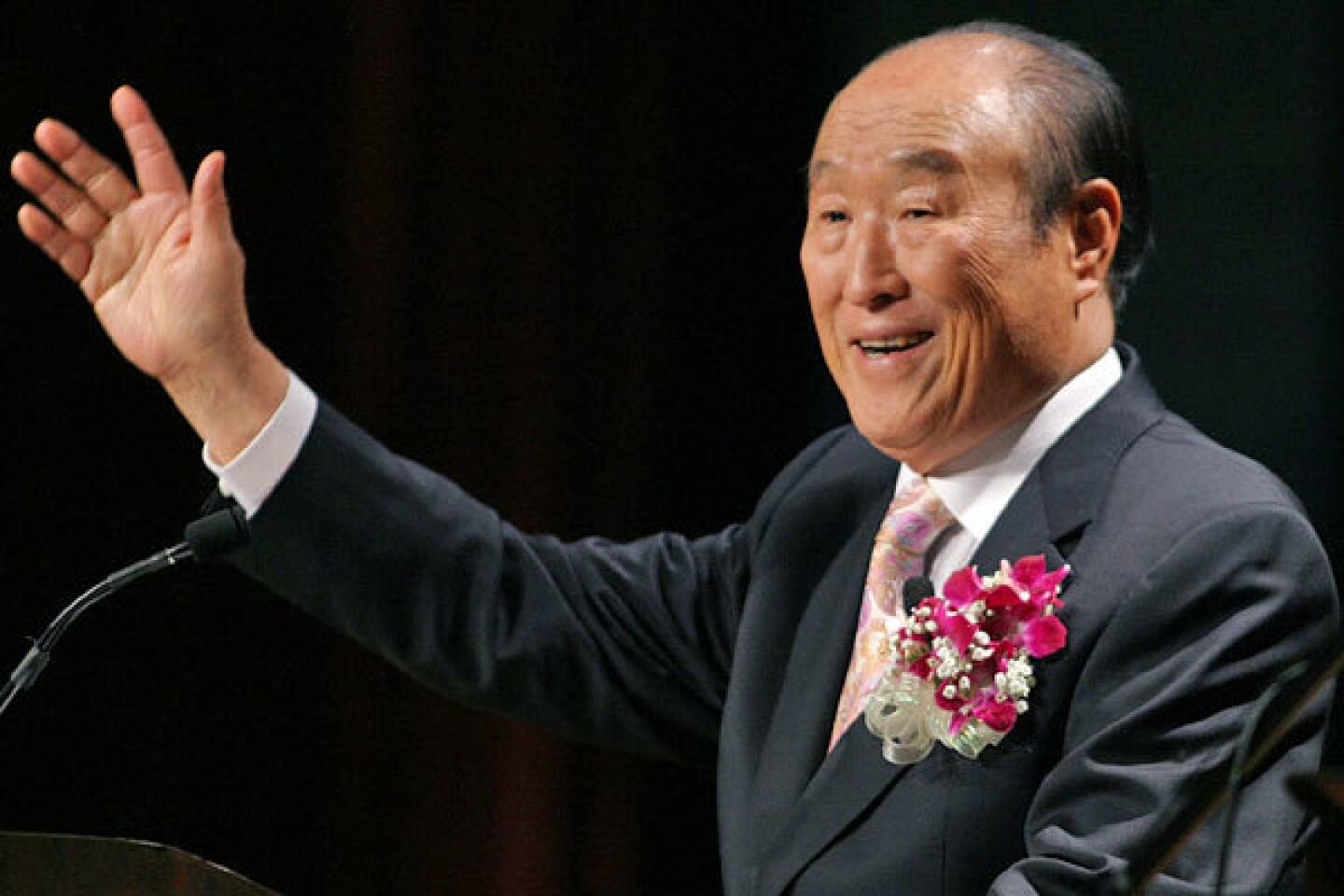

Notable deaths of 2012 (David Longstreath / Associated Press)

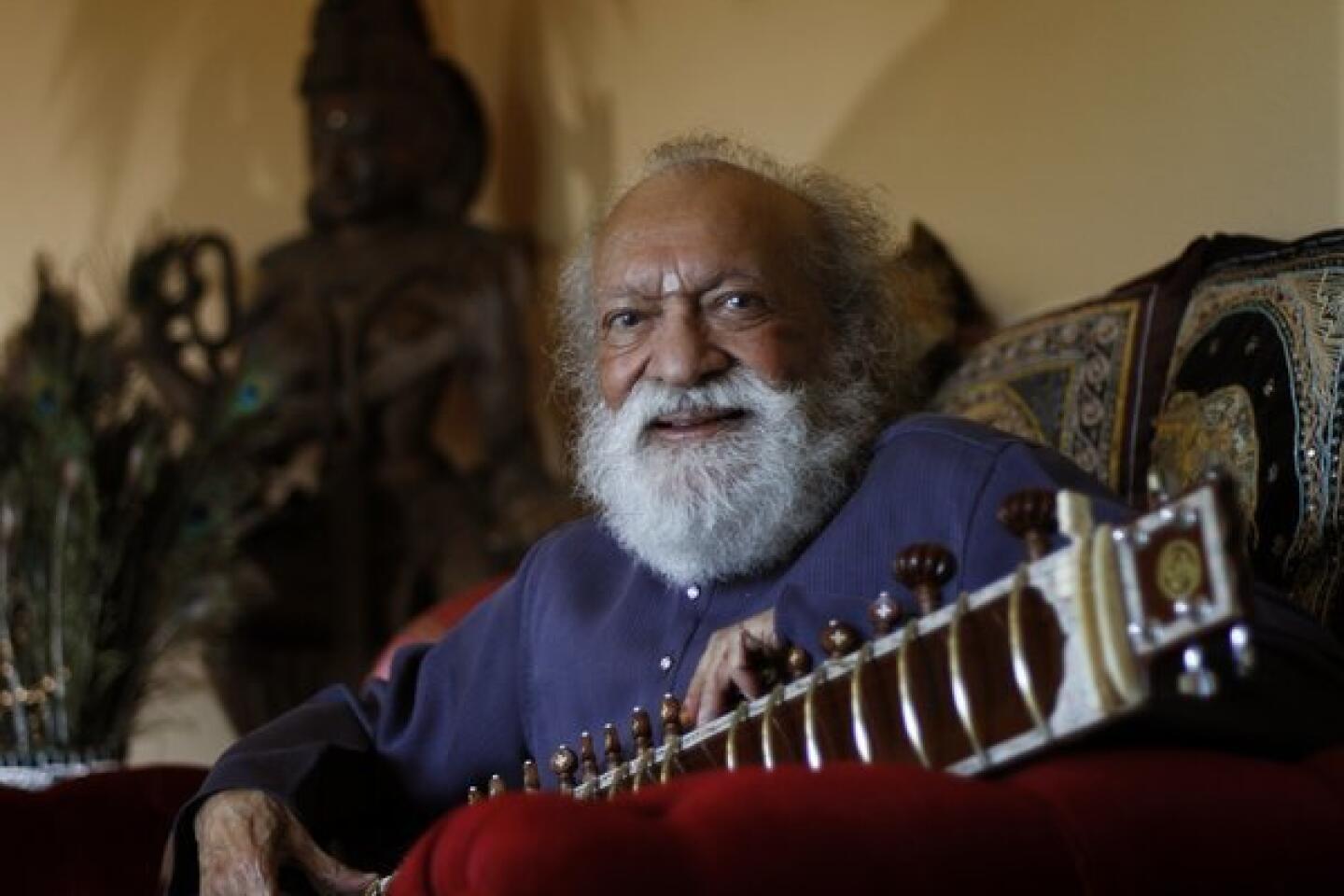

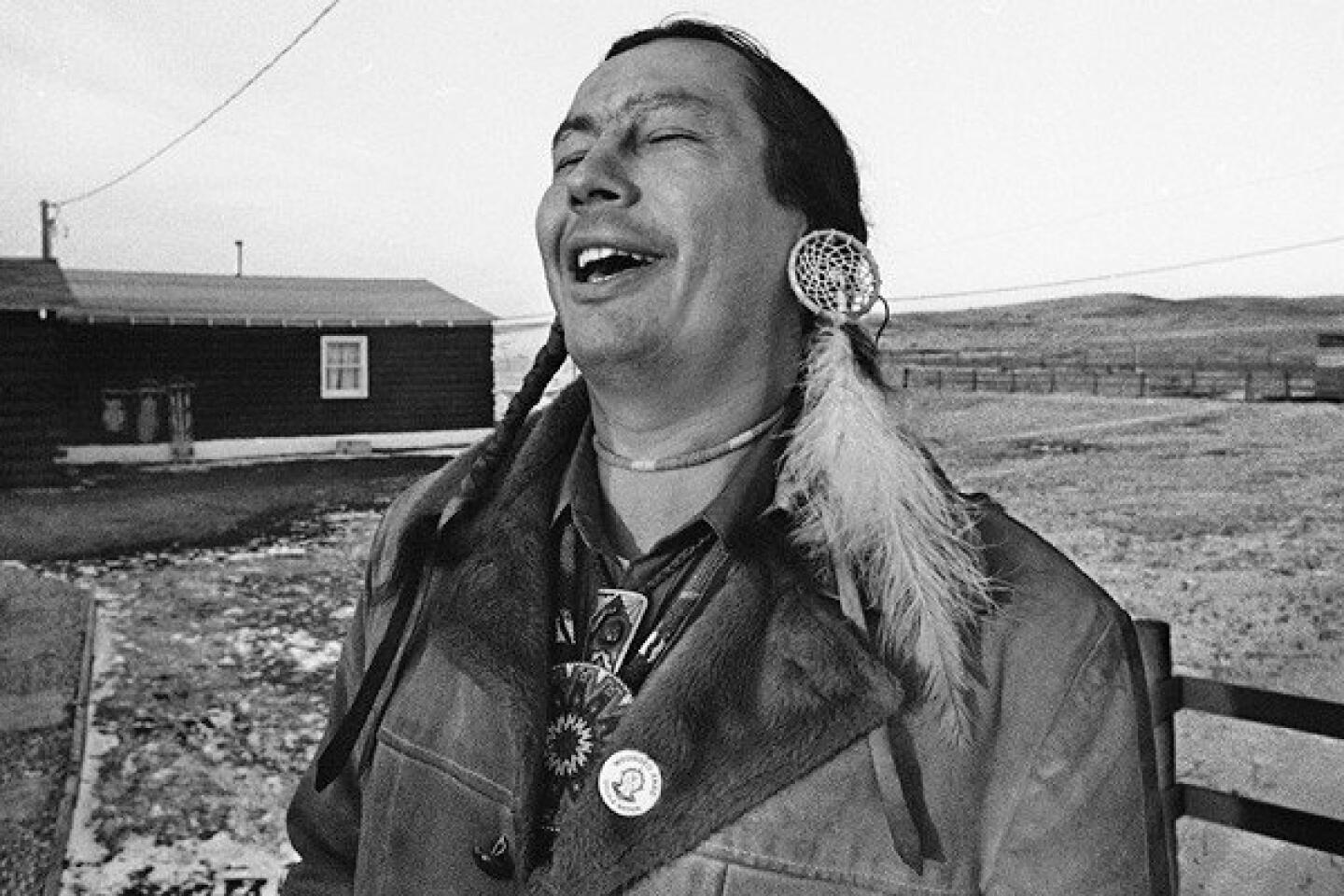

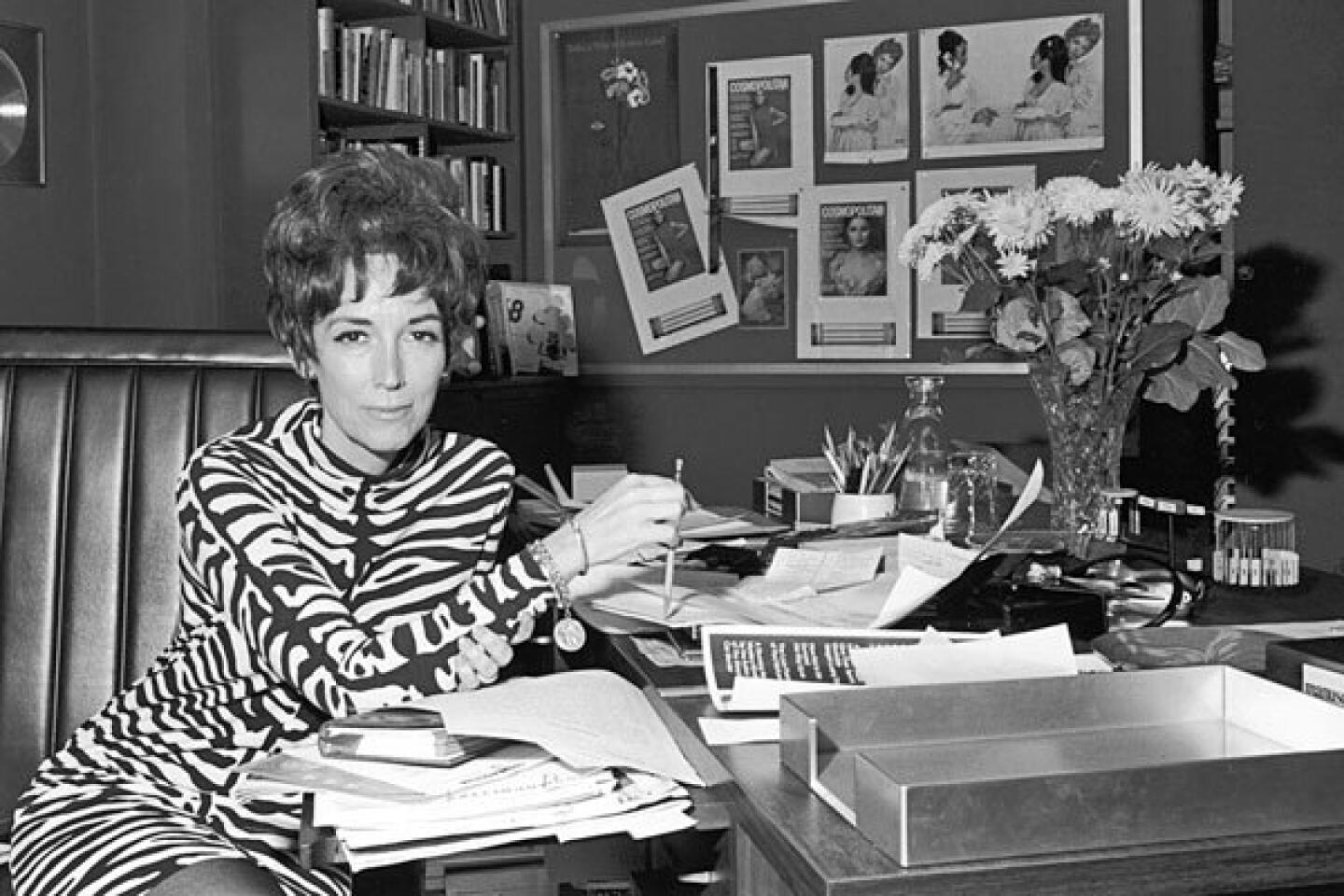

Notable deaths of 2012 (Chris Pizzello / Associated Press)

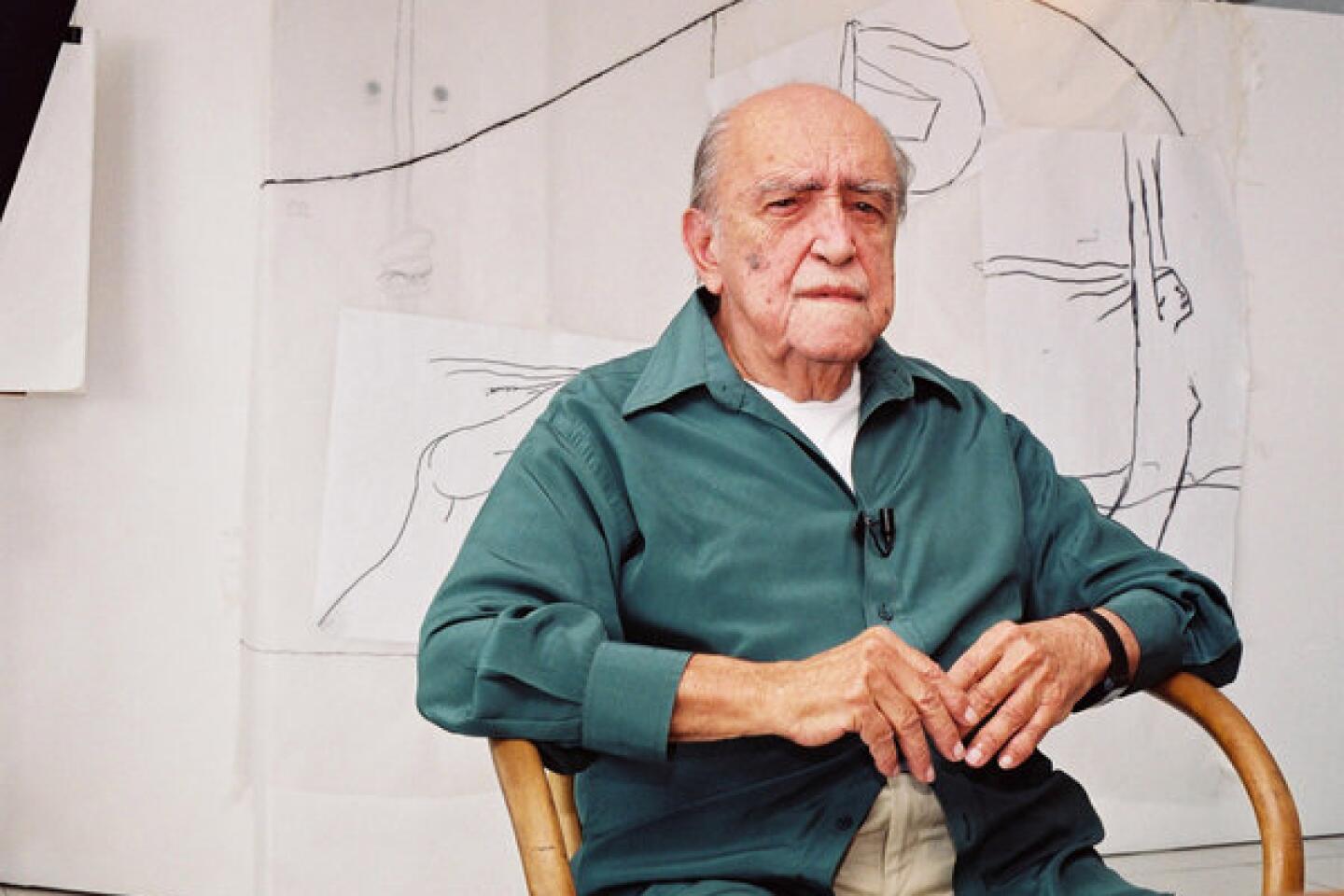

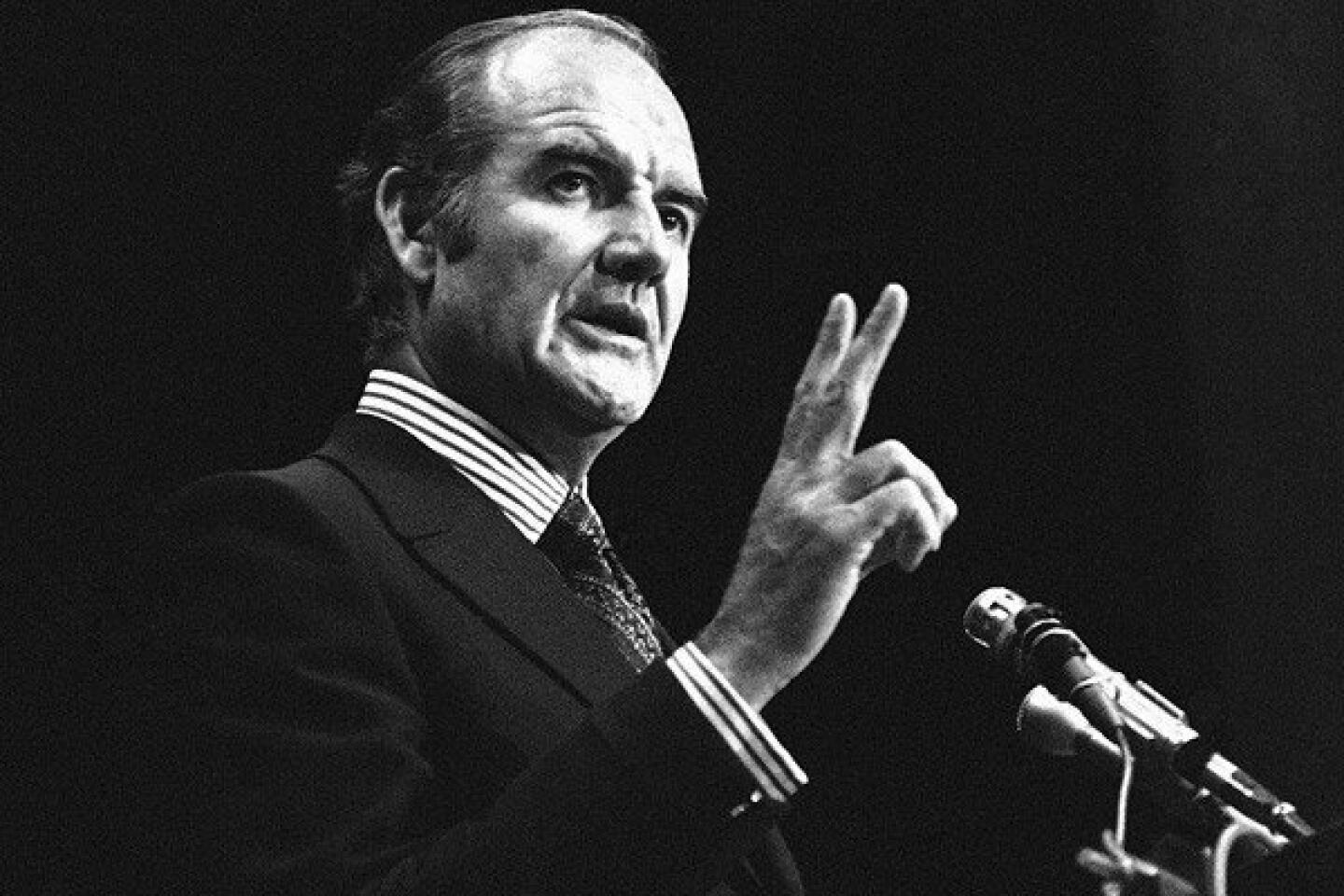

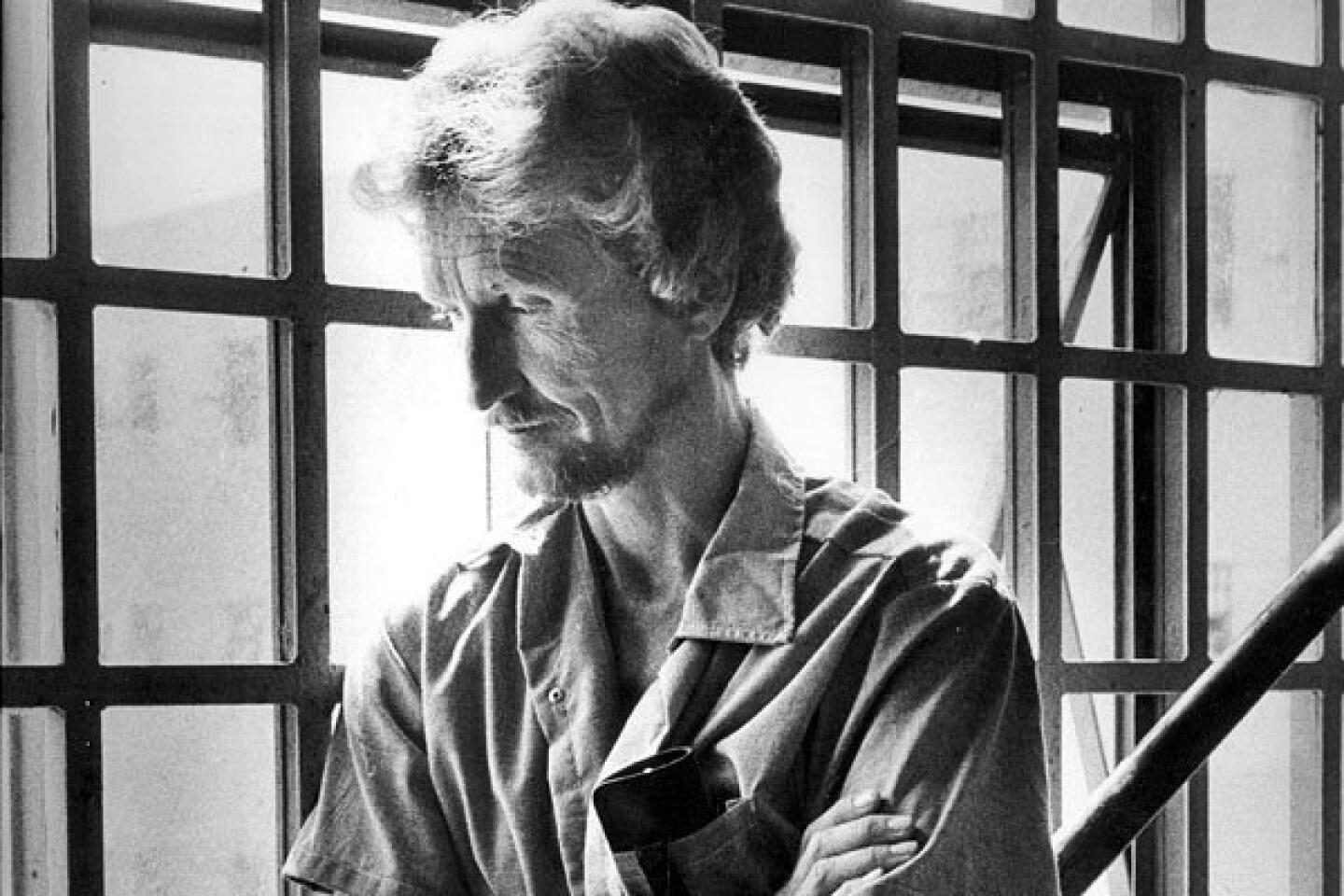

Notable deaths of 2012 (John Duricka / Associated Press)

Notable deaths of 2012 (Lucy Pemoni / Associated Press)

Notable deaths of 2012 (Don Bartletti / Los Angeles Times)

Notable deaths of 2012 (Victoria Will / Associated Press)

Notable deaths of 2012 (Andre Luiz / Associated Press)

Notable deaths of 2012 (Ron Edmonds / Associated Press)

Notable deaths of 2012 (Tony Gutierrez / Associated Press)

Notable deaths of 2012 (Charles Rex Abrogast / Associated Press)

Notable deaths of 2012 (Jennifer S. Altman / For The Times)

Notable deaths of 2012 (Genaro Molina / Los Angeles Times)

Notable deaths of 2012 (Elizabeth Conley / Associated Press)

Notable deaths of 2012 (Eric Gay / Associated Press)

Notable deaths of 2012 (Jim Mone / Associated Press)

Notable deaths of 2012 (Walt Zeboski / Associated Press)

Notable deaths of 2012 (David Van Der Veen / AFP / Getty Images)

Notable deaths of 2012 (Matthew Cavanaugh / EPA)

Notable deaths of 2012 (Ray Howard / Associated Press)

With his silky voice and and casual style, the baritone most famous for his rendition of “Moon River” was one of America’s top vocalists from the 1950s into the 1970s. He was 84. Full obituary

Notable deaths of 2012

Notable deaths of 2012 (Carlo Allegri / Associated Press)

Notable deaths of 2012 (John Marshall Mantel / Associated Press)

Notable deaths of 2012 (Gary Friedman / Los Angeles Times)

Notable deaths of 2012 (Gus Ruelas / Associated Press)

Notable deaths of 2012 (Santi Visalli / Getty Images)

Notable deaths of 2012 (Ken Hively / Los Angeles Times)

Notable deaths of 2012 (Carolyn Cole / Los Angeles Times)

Notable deaths of 2012 (Genaro Molina / Los Angeles Times)

Notable deaths of 2012 (Jim Hollander / EPA)

Notable deaths of 2012 (Charles Sykes / Associated Press)

Notable deaths of 2012 (Bebeto Matthews / Associated Press)

Notable deaths of 2012 (Jay L. Clendenin / Los Angeles Times)

Notable deaths of 2012 (George Wilhelm / Los Angeles Times)

Notable deaths of 2012 (Diether Endlicher / Associated Press)

Notable deaths of 2012 (Hassan Ammar / Associated Press)

Notable deaths of 2012 (Ed Rode / Associated Press)

Notable deaths of 2012 (Nati Harnik / Associated Press)

Notable deaths of 2012 (Alexander Joe / AFP / Getty Images)

Notable deaths of 2012 (Olivier Ferrand / Capitol Records)

Notable deaths of 2012 (Gary Friedman / Los Angeles Times)

Notable deaths of 2012 (Jakub Mosur / For The Times)

Notable deaths of 2011 (Frazer Harrison / Getty Images)

Notable deaths of 2011 (Al Messerschmidt / Getty Images)

Notable deaths of 2011 (Jae C. Hong / Associated Press)

Howard B. Schow

Manager of Vanguard mutual funds

Howard B. Schow, 84, a well-regarded manager of Vanguard mutual funds such as the $30.1-billion Vanguard Primecap, died of natural causes April 8 at Huntington Hospital in Pasadena, said Joel P. Fried, president of Pasadena-based Primecap Management Co.

A San Marino resident who was co-founder and chairman emeritus of Primecap Management, Schow — rhymes with “now” — managed portions of five funds for Vanguard Group Inc., the world’s biggest mutual fund company.

Schow, Fried and Primecap Management’s vice chairman, Theo A. Kolokotrones, were named domestic stock managers of the year for 2003 by Morningstar Inc.

In a rare 1994 interview with Forbes magazine, the publicity-averse Schow cited the importance of patience to go along with savvy stock picking.

“We don’t go for 20% or 30% gains,” Schow said. “We go for triples, quadruples, octuples. But that takes years.”

“A lot of doing well is drudgery,” he added.

Howard Bernard Schow was born July 28, 1927, and grew up on New York’s Long Island. After serving in the U.S. Navy during World War II, he attended Williams College and Harvard Business School. He started his investing career with $6,000 earned as a settlement after a serious car accident, according to Charles D. Ellis’ 2004 book, “Capital: The Story of Long-Term Investment Excellence.”

Schow moved to Los Angeles in 1962 to work at Capital Research & Management Co., the oldest unit of Capital Group Cos., one of the largest U.S. investment companies. There, he rose to chairman.

Under his guidance, the firm’s Amcap Fund returned 12.7% annually, compounded, from its inception in 1967, Forbes reported in its 1994 profile. That fund’s recipe for success was mixing large companies with fast-growing, innovative small ones, then holding shares for years, Forbes said.

In 1983, Schow left Capital Research to open his own firm, landing the contract with Vanguard to run its new Primecap fund.

Bloomberg News

Start your day right

Sign up for Essential California for the L.A. Times biggest news, features and recommendations in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.