Editorial: My $54,000 helicopter ride

- Share via

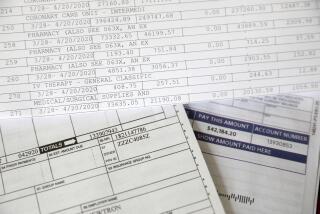

One of the benefits of the Affordable Care Act that President Obama often touts is the limit it places on medical bills: no more than $6,350 annually per insured individual or $12,700 per family. The insurance industry’s idea of an “out-of-pocket maximum,” however, doesn’t deliver on the promise implicit in its name, as I learned when my insurer told me I might owe half of a $54,000 ambulance bill.

My coverage from Blue Cross Blue Shield of Illinois is exempt from the new limits because it predates the ACA, but it still has annual spending caps. The limits are $10,000 for services by providers in the plan’s network and $20,000 for out-of-network services. As a Blue Cross Blue Shield representative patiently explained to me, however, the out-of-network limit isn’t really a limit. When a customer reaches that amount, the insurer will still pay only the standard out-of-network share. That’s why my plan covered only 50% of the $54,755 charged by Tristate Care Flight to ferry me (by helicopter) from a car wreck in Quartzsite, Ariz., to a hospital in Phoenix. If Tristate wanted to bill me for the other half, the representative explained, it was free to do so.

The healthcare law’s out-of-pocket limit suffers from the same shortcoming. Once you reach it, your insurer will cover 100% of the cost only of the essential health benefits covered by the plan, and out-of-network services are exempt (except for emergency treatments). That’s a troubling thought, considering how many insurers are reducing the number of doctors and hospitals in their plans. These “narrow networks” increase the chances that a doctor, therapist or clinic you’d like to use won’t be subject to the annual cap.

More ominously, being treated at an in-network hospital is no guarantee that the specialists who see you there will be in your plan’s network as well. If there’s no emergency involved, you could be stuck paying the difference between the contracted amount and the specialist’s charges, even if you’ve hit the out-of-pocket limit. And the difference can be staggering: In one extreme example cited by the insurance industry, an out-of-network California pathologist charged $8,100 for a tissue exam for which Medicare reimburses $128.

My own story had a happy ending. After pointing out to Blue Cross Blue Shield that I couldn’t have shopped around for an in-network helicopter ride, given that I was strapped to a back board with a broken neck, my insurer recognized that the bill was for emergency care. I’d already hit my out-of-pocket limit, so Blue Cross Blue Shield paid the entire cost of my flight.

Nevertheless, the episode taught me a sobering lesson about a much-touted benefit of the healthcare law. It’s a great shield against financial ruin, but only if you know how to stay behind it.

--Jon Healey

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.