Bitcoin ATMs popping up around San Diego

- Share via

San Diego County now has more physical locations to buy bitcoin, a digital currency rising rapidly in price.

- Bitcoin has seen a more than 1,000 percent price increase in a year.

- Some people looking to buy or sell choose to use specialized ATMs that charge a fee.

- San Diego County went from five machines in 2016 to 27 in 2017.

Bitcoin ATM’s: Here’s the full story

It’s a bitcoin gold rush and, for better or worse, it’s showing up in places you might not expect in San Diego.

Potential investors in the digital currency now have increasing opportunities to buy it at brick-and-mortar locations with bitcoin ATMs in coffee shops, bodegas and bars.

The ATMs, which sometimes charge high fees, offer a way to quickly invest in bitcoin. With a nearly 1,300 percent price increase in 2017, ATM operators are betting on businesses and consumers looking to get in on the craze.

There are now 27 bitcoin ATMs in operation in San Diego County, said cryptocurrency tracker Coin ATM Radar. The first eight opened in 2014, but by 2016 there were just five, the company said. As the price of bitcoin soared, so too did the number of machines. In 2017, 29 machines were added (while seven closed).

There are also three bitcoin ATMs in operation across the border in Tijuana.

Bitcoin was invented in 2008 as an alternative to government-backed currencies. Because of its ability to be used anonymously, it has gained a reputation among some as a way to purchase illegal items. In 2017, the value of bitcoin increased from $997.69 on Jan.1 to $13,860.14 by Dec. 31, said CoinDesk.

While many of bitcoin’s earlier and most passionate adopters were those who saw the currency as a way to take back control from governments and banks, its value now is seen more as an investment given the substantial price climb.

There is still much skepticism among financial advisers about digital currencies as an investment. Billionaire investor Warren Buffett said last week on CNBC that he could say “with almost certainty that they will come to a bad ending.”

How do businesses use it?

The ATMs are not your traditional bank machine that allows users to take cash out of checking or savings accounts. Instead, they are primarily used to deposit or convert dollars to bitcoin, which can then be used to purchase things or — more typically in recent months — convert back into dollars when the digital currency rises in value.

John Husler, owner of the Lestat’s coffee house franchise, said he didn’t think a lot about it when he installed the ATM in November. He said bitcoin ATM maker EasyBit approached him about using his space, which he had available, and paid him a percentage of earnings in bitcoin.

“It seems to get fairly good use,” he said. “I really don’t know much about it.”

He said the machine gets around 15 people using it a day, more than he expected, and sometimes has a line. But there isn’t a huge correlation between coffee and the ATM. He said a few people might buy coffee after taking out money, but it is rare. Most walk out after using the machine.

Lestat’s machine is unique in the region because it allows users to convert bitcoin back into actual dollars, whereas others only allow users to buy bitcoin. However, it was out of funds when a San Diego Union-Tribune reporter used it in early January.

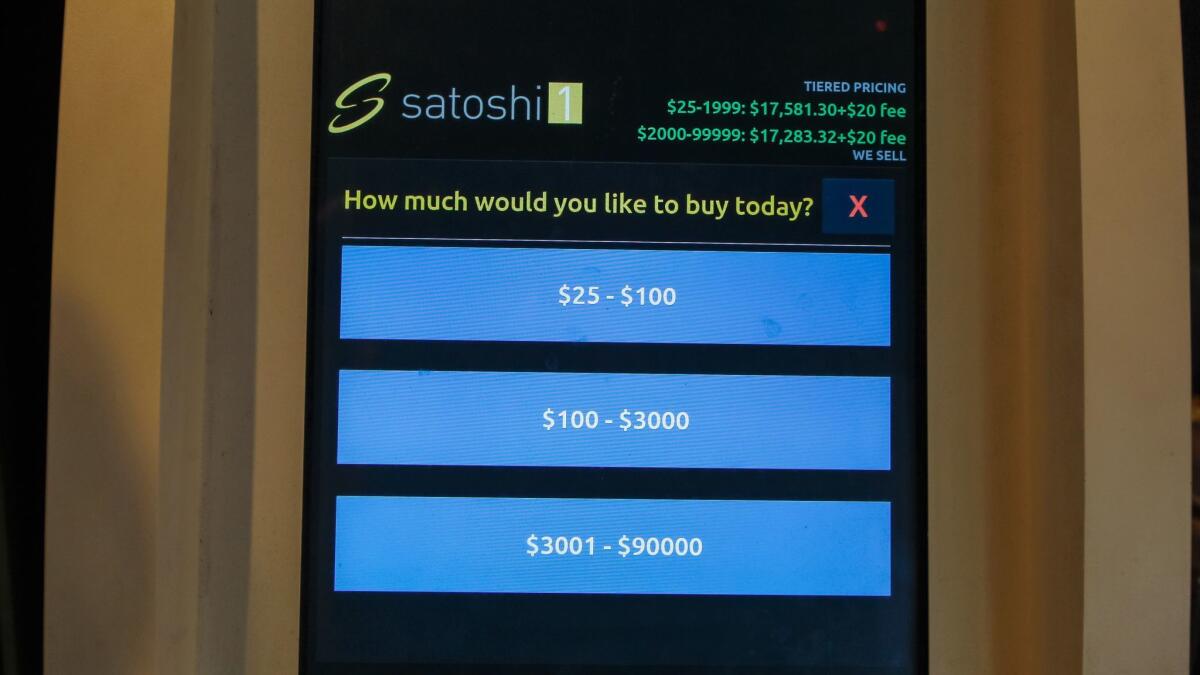

Not all bitcoin machines have the same fee structure, something an unsuspecting consumer may not realize. Lestat’s uses an EasyBit machine that was requiring a $20 flat fee, a rarity in the bitcoin ATM market, which almost always charges percentage fees. The worldwide average fee to buy bitcoin was 8.36 percent in December, said Coin ATM Radar. The average sell fee was 5.37 percent.

ATM users are typically just buying fractions of a bitcoin, so a high fee makes it prohibitive to make small investments, like $5.

Bobby Sharp, co-founder of bitcoin ATM company Coinsource, said consumers should be wary of high transaction fees. Coinsource charges an 8 percent rate for purchases and 4 percent for withdrawals.

“If anyone is charging over a 10 percent interest rate, there is probably a nefarious reason behind that,” he said.

Coinsource has 200 machines in 14 states. Rather than paying an owner a percentage of profits, it pays shop owners a monthly flat fee (ranging from $200 to $500) to put an ATM in their businesses.

Why use an ATM?

One of the biggest reasons for most people buying or selling bitcoin at an ATM for investment purposes is the transaction is nearly instantaneous.

Trades on San Francisco-based Coinbase, a mobile and desktop application that allows users to exchange or buy bitcoin with a few clicks, can take a week or more to finalize. Such delays can make trading difficult as the price zigzags so much.

Coinbase, one of the simplest places for novices to buy bitcoin, remains top dog. It has users in 32 nations, has had more than $50 billion in digital currency exchanged and at one point in December was the most-downloaded application in Apple’s App Store.

Coinbase also charges fees. The prices change based on the country and what type of payment you use to buy bitcoin. It charges a base rate of 4 percent for all transactions but can go up from there if the user is using PayPal, credit and debit cards, or bank transfers.

Coinbase recently agreed to hand over records of customers who made transactions of more than $20,000 to the Internal Revenue Service. For bitcoin owners who don’t want the government to know they have the cryptocurrency, some think ATMs could be a way to avoid scrutiny — but that might not be the case.

Sharp said it is possible to be anonymous on a small scale but all bitcoin transactions (even though they appear as a series of numbers and letters) can be viewed on an open ledger that leaves a forensic trail. To sign up on Coinsource, users need to scan both sides of their driver’s license.

Federal investigators have proven they can track down bitcoin users if they need to, with high-profile arrests of the creator of Silk Road — a black market website that facilitated the sale of drugs — and others accused of money laundering.

What’s next?

While the general public mostly sees Bitcoin as an investment, some of its most hardcore advocates see it as the future of money.

Dillon Chaulsett, the co-owner of the Rooted Kava Bar in Hillcrest, sees it both ways. He has accepted bitcoin for years, using an application called Bitpay, for customers buying kava, a bitter drink that originated in the western Pacific.

But he’s now taken the unique step of buying his own ATM through North Carolina-based CoinOutlet, which should arrive at the bar possibly this week. By owning the machine, he does not need to share profits when people use it. But there is an initial investment. CoinOutlet’s website says it charges $6,000 for the machine, with extra costs for shipping and software updates.

Chaulsett said the ATM will be stocked with his own bitcoin and money. He plans to charge a 9 percent fee on purchases and 7 percent for withdrawals.

Even if bitcoin goes away, Chaulsett said he is enthusiastic about cryptocurrency’s future. Other popular digital currencies include Litecoin, Ethereum, Ripple and Bitcoin Cash.

“We want cryptocurrency to come into the mainstream,” he said.

Disclosure: The author of this post purchased $130.12 in bitcoin in 2014. He sold more than half in 2017. He bought another $60 in 2018.

Business

phillip.molnar@sduniontribune.com (619) 293-1891 Twitter: @phillipmolnar

ALSO

For sale: 2.3 acres in North Park. Bitcoin perferred

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.