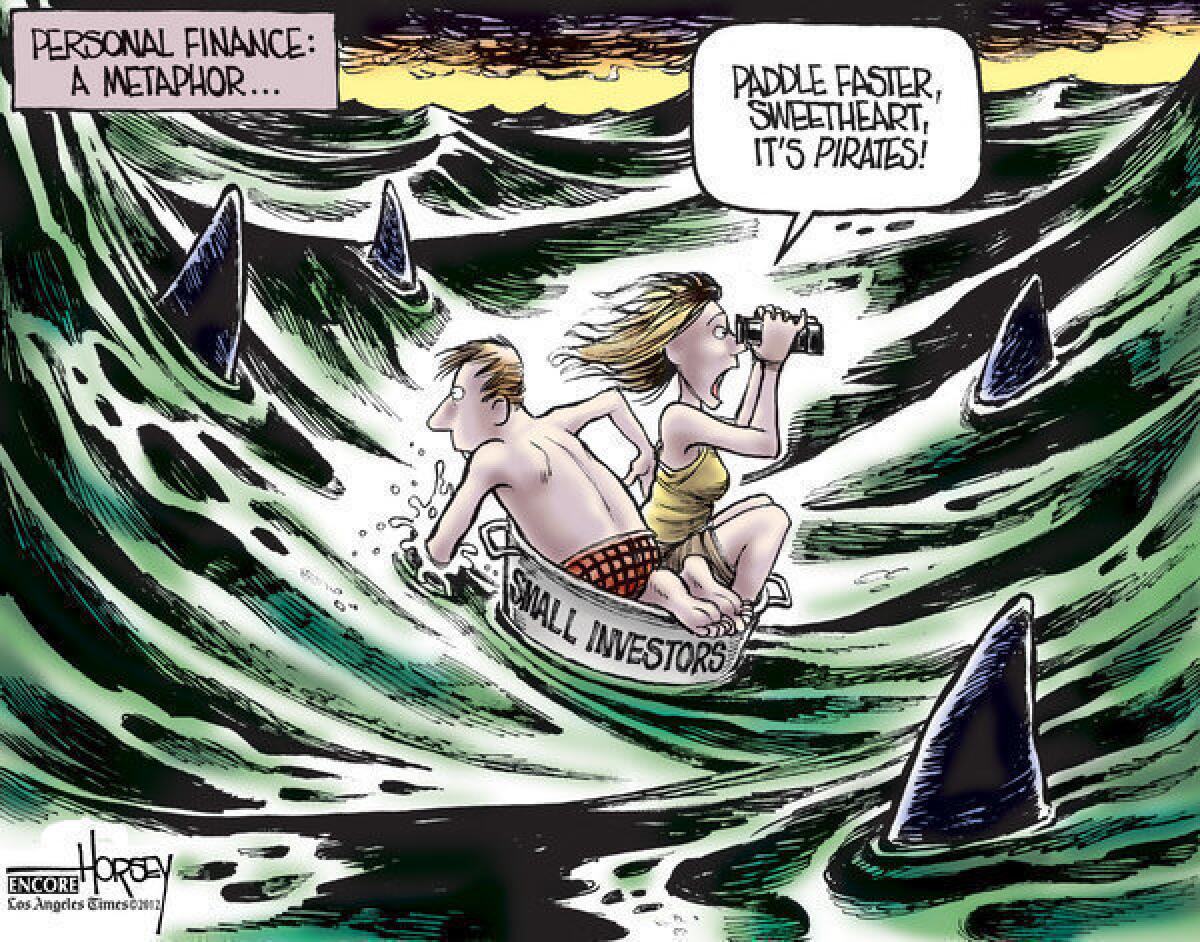

Small investors are at the mercy of big bankers’ greedy antics

- Share via

While a horde of lobbyists representing big banks and financiers fights every modest effort of the Obama administration to set limits on their clients’ buccaneering ways, JPMorgan Chase and Morgan Stanley have shown, once again, how these pirates of finance cannot be trusted with the power they have over the economic security of the American middle class.

A couple of weeks ago, JPMorgan Chase & Co. revealed losses on risky investments that, thus far, total more than $2 billion. It seems that, even after the near-death experience of the 2008 global financial meltdown, hotshot investment bankers at JPMorgan were rolling the dice and betting enormous amounts of other people’s money on high-risk ventures.

Then, after Facebook’s first public stock offering fell far short of expectations, it was revealed that Morgan Stanley, the bank that managed the IPO, had quietly warned big investors that buying into Facebook might not be such a great idea. More modest investors, as always, were left out of the loop.

The Associated Press quoted one small-scale investor who, after blurting out a string of expletives, made a plaintive query: “How can they give that information to the big boys and not give it to the public?”

In years long gone, this sort of behavior would not have mattered quite so much to the public at large. Wall Street was a place for men in striped suits with money to spare; it was not a place for the typical working man. But, over the last couple of decades, the financial lives of the majority of Americans have become enmeshed with the ups and downs of the market.

Many have bought into mutual funds, an affordable and supposedly reliable way for the small investor to reap a little profit from the bigger investment game. Many have also become investors, whether they like it or not, as pension plans have been replaced by 401(k) schemes. This change seemed like a sensible step considering the trajectory of the stock market in the 20th century.

After the Wall Street crash of 1929 and the subsequent 10 years of depression, federal rules and regulations were put into place that tempered the fevers of financial speculators, kept risk at a containable level and eliminated the boom-bust cycle that prevailed during the 1800s. The result was that, despite economic ups and downs, the patient small investor could pretty much assume he would end up at retirement with more money in the bank than when he started. A broker or financial advisor had an easy sell because he could always pull out a chart showing a dependable rise in investment returns over a 30- or 40-year period. No one seemed to have any doubt that this financial return was as certain as the sunrise; as much a constant force as gravity.

Well, the gravity is gone. These days, small investors are seeing their money drifting away into space and, if the sun fails to come up tomorrow, don’t be surprised.

By the start of this new century, even as pretty much everyone was buying into this sure thing, many of the rules that kept the bet reasonably safe were being taken away. This allowed the wheeler-dealers in the giant banks and financial powerhouses in New York, London and around the globe to place complicated bets on newly devised “financial instruments” built on manipulations of money, rather than real goods or services. Most people – including even the high flyers at the heart of this game – did not fully understand the complexities of these new kinds of investments, and no one, apparently, anticipated the colossal havoc the derivatives market would create if and when it collapsed.

In 2008, we all witnessed the chaos and paid a big price. Most have not recovered their losses and many average folks have been denied their dreams of owning a home or retiring with security. But the bankers are back, the hedge fund managers are up to their old tricks and, though they hold the power to wreck the U.S. economy, none of them seems to feel the slightest inclination to protect anyone’s interest but their own.

It is as if the U.S. financial system is a churning ocean on which the captains of finance rove in their treasure ships while the rest of us are left to drift in tiny vessels, surrounded by sharks, with no oars or compasses or clues about how to find safe harbor.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.