Ecuador faces a huge budget deficit because of loans it received from China

- Share via

Reporting from Quito, Ecuador — Rafael Correa wanted to fast-track development projects when he was president of Ecuador, so he borrowed billions of dollars from China. But the loans have come back to haunt his successor, Lenin Moreno, who will go hat in hand to China this month to seek more flexible terms and breathing space.

A onetime ally and now bitter enemy of Correa, Moreno and his government are straining under a huge budget deficit caused partly by obligations to the Chinese, whose loans financed roads, dams, schools and office buildings during Correa’s time in office from 2007 to 2017.

Ecuador is one of several Latin American countries that in recent years benefited from China’s lending spree. Like other loans China has made in the region, those to Ecuador are partially payable with shipments of natural resources — oil, in Ecuador’s case — which China needs to stoke its fast-growing economy.

Correa was a close ally of Venezuela’s socialist, anti-U.S. President Hugo Chavez and saw Chinese loans as attractive because the Asian giant made no political or ideological demands, and the loans were a way of thumbing his nose at Uncle Sam, analysts say.

But terms of Ecuador’s $6.5 billion in Chinese debt have become onerous with the global decline in the price of oil, Ecuador’s main source of revenue from exports. Moreover, some developments financed by the loans, including hydroelectric plants, are not producing the revenue that was anticipated.

Correa also made deals to sell the Chinese millions of barrels of oil in advance on favorable terms, committing the country to ship 90% of all its exportable crude to the Asian giant through 2024. Terms of the deals, by which he mortgaged to China much of the country’s future production of crude, its principal source of export dollars, remain shrouded in mystery.

Ecuador is just the latest Third World borrower to have trouble making payments to China; the list includes Sri Lanka and the Maldives.

In a radio interview Thursday from the presidential palace in Quito, Moreno acknowledged that he will travel soon to China to ask the government and banks there to cut Ecuador some slack because the “previously made commitments are not the most suitable if the country is to go forward. ... We are trying by any means to secure financing.”

Finance Minister Richard Martinez used more stark language last month when he spoke before the National Assembly, describing Ecuador’s $6-billlon spending deficit (not including $4 billion in debt payments due) for 2019 as “unsustainable … deriving from the implementation of a development model in which the state inevitably spent more money than it had,” a reference to Correa’s presidency.

Vicente Albornoz, dean of the economics department at the University of the Americas in Quito, said that even if China relaxes loan terms, Ecuador will still need a bailout loan from the International Monetary Fund of as much as $10 billion. (Ecuador’s finance and energy ministries did not respond to requests for interviews.)

“Correa thought he was a genius and he has escaped accountability by giving the problem to someone else,” Albornoz said. “Moreno knew he was inheriting a country in bad shape but wasn’t fully aware of the things he has to do to correct the problem.”

Jaime Carrera, director of the watchdog Fiscal Policy Observatory, said the IMF is sure to set conditions for any bailout, including a likely demand that Moreno cut at least 10% of the 450,000-strong central government workforce and end all or most of $4 billion in annual fuel subsidies for consumers. Meeting those preconditions will carry a political cost, he said.

“Those reductions will bring a lot of people out into the streets to protest,” Carrera said.

Making matters worse, said former energy minister Fernando Santos, is that some of the projects built with Chinese loans are overpriced and of poor quality, particularly the biggest, the $2.8-billion Coca Codo Sinclair dam.

As is often their practice when making large-scale public works loans, the Chinese made the naming of a Chinese company as general contractor a condition of granting the financing. There was no bidding for the project, which made it vulnerable to overruns and corruption, said Maria de la Paz Vela, an analyst with the Multiplica economics consulting firm in Quito.

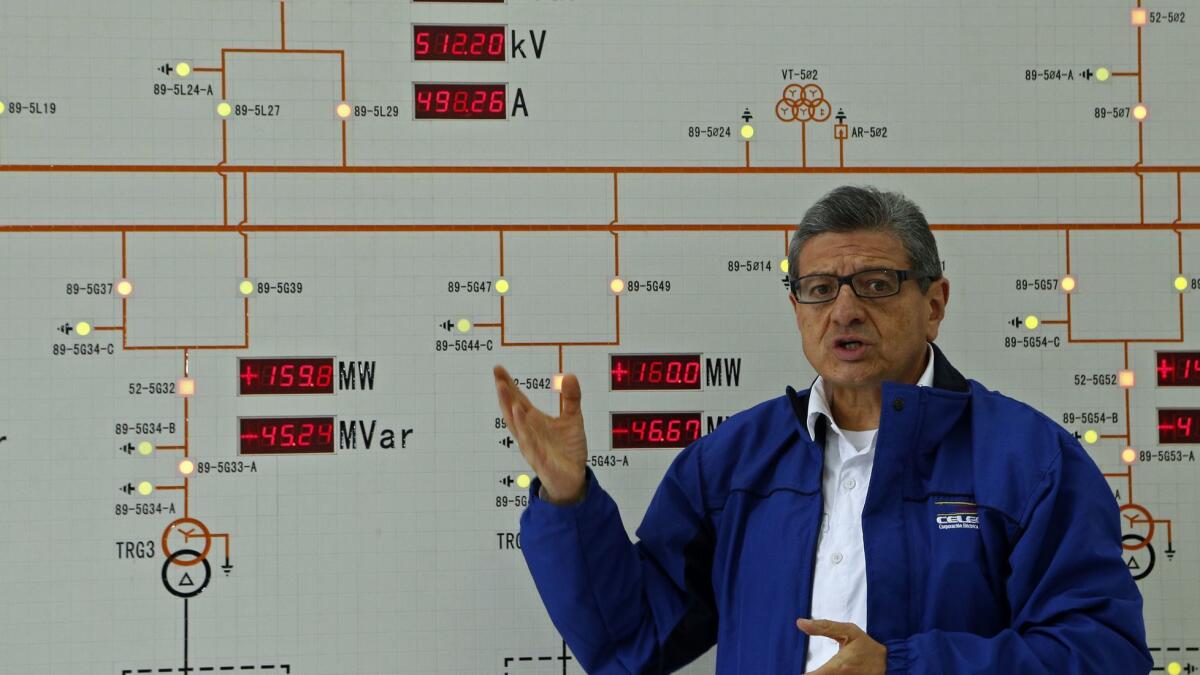

The massive project located 90 miles east of Quito was inaugurated with much fanfare by Correa and Chinese President Xi Jinping in 2016. Designed as a 1,500-megawatt facility, the dam is operating at half that capacity since the discovery in March by a German inspection firm of serious structural problems that could require hundreds of millions of dollars to repair — if they can be repaired at all.

A report issued last month by the government controller’s office said inspections had turned up 402 “large and small cracks” in the machine room that houses the dam’s eight turbines.

The report made scathing comments about Sinohydro Corp., the Chinese company that built the dam, for the project’s “irresponsible and incomprehensible” use of substandard building materials and construction methods including inferior welds. Part of the structure may have to be demolished and rebuilt, the report said.

The report also said the Chinese contractor ignored a stipulation of the construction contract, that the dam be built according to rigid standards set by the American Society Of Mechanical Engineers. “The Chinese used bad-quality steel and fired inspectors who said to change it, “ said ex-minister Santos.

“The Chinese had a party with us and took advantage,” said Augusto Tandazo, an energy analyst in Quito. “It was a case of a big country ripping off a small one.”

Ecuador is no stranger to financial crises. In 1999, several big banks failed and the country defaulted on $98 billion in foreign debt. While the debt load is lighter now than in 1999, Ecuador finds itself in an acute short-term cash squeeze, unable or unwilling to stem the flow of red ink by drastically cutting spending. The adoption of the U.S. dollar as the national currency in 2000 brought a measure of stability — until the current debt squeeze.

In addition to Chinese debt, Moreno is also confronting an enormous amount of domestic obligations left by Correa. He raided the $2.5-billion Social Security fund to finance his agenda and allowed the government-owned Petroamazonas oil firm, which produces 80% of the country’s oil, to run up $3 billion in debts to contractors including Texas-based oil field services firm Schlumberger, Tandazo said.

Although Correa has been made the scapegoat for Ecuador’s problems, economics dean Albornoz also blamed Moreno for not doing enough to reduce state budgets since he took office in May 2017. Government spending, which Correa nearly tripled over his decade in office, is still too high, he said.

“Has Moreno learned anything? I’m afraid not. I don’t see any austerity in the government and there should be a lot of it,” Albornoz said. “The IMF is a bank and it expects to be paid. But with no austerity plan, a huge deficit and public expenditures rising, it’s going to be difficult for Moreno to get a loan.”

Correa has his defenders, including economist Hugo Villacres, a professor at Catholic Pontifical University in Quito, who worked in his administration.

“When Correa came in, there was an enormous social debt and paying it down was paramount. There had been 20 years without much public investment in education, health, infrastructure,” Villacres said. “Could he have done it better? Yes. He should have gone after corruption more harshly. But he reduced poverty and inequality and we’re certainly no better off now than we were when he left office in May 2017.”

Among other Latin American countries benefiting from Chinese largesse are Panama, which is using loans to expand the port of Colon; Costa Rica, for the construction of a new freeway; and Argentina, to upgrade a dilapidated urban rail system, said Nashira Chavez a professor at FLACSO graduate studies center in Quito.

Andres Paez, a former National Assembly member whose family was persecuted for its opposition to Correa, blamed the former president’s authoritarian actions, including the establishment of a network of state-run media, for keeping the nation in the dark about the extent of Ecuador’s mounting debt.

“Every day, over five state-owned TV channels, 20 radio stations and three newspapers, we were told the revolution was going great, marvelous,” Paez said. “But he never explained how much it was all costing.”

Special correspondent Kraul is based in Bogota, Colombia. Special correspondent Pablo Jaramillo Viteri in Quito contributed to this report.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.