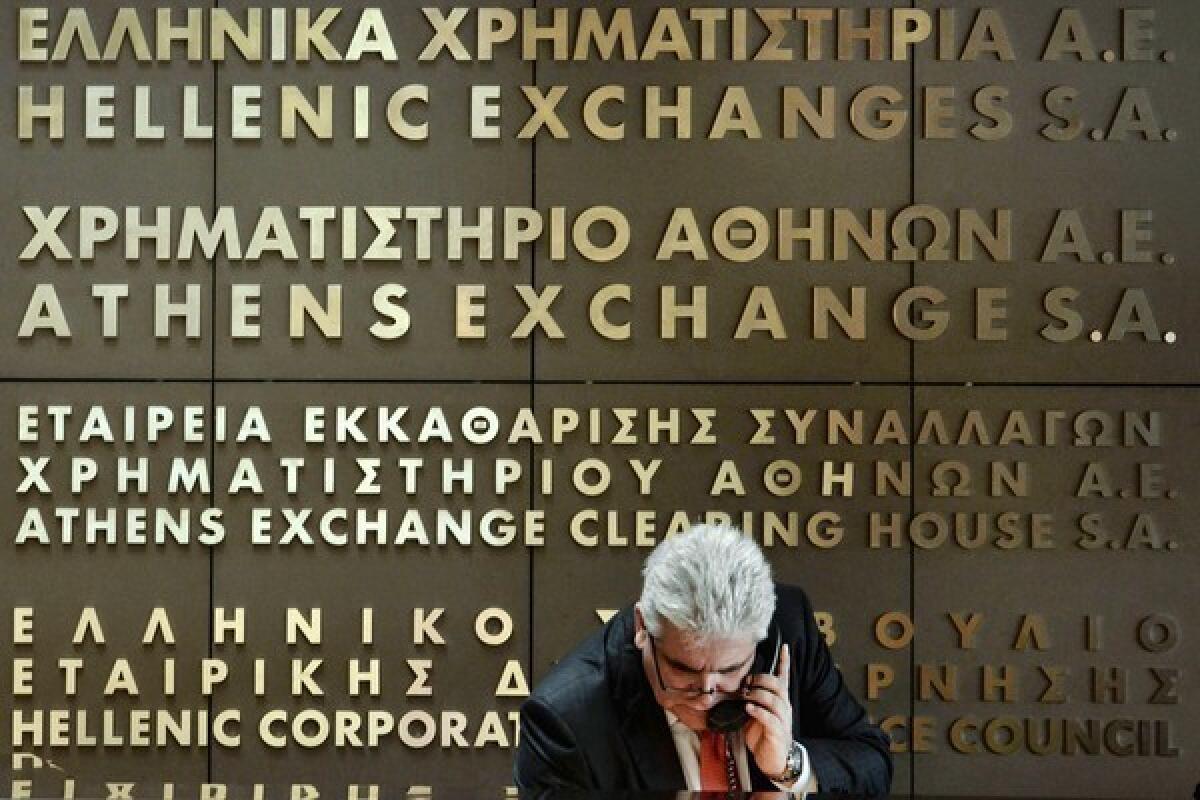

Greek bank stocks plunge after merger freeze

- Share via

ATHENS — Greek bank stocks plunged 30% on Monday, the maximum allowed in a day, after plans to merge the country’s two biggest lenders were suddenly frozen.

The surprise freeze came amid testy talks between the government and international lenders, and renewed fears about Greece’s efforts to fix its faltering economy. The European Commission, the European Central Bank and the International Monetary Fund are keeping Greece afloat with a multibillion-dollar rescue package in exchange for strict fiscal reforms.

Investors dumped shares of the National Bank of Greece and Eurobank during the early hours of trading after both institutions confirmed late Sunday that their merger was off because of fears that the new combined entity would be too big to handle.

The bank merger was part of a broader plan to consolidate the financial sector in order to cope with the fallout of Greece’s devastating debt crisis and deepening recession. But the trio of international lenders expressed concerns about the banks’ ability to raise about $20 billion between them to meet the solvency criteria set by the country’s central bank.

Failure to raise that amount would in effect push the banks into the hands of the state. The potential of nationalization spooked already skittish private investors and European markets.

“Their admission that they are unlikely to raise the required 10% from private investors is quite negative, [as] their shareholders may become owners of a nationalized bank,” said Maria Kanellopoulou, an analyst at Euroxx Securities.

Greek officials say National Bank and Eurobank deposits will not be affected by the deal’s suspension. Customers, however, remained jittery after a recent rescue plan in Cyprus saw European lenders recommend tapping private savings to bail out failing banks.

The government in Athens did not rule out the merger’s eventual completion. Even so, the debacle underscored the difficulty of talks between the government and its international lenders over a list of lagging fiscal and structural reforms.

Lenders want Athens to lay off about 25,000 public servants by the end of the year in exchange for rescue funds. Finance Minister Yannis Stournaras has so far refused to heed such demands, telling creditors they can “take the keys” to his ministry if they insist on additional austerity from a nation experiencing a sixth straight year of recession.

The two sides were expected to meet Tuesday.

Carassava is a special correspondent.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.