How the states suck the fairness out of America’s tax system

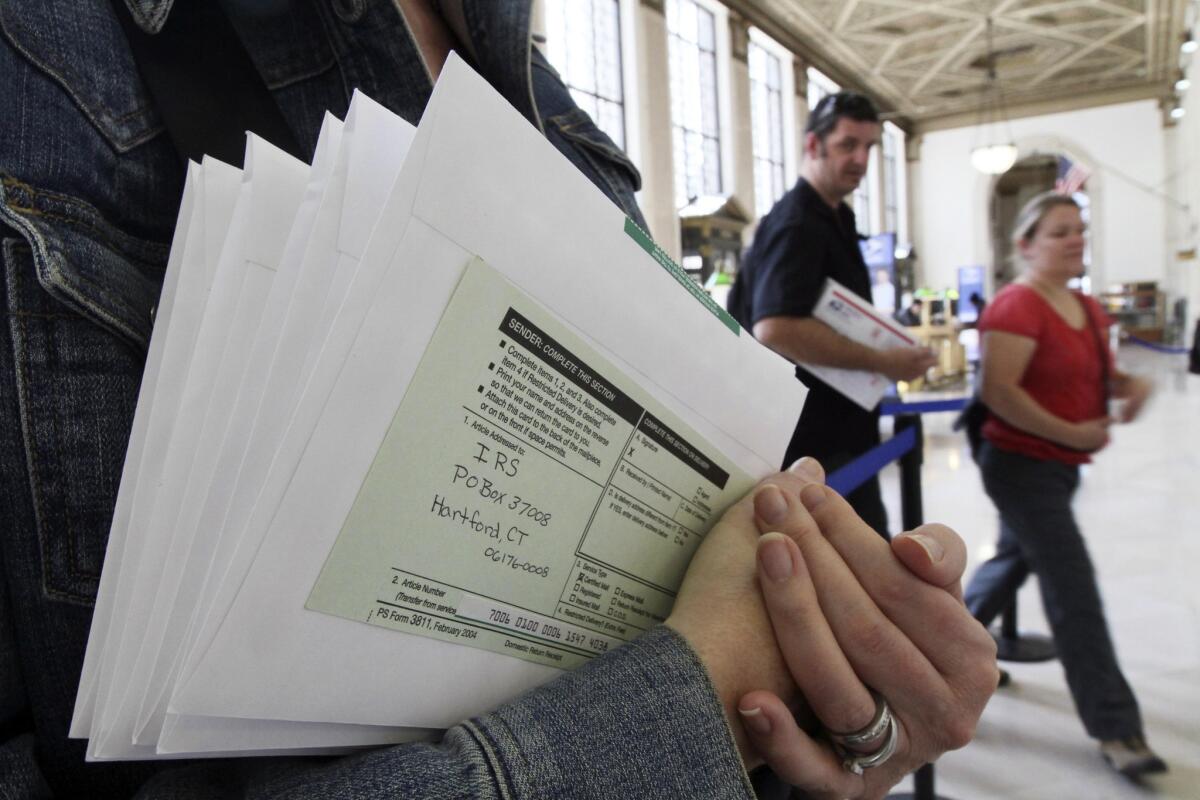

The annual moment of truth arrives.

- Share via

Complaints by and on behalf of America’s wealthy about their crushingly unfair tax burden typically reach a crescendo right about now, with the approach of April 15. They also employ highly refined cherry-picking, by referring almost exclusively to the federal income tax, which indeed is designed to be progressive (the tax rate rises as income rises).

That’s deceptive, for two reasons. One is that the federal income tax system is a lot less progressive than it used to be, a trend that obviously favors the wealthy. (More on that in a moment.)

Second, it ignores the effect of state and local taxes, which fall disproportionately on the working and middle classes. The difference is shown by the latest annual report on “Who Pays Taxes in America,” released last week by Citizens for Tax Justice. (Hat tip to Josh Harkinson of Mother Jones.)

“Contrary to popular belief,” CTJ finds, “when all taxes are considered, the rich do not pay a disproportionately high share of taxes.”

CTJ shows that combined local, state and federal taxes produce a system that more resembles a flat tax than a progressive tax: In 2015, the top 1% will pay 32.6% of their income in taxes, while those in the 60th-80th percentile (with average income of $81,000) pay 30.4% and the next highest 10% (average income of $125,000) pay 32.1%. Overall, the bottom 99% pay 29.8% of their income in taxes, a ratio not much smaller than the top 1%.

A look at the data used by CTJ shows why this happens. It’s compiled annually by the Institute on Taxation and Economic Policy, which issues its own report, “Who Pays,” every few years. The main culprits are sales and excise taxes, which disproportionately hammer lower-income taxpayers. In every state and the District of Columbia, the wealthy pay lower proportions of their income in state and local taxes than the poor, or middle-income households, or both.

The effect is especially strong in states without income taxes and therefore place heavy reliance on those regressive levies. Among the states identified by the Institute on Taxation and Economic Policy as its “Terrible 10,” thanks to the regressive structure of their tax codes, four (Florida, South Dakota, Texas and Washington) have no income tax and a fifth, Tennessee, taxes only interest and dividend income. Six of the 10--the five listed above plus Arizona--get at least half of their revenue from sales and excise taxes, well above the national average of one-third.

Washington, despite its progressive, blue-state reputation, has the most regressive tax system in the country. There the poorest fifth of residents pay seven times as much of their income in state and local taxes as the top 1%.

That brings us back to the federal income tax. Conservatives never tire of complaining about how “skewed” the federal tax system is. This tax season, the Wall Street Journal is out with a new statistical run showing that the top 20% of income earners ($134,000 income and up) accounted for 51.3% of all income but a whopping 83.9% of the income tax; those earning between $47,300 and $79,500, a good swath of the middle class, accounted for 14.8% of all U.S. income but only 5.9% of income taxes.

Conservative commentators like Bloomberg’s Megan McArdle use similar figures to argue that “our fiscal capacity to tax the wealthy” would be exhausted by, say, asking them to pay a fair share of the Social Security payroll tax, from which all wage income over $118,500 and all unearned income is exempt. (We critiqued McArdle’s take on Social Security and the payroll tax last week.)

The truth is that America’s federal tax system is less progressive than those of many other developed countries, and it’s been getting flatter. Emmanuel Saez of UC Berkeley and Thomas Piketty of the Paris School of Economics documented the latter trend in a 2007 paper. (See accompanying graph.) And data from the Organization for Economic Cooperation and Development show that the top marginal U.S. federal income tax rate of 39.6% is well below that of many other developed countries, including Australia, France and Britain (all 45%).

Keep up to date with the Economy Hub. Follow @hiltzikm on Twitter, see our Facebook page, or email mhiltzik@latimes.com.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.