California puts $750 million in tax credits into retaining employers

- Share via

Reporting from SACRAMENTO — California is fighting back in the battle to keep businesses from relocating to lower-cost states.

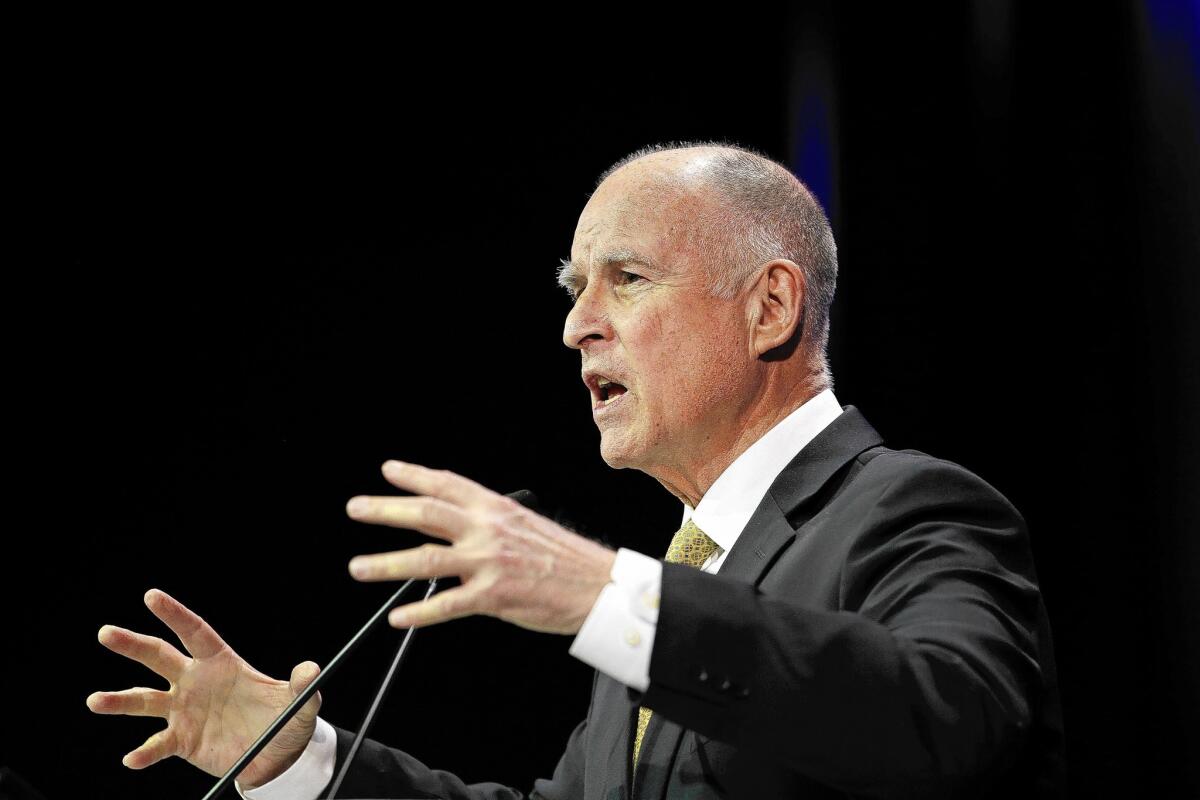

Gov. Jerry Brown’s administration is rolling out a new $750-million program that offers some modest financial incentives to encourage California employers to stay put and help persuade out-of-state companies to move here.

A trio of tax credits, approved by the Legislature last year, are now in play. They’re aimed at preventing high-profile departures by companies such as Toyota Motor Corp. and Occidental Petroleum Corp., both of which plan to go to Texas.

“These tax credits will spur new jobs and help communities hardest hit by the recession,” Brown said in a recent statement unveiling the new sweeteners.

The governor’s tax package includes:

• A reduction in the amount of sales tax a business pays on the purchase of equipment for manufacturing, food processing, biotech, and research and development

• A California Competes income tax credit, negotiated by the Governor’s Office of Business and Economic Development, for companies that invest in new jobs anywhere in the state

• A New Employment Credit on income taxes for boosting the number of jobs for veterans, public assistance recipients and former prisoners in targeted areas with high unemployment and poverty levels

The program “puts California back in the mix for significant manufacturing investments,” said Gino DiCaro of the California Manufacturers & Technology Assn.

The new employment tax credit, for now, is limited to three pilot zones selected by the Brown administration: portions of Riverside, Merced and Fresno counties.

The city of Riverside is already getting the word out to potentially eligible businesses, said Larry Vaupel, the city’s economic development manager.

But benefits from the incentive could be limited, he cautioned, because the state has too narrowly restricted the census tracts where the new hires would need to be living.

Sports fines

It didn’t take long for outrage over tape-recorded comments about blacks made by Los Angeles Clippers owner Donald Sterling to spur legislation at the State Capitol.

Two members of the Assembly last week called for a change in state tax laws to prevent professional sports team owners from deducting from their income taxes the cost of disciplinary fines for misconduct issued by league officials.

Assemblymen Raul Bocanegra (D-Pacoima) and Reggie Jones-Sawyer (D-Los Angeles) said they amended an unrelated Bocanegra bill, AB 877, that’s idling in the state Senate, awaiting a committee assignment.

The lawmakers acted a week after a record $2.5-million fine issued to Sterling by the National Basketball Assn. Sterling also was banned for life from NBA activities.

“Rewarding Mr. Sterling or any other professional sports team owner with tax relief as a result of being fined for despicable behavior is outrageous,” Jones-Sawyer said.

Twitter: @MarcLifsher

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.