Chiron Failure Opens Door to Other Flu Vaccine Makers

- Share via

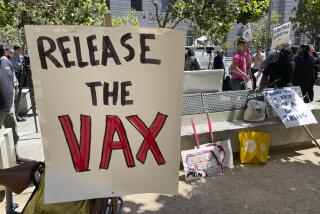

As Chiron Corp. deals with its influenza vaccine mess, some competitors are preparing to take a shot at its $300-million-a-year business in the U.S.

GlaxoSmithKline, the largest vaccine maker in the world, and ID Biomedical, a small Canadian company, have announced plans to sell flu shots in the U.S. ID Biomedical could enter the market as soon as next year.

That would reduce the nation’s reliance on two vaccine makers -- and the odds of another massive shortage.

The competitive interest in making flu vaccines could dispel the notion that there is no money to be made in the business. In fact, over the last five to six years, the wholesale price of a flu shot has jumped to more than $8 from less than $2, far outpacing increases in production costs. What’s more, the market is growing. Demand has risen to about 80 million doses annually from half that in the mid-1990s. U.S. public health authorities aim to vaccinate 150 million Americans annually by 2010.

“It is a very attractive business,” said Anthony Holler, ID Biomedical’s chief executive.

Chiron is feverishly working with regulators in the U.S. and Britain to reopen its factory in Liverpool so that it can supply flu vaccine in 2005. But it could take more time for Chiron to regain the trust of the distributors, hospitals and clinics that were abruptly left without vaccine two weeks ago.

Authorities in Britain suspended Chiron’s license to produce flu vaccine Oct. 5, saying they couldn’t be certain that the shots were free of bacterial contamination. The U.S. Food and Drug Administration confirmed Friday that more than 40 million doses at the factory were unsafe for use.

Chiron’s share of U.S. flu vaccine sales could plummet to 30% in 2005 from what would have been 50% this year, drug industry consultant David Webster said. The Emeryville, Calif., company would lose business to Aventis Pasteur Inc., right now the only other supplier of flu vaccine in the U.S.

Glaxo and ID Biomedical each have offered to provide a small number of shots to ease the shortage -- ID Biomedical 1.2 million doses and Glaxo an undisclosed amount -- a gesture that would give the firms a toehold in the U.S. market. Glaxo supplies flu vaccine to 70 countries outside the U.S. from a factory in Germany, and ID Biomedical provides 75% of Canada’s flu shots.

U.S. public health officials have said they are unsure the FDA could move swiftly enough to approve the shots. The FDA will clear a drug only if the manufacturer can demonstrate that the product is safe and effective, a process that typically takes years.

Even before the Chiron flu vaccine fiasco, ID Biomedical and Glaxo had set their sights on the U.S. Glaxo hasn’t been specific about its plans, but ID Biomedical said in September that it planned a $45-million expansion of its Montreal vaccine factory, which could supply as many as 38 million doses to the U.S. by 2007.

ID Biomedical’s Holler said the company was in preliminary discussions with U.S. health authorities about supplying vaccine in 2005. Holler said ID Biomedical could produce 10 million to 12 million doses for the U.S. next year.

The FDA must act quickly. Holler said it would take time for the company to obtain thousands of additional fertilized chicken eggs in which to make the vaccine. All vaccine makers must begin production by March in order to have shots ready before the start of the 2005 flu season.

Last week, U.S. Secretary of Health and Human Services Tommy G. Thompson floated a proposal that the government purchase as many as 100 million doses each year, a move that could make the flu vaccine business even more attractive to manufacturers.

Experts say the public’s demand for influenza vaccine varies from year to year and is notoriously difficult to forecast. Last year, demand was high because the flu season hit early and hard. There were spot shortages of vaccine though Aventis and Chiron sold all 87 million doses produced, said Mark Steinhoff, a professor at Johns Hopkins Bloomberg School of Public Health.

By contrast, Steinhoff said, manufacturers made 100 million doses in 2002, a mild flu season. The companies were forced to throw out 18 million unsold doses, he said. Wyeth, reeling from lawsuits in its diet drug business and saddled with aging factories, quit the flu vaccine business after that season.

Thompson’s idea could help ensure adequate supplies in bad flu seasons while protecting manufacturers against losses in mild years. ID Biomedical sells most of its vaccine directly to the Canadian government and wants a similar arrangement in the U.S., Holler said.

“Having a guaranteed market is not a bad idea for this vaccine,” Steinhoff said.

Chiron was among the first to sense fresh opportunity in the U.S. flu vaccine business. The company acquired the Liverpool factory in mid-2003 as part of its $878-million purchase of PowderJect Pharmaceuticals, a key supplier of vaccine to the U.S. The timing of the deal gave Chiron a chance to scoop up a portion of the business abandoned by Wyeth.

Chiron committed $100 million for improvements to its facility in England and made plans to boost production. Chiron produced 38 million doses in 2003, an increase of about 50% over the approximately 25 million doses shipped by PowderJect in 2002. Chiron’s plan to deliver 52 million doses this year started to unravel Aug. 25, when the company announced it had found bacterial contamination in some batches of vaccine.

Some on Wall Street said quality control might have been sacrificed in the ramp-up, leading the Medicines and Healthcare Products Regulatory Agency, the British counterpart to the FDA, to suspend Chiron’s license. The British agency said Chiron had failed to follow good manufacturing practices but has offered few details. Chiron hasn’t shed much light on the matter either.

The company faces investigations by the Justice Department and the Securities and Exchange Commission that experts say probably focus on whether the company made misleading statements on its ability to provide vaccine.

Chiron’s problems aside, the outlook is good for the flu vaccine business, experts say. Industry consultant Webster predicts that the price of flu shots will rise again next year. The shortage has underscored the importance of flu vaccination, he said, and stimulated demand for shots. The U.S. market for flu vaccines could one day reach $3 billion, Webster said, up from about $700 million in 2003.

“At $8.50 a shot,” Webster said, “the product is still undervalued.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.