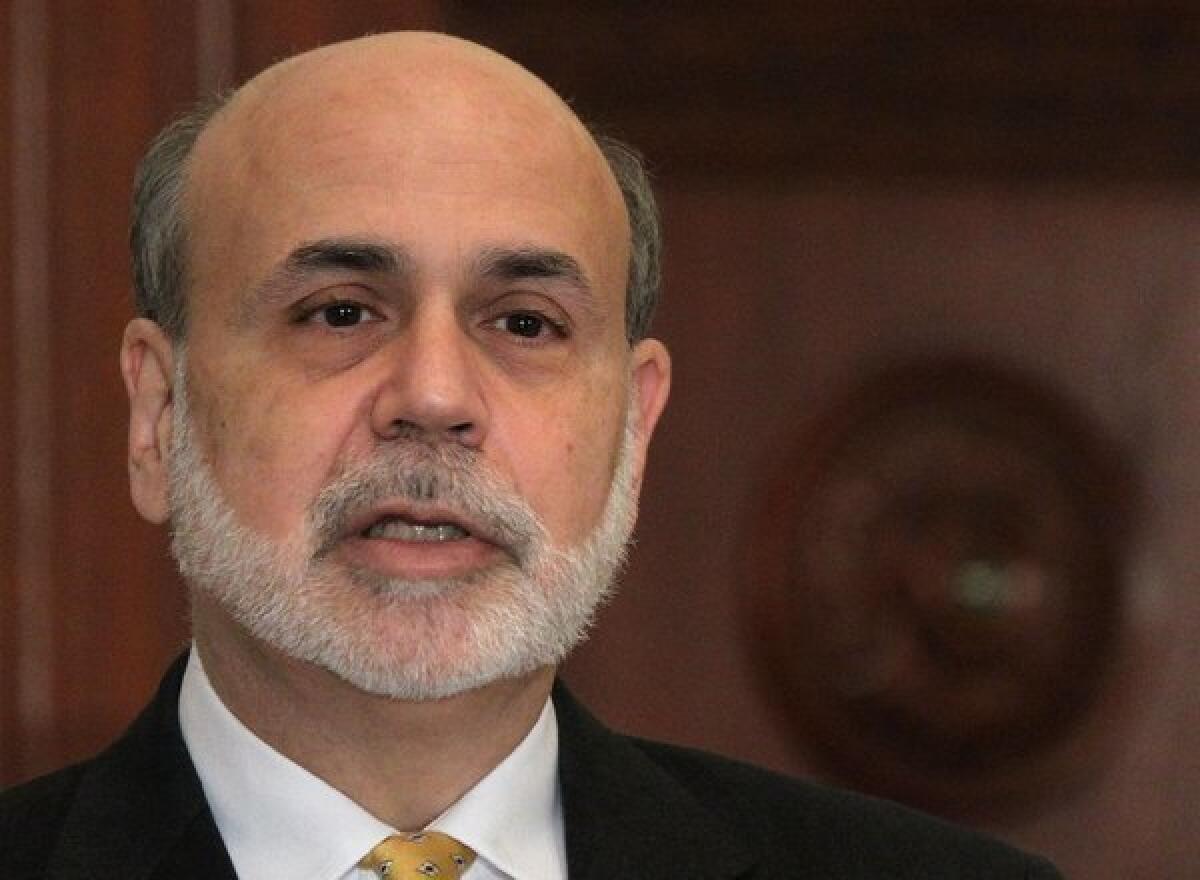

Bernanke calls high unemployment rate ‘an enormous waste’

- Share via

WASHINGTON -- Despite the moderate pace of recovery, the Federal Reserve is so worried about the stubbornly high level of unemployment that it promised to extend its unprecedented stimulus steps until there is “substantial improvement,” Fed Chairman Ben S. Bernanke said.

“The conditions now prevailing in the job market represent an enormous waste of human and economic potential,” Bernanke told reporters Wednesday.

The new goal for the Fed is to get the jobless rate down to 6.5%, the first time it has tied interest rates to a specific unemployment target.

Fed policymakers said Wednesday they would keep short-term interest rates near zero until the unemployment rate fell to 6.5% or lower and the long-term outlook for inflation is not above 2.5%.

Previously, the Fed used a time-range target, saying it was unlikely to raise its benchmark interest rate until at least mid-2015.

The new targets produce roughly the same timetable, as the Fed doesn’t project unemployment would get to 6.5% until mid-2015.

Fed policymakers believed that tying interest rates more explicitly to the state of the economy was better than a vaguer date target, Bernanke said.

The jobs market also is affected by the threat of large tax increases and government spending cuts coming on Jan. 1, he said.

It is crucial for Washington politicians to come together soon on a deal to resolve the so-called fiscal cliff so it doesn’t derail the recovery, Bernanke said.

The tax increases and spending cuts would have “very significant adverse effects on the economy and the unemployment rate.”

And although the Fed would consider more stimulus if the fiscal cliff was not resolved, there would be little the Fed could do to help, he said.

“We cannot offset the full impact of the fiscal cliff,” Bernanke said. “It’s just too big given the tools we have available and the limitations on our policy toolkit at this point.”

[For the record, 2:08 p.m. Dec. 12: An earlier version of this post said the Federal Reserve would keep short-term interest rates near zero until the unemployment rate fell to 6.5% or lower and the long-term outlook for inflation topped 2.5%. Actually, the Fed would keep interest rates near zero until the unemployment rate fell to 6.5% or lower and the long-term inflation outlook is not above 2.5%.]

US Unemployment Rate data by YCharts

ALSO:

Fed renews stimulus efforts, ties interest rates to jobless rate

Big-company CEOs cautious about growth because of ‘fiscal cliff’

More Americans optimistic on the economy even as ‘fiscal cliff’ looms

Follow Jim Puzzanghera on Twitter and Google+.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.