Three Americans win Nobel Prize in economics

- Share via

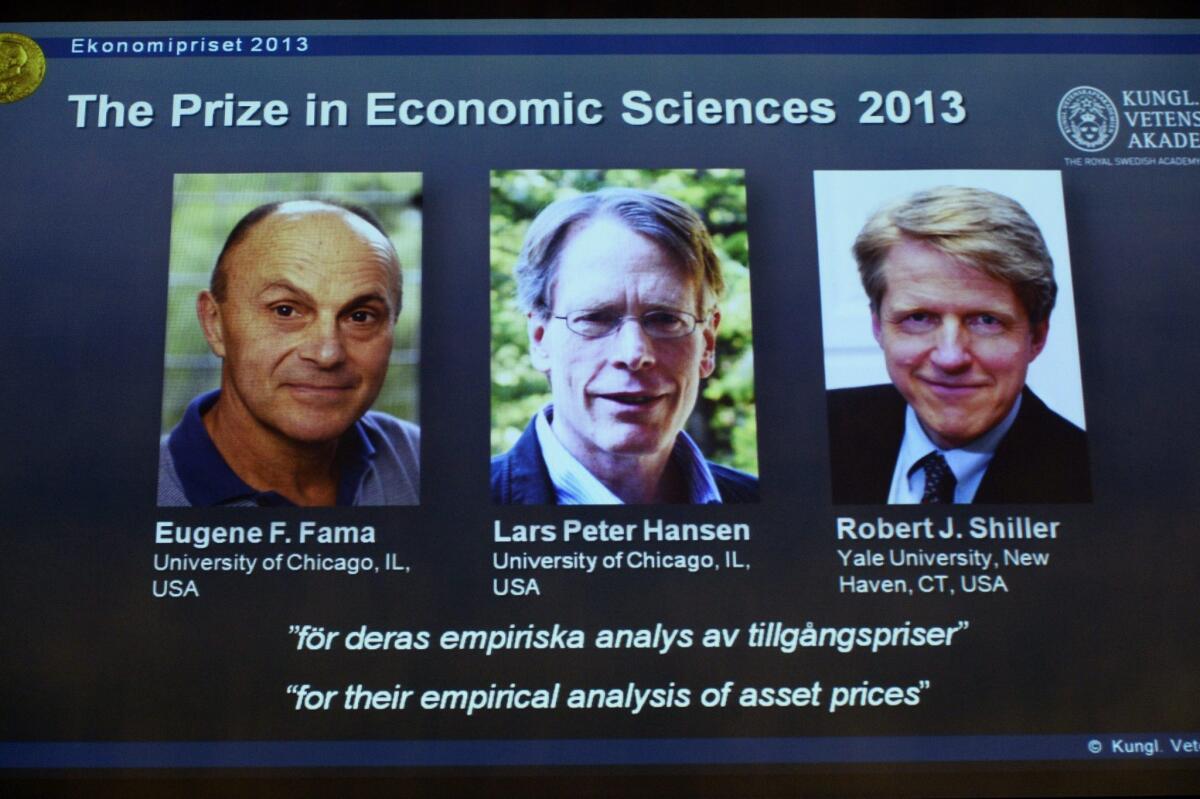

WASHINGTON -- A trio of U.S. scholars on Monday won the Nobel Memorial Prize in Economic Sciences for their research on the predictability of the price of stocks, bonds and other assets.

Eugene F. Fama and Lars Peter Hansen, both of the University of Chicago, and Robert J. Shiller, of Yale University, will share the $1.2-million prize.

“Disbelief, that’s the only way to put it,” Shiller, co-founder of the Case-Shiller housing price index, said by telephone from New Haven, Conn., describing his reaction to the news in an interview with the Royal Swedish Academy of Sciences, which announced the prize.

The academy said the three professors, who worked independently of each other, “laid the foundation for the current understanding of asset prices.”

Their work showed that though there is no way to predict prices of stocks and bonds in the short term, it is possible to foresee price trends in the long run, the Nobel committee said in a statement. “These findings, which might seem surprising and contradictory, were made and analyzed by this year’s laureates.”

The statement said their research has had important practical applications, influencing market practices in many ways, such as giving rise to the index funds, which collect all stocks in passively managed portfolios.

One key aspect of their work is the relationship between asset prices and the broader economy. Changes in asset prices can give important signals to firms and individuals regarding investment and savings, but, as academy officials pointed out, their mispricing can lead to asset bubbles and cause problems for the overall economy, as was the case in the recent financial crisis.

Of the three new economics laureates, Shiller may be the best known to the public, for his housing price index and writings about the housing bubble and the economy. The Nobel committee said he “suggested early on that important risks facing investors are sometimes hard to measure and thus are non-insurable by existing market instruments.”

In the telephone interview, Shiller said although the field of finance has controversial elements, he believed it provides a useful body of knowledge with important implications.

“I would say finance drives modern civilization,” he said, noting society’s best activities have to be financed. “I want to see finance developed further to serve humankind.”

ALSO:

How the U.S. gave up on Nobel Prize research

Caltech economist nets MacArthur genius grant

Alice Munro’s quiet, precise works lead to Nobel Prize in literature

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.