Saying economy is strengthening, Fed’s Powell suggests faster pace of interest rate hikes

- Share via

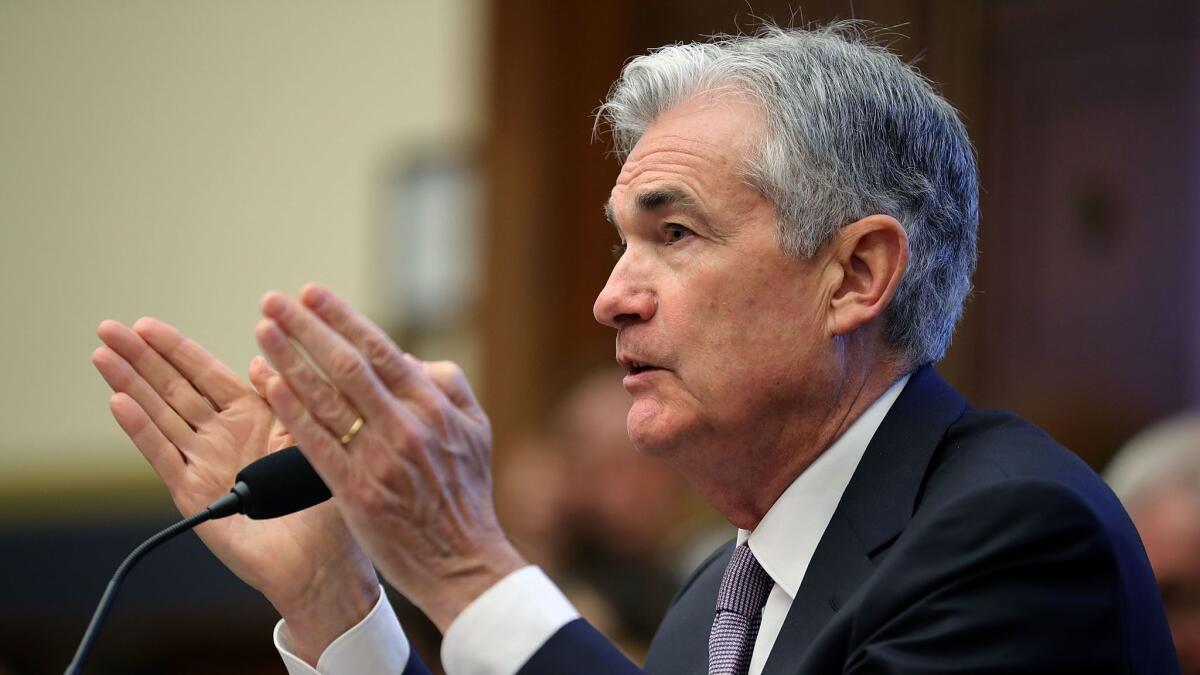

Reporting from Washington — Saying the U.S. economy has strengthened in recent weeks, new Federal Reserve Chairman Jerome H. Powell suggested Tuesday that the central bank could hike its key interest rate faster than anticipated.

Powell said he and his Fed colleagues will try to balance stronger growth with the potential for “an overheated economy” now that “fiscal policy is becoming more stimulative” with tax cuts and increased federal spending.

In his first extensive public comments since taking over as Fed chief at the start of the month, Powell told the House Financial Services Committee that “the economic outlook remains strong” despite recent financial market volatility.

“At this point, we do not see these developments as weighing heavily on the outlook for economic activity, the labor market or inflation,” Powell said during his first congressional appearance since becoming Fed chief.

Even though the nine-year economic expansion is the second-longest in the nation’s history, Powell said he was not concerned a downturn is looming.

“There’s always a risk of a recession at any given point in time,” he said. “I don’t see it as at all high at the moment.”

Powell struck an upbeat but cautious tone in his initial remarks.

He did not indicate whether the Fed would accelerate its pace of interest rate hikes, saying that the central bank’s policymaking Federal Open Market Committee still viewed “further gradual increases” in the benchmark federal funds rate as the way to “best promote attainment” of the dual objectives of stable prices and maximum employment.

Fed officials indicated in December they expected three small rate increases this year.

But pressed on developments since then — including implementation of the tax cuts and economic data showing higher wage growth and consumer prices — Powell acknowledged his views on the economy have improved.

Then he indicated the forecast for rate hikes this year might increase when the policymaking Federal Open Market Committee meets on March 20 and 21.

“My personal outlook for the economy has strengthened since December,” Powell said. “I wouldn’t want to prejudge that new set of projections, but we’ll be taking into account everything that’s happened since December.”

His comments about 40 minutes into the hearing caused the yield on 10-year Treasury bonds to jump and major stock indexes to begin dropping as investors anticipated a fourth rate hike this year, which would be designed to slow growth to keep the economy from overheating.

Powell “certainly opened the door” to a fourth small rate hike this year, said Diane Swonk, chief economist at accounting and advisory firm Grant Thornton. She is forecasting a fourth rate hike this year and warned that a recession could come in late 2019 or 2020.

“I’m worried that we’re feeding a boom-bust cycle,” she said of the stimulus from tax cuts and spending increases at this stage of the economic expansion. “That means that things will get better before they get worse, but then things will get much worse.”

The yield on the 10-year Treasury increased in a matter of minutes Tuesday, from 2.86% to 2.92% and stayed at about that level for the rest of the 3 1/2-hour hearing. It closed at 2.9%. Major U.S. stock indexes were down about 1.2% after being up slightly before the hearing.

“That did spook the market a little bit…seeing that we may have a slightly quicker trajectory in the interest-rate cycle,” said Myles Clouston, senior director at Nasdaq Advisory Services, which provides analysis to publicly traded companies. But he stressed that rising rates aren’t necessarily a bad thing because they show the economy is improving.

Powell declined to be pulled into the heated political debate in Congress between Republicans and Democrats over the tax cuts enacted at the end of last year.

He was greeted by Rep. Jeb Hensarling (R-Texas), the committee’s chairman, who railed against what he called the substandard economic growth caused by “high taxes and heavy-handed regulatory policy” of the Obama administration.

“Fortunately with the election of Donald Trump and the passage of the Tax Cuts and Jobs Act, that has all changed,” Hensarling said. “Unemployment is now at a 17-year low, wage growth is the fastest in almost a decade and companies all over America are now announcing bonuses to their employees and expansions in their communities.”

But Rep. Maxine Waters (D-Los Angeles) told Powell that she was “concerned that the hard-earned economic recovery, which came as a result of policies and reforms put in place by President Obama, Democrats in Congress and the Federal Reserve, will be undermined by the reckless and misguided policies of this president and congressional Republicans.”

Powell, a Republican, didn’t take sides.

He wouldn’t say whether the large corporate tax cut would lead to significantly higher wages for workers, as Republicans have claimed by pointing to the roughly 400 companies that have announced pay changes since the tax cuts were passed, most in the form of one-time bonuses instead of salary increases. Powell also wouldn’t say whether the increasing federal budget deficit this year caused by the tax cuts and higher federal spending would lead to faster rising interest rates.

His responses showed he already was adept at the evasive answers that have become a trademark of previous Fed leaders.

Fiscal policy changes can have an effect, and changes of this size can have an effect, and that can be seen of course in the path of policy. It’s very hard to say in advance what that would be,” Powell said in response to a question from Rep. Brad Sherman (D-Porter Ranch) about the potential negative impact of the Republican actions. “Our own job is to focus not on fiscal policy but on monetary policy.”

Sherman responded by saying, “Thank you for evading my question.”

Under normal circumstances, the first testimony and extended public comments by a new Fed chief would be highly anticipated. But given the recent market gyrations — triggered by concerns that a strengthening economy would lead the Fed to raise its key interest rate faster — Wall Street was paying extra close attention to Powell’s appearance on Capitol Hill Tuesday.

Powell took over for former Fed Chairwoman Janet L. Yellen on Feb. 5, and on his first day in office, the Dow Jones industrial average experienced its largest one-day drop, plunging 1,175 points. Three days later, it tumbled more than 1,000 points again.

Investors were concerned that the large tax cuts and a big boost in federal government spending would push inflation higher, in turn triggering an increase in interest rates that would slow growth and make stocks a less attractive investment.

The Dow and broader Standard & Poor’s 500 index at one point this month were down 10% from their recent highs — what’s considered a market correction — but have recovered most of those losses.

Powell did not indicate any alarm over financial markets and noted that inflation continues to run below the Fed’s 2% annual target.

“In gauging the appropriate path for monetary policy over the next few years, the FOMC will continue to strike a balance between avoiding an overheated economy and bringing … inflation to 2% on a sustained basis,” he said.

“While many factors shape the economic outlook, some of the headwinds the U.S. economy faced in previous years have turned into tailwinds: In particular, fiscal policy has become more stimulative, and foreign demand for U.S. exports is on a firmer trajectory,” Powell said.

President Trump opted not to nominate Yellen, a Democrat, for a second four-year term. He instead turned to Powell, who has served on the Fed’s board since 2012 and has supported Yellen’s gradual increase in the central bank’s benchmark interest rate as well as tougher financial regulations.

Twitter: @JimPuzzanghera

UPDATES:

1:05 p.m.: This article was updated with the market closing figures.

11:05 a.m.: This article was updated with comments from investment manager Craig Pernick of Chevy Chase Trust.

9:50 a.m.: This article was updated with the effect of Powell’s comments on Wall Street.

8:55 a.m.: This article was updated with additional comments from Powell and lawmakers at the hearing.

7:25 a.m.: This article was updated with Powell delivering his remarks.

This article originally was published at 6:55 a.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.