Several California Republicans remain undecided as House bill is expected to pass

- Share via

Though the House

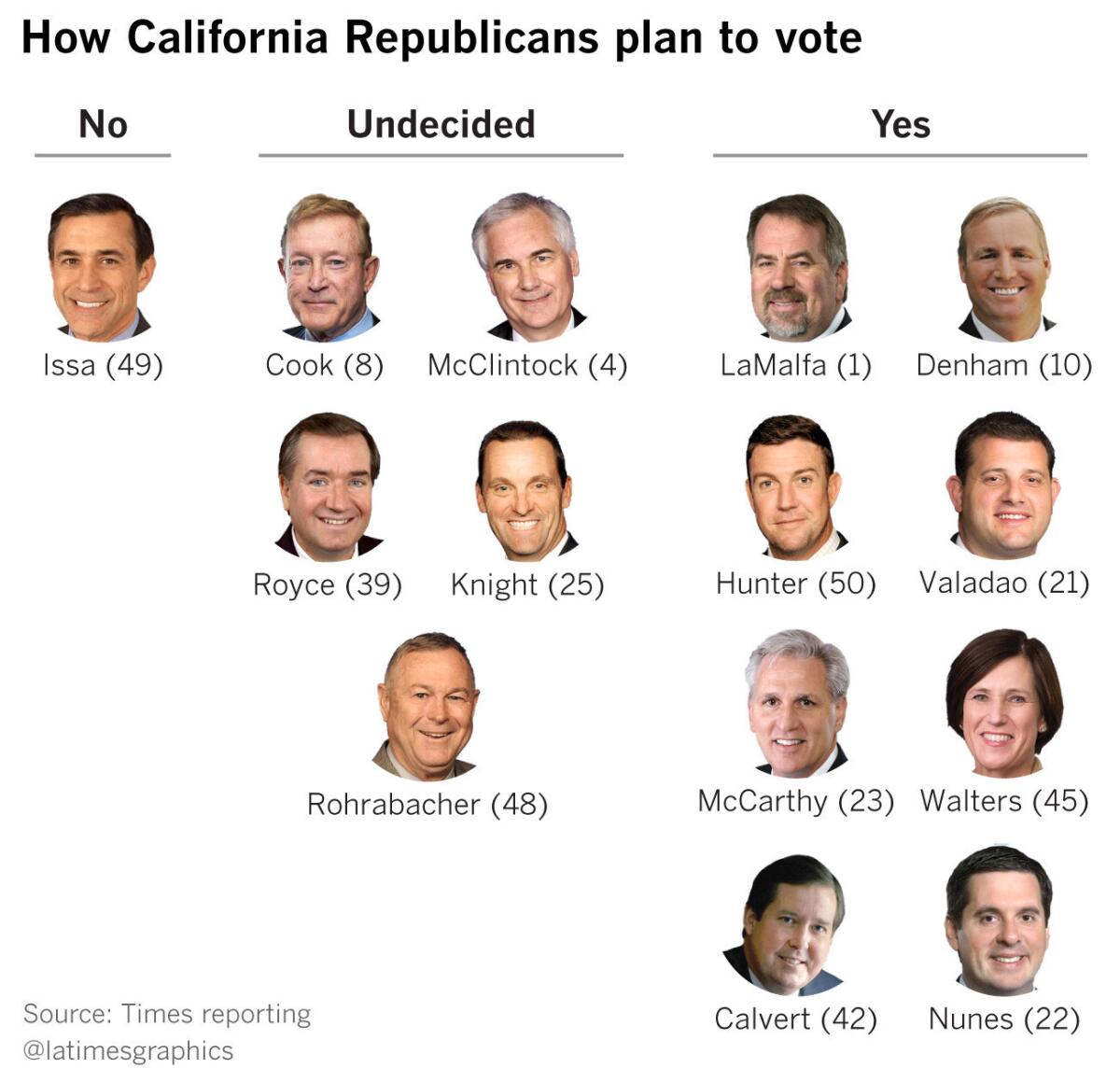

Eight of the state’s Republicans plan to vote for the bill and one is leaning toward voting yes. Four others are undecided, and only Rep.

The bill tightens state, local and mortgage interest tax breaks, which are popular with Californians, and the state delegation has been bombarded with pressure from all sides: Fellow Republicans desperate for a legislative win, constituents, real estate lobbyists, and Democratic officials in California, including Gov. Jerry Brown.

Rep.

His concerns drew the attention of House Speaker Paul D. Ryan (R-Wis.), who spoke with him afterward. But McClintock, who was just added to the list of 10 Republicans that Democrats are targeting in next year’s midterm election, remained unconvinced.

“I’m still awaiting a satisfactory assurance that the end product will not do harm to American families,” he said Wednesday.

Costa Mesa Rep.

"I don't know. I'm looking at all the numbers that are being bandied around, and the numbers as to whether or not a significant number of my constituents are going to be facing a tax increase, and if that is the case, I'm not going to vote for it," Rohrabacher said Tuesday.

But he also said he might vote for it in hopes of a compromise when the House and

"I'm just really intensely looking at it," Rohrabacher said. "This is not a clear-cut decision because there are many different factors at play."

Rep.

“We’re still talking about; that’s all. I’m just still talking about it. I have to say my prayers and get divine guidance,” Cook said. “And if I’m right, I’m going to vote the right way and go to a race track right afterward.”

While several California yes votes will come from enthusiastic supporters of the legislation, like House Majority Leader Kevin McCarthy of Bakersfield, some Californians in the House said they planned to vote for the bill Thursday just to move it forward. Similar to Rohrabacher, they expect changes when a final bill is negotiated between the House and Senate.

The current Senate bill contains even deeper cuts to the state and local tax break, but maintains the mortgage interest deduction. It also repeals the

Rep.

“California is a very liberal state. We have very liberal policies, we have very high taxes, we have a very high cost of housing, and we want to make sure that our middle-income Americans have more money in their pocket at the end of the day when this bill is complete and put on the president’s desk,” Walters said. “They have given us assurance that they will help provide some more relief for Californians.”

Rep.

"There's a lot of great things that stand out about the tax bill. We're getting it to a place where if we can just work out a couple of these smaller issues, we know the economy is going to boom with this," Knight said. "We're still talking — we're still chatting."

The only California member who has said he’ll vote against the plan, Issa, warned his colleagues against getting burned like he did earlier this year, when he voted for the House Affordable Care Act repeal plan in hopes it would improve in the Senate, only to watch it die there. He said using that strategy for the tax bill is the wrong move.

"This is a pretty good bill from a business standpoint and a poorly thought-out bill on the nonbusiness side," Issa said Tuesday. "I know it's not going to change, and I'm just going to have to make a vote of conscience."

Staff writer Lisa Mascaro contributed to this report.

Follow @sarahdwire on Twitter

Read more about the 55 members of California's delegation at latimes.com/politics

ALSO

Some GOP senators raise doubts about revised Republican tax overhaul

California could flip the House, and these 13 races will make the difference

Updates on California politics

UPDATES:

9:01 a.m.: This article was updated with details on the bill’s expected passage.

This article was originally published at 12:05 a.m.

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.