Bank’s Buyer : Arab’s Hunt for Bargains Spans World

- Share via

Ghaith R. Pharaon, the Saudi Arabian who made a fortune in construction in his homeland and and then turned much of his attention to the United States, likes to portray himself as a simple bargain hunter, whether he’s shopping for antiques or banks.

Giving visitors a tour of his mansion in Jidda two years ago, Pharaon quickly walked past such showy objects as a set of eight-foot elephant tusks, two man-sized 18th-Century Japanese vases and a huge oil painting of an Arabian horseman wielding a flashing sword. “You’re looking at the wrong things,” he said of those.

Pharaon stopped instead at a wall display of modest-looking blue-and-white serving plates. “ These ,” he explained, “are the really expensive things. Chinese, from the Ming Dynasty.”

The point of pride was that they had not been expensive for Pharaon, who said he discovered them in a shop in the Maldives, the group of islands in the Indian Ocean. “This one I got for $25,” he said, gesturing at a plate decorated with a drawing of flowers. “I had it appraised and found it was worth 25,000 pounds,” about $60,000 at the exchange rate at that time.

Then he laughed, deeply and with pleasure.

Pharaon talks much the same about banks in the United States, the pursuit of which also has been a hobby of his for the past decade.

“In America, a $400-million bank can be acquired for $20 million,” he remarked once. “Where else can you do that?”

But the purchase of Encino-based Independence Bank, completed last week, is not a typical acquisition for the 45-year-old Pharaon.

In three previous moves to set up a U.S. banking base, Pharaon had shown a preference for high-profile deals involving prominent business and political figures.

In 1975, when he bought a substantial interest in the Bank of the Commonwealth in Detroit, Michigan’s sixth largest bank, auto maker Henry Ford II helped smooth the way by calling local Jewish leaders to ease their concerns about the takeover of the bank by an Arab. In 1977, he bought a 20% interest in the Main Bank of Houston, one of whose major shareholders was former Texas Gov. John Connally. Then, in 1978, he bought out the controlling interest of Bert Lance, President Jimmy Carter’s close friend, in the National Bank of Georgia.

1,800-Acre Plantation

Pharaon’s apparent fascination with American power brokers was underscored again several years ago, this time in his personal life, when he went shopping for a part-time U.S. home for his family. He settled on a 1,800-acre plantation near the Georgia coast that once was the winter residence and laboratory of Henry Ford.

In contrast, Independence Bank is hardly a glamorous property. Although it is the largest bank based in the San Fernando Valley, Independence is basically a consumer-oriented institution known for installment and real estate loans. And its former owners--it was founded 23 years ago by a group of Canoga Park businessmen, then sold in 1980 to investors from the Far East--were not front-page personalities.

The acquisition of the 10-branch bank, however, is consistent with Pharaon’s insistence that he has been miscast as another wealthy Arab who throws his money around, in his case presumedly to gain favor with influential figures. Pharaon was particularly perturbed by suggestions that his original National Bank of Georgia investment, a $14-million deal for 60% of the stock, was an overly generous bail-out of Lance, who had been forced to resign as Carter’s budget director because of questions raised about his banking practices and debts.

‘Everyone Was Doubting’

“People thought I was coming in with megabucks to salvage somebody,” Pharaon said several years after he had paid $20 a share for the bank’s stock, about twice the market price. “Everyone was doubting whether we were really prudent investors.”

At the time, Pharaon was gloating over the bank’s annual report for 1982, which showed it had changed from a struggling bank into a money-maker, earning $3.9 million that year. The bank’s profits have grown since then, with earnings reaching $10.4 million last year.

“I think that, if you have recently seen the results with the National Bank of Georgia, you will come to the conclusion that the investment was a good one,” he said. “If all my investments did as well as that one, I should be a very happy man.

“Any time you can buy a bank that makes money for below book, my advice to you is buy it!” he said, again offering the deep laugh that is one of his trademarks.

Son of Influential Statesman

Pharaon could not be reached for comment on his purchase of Independence Bank. But analysts said that the estimated $23-million price was slightly above book value in this case. James Alexander, president of J. Alexander Securities of Los Angeles, said the sum was “right in line” with market prices, with perhaps a slight advantage for the buyer.

Pharaon is the son of one of his country’s most influential elder statesmen. His father, Dr. Rashad Pharaon, is a Syrian by birth who decades ago served as personal physician to the legendary King Abdul Aziz ibn Saud, founder of the modern Kingdom of Saudi Arabia. Rashad Pharaon has been a close adviser to every royal family since.

Ghaith Pharaon was sent to the United States for his higher education, attending the Colorado School of Mines from 1958 to 1961, Stanford University from 1961 to 1963 and the Harvard Business School, where he received his MBA in 1965. (Editions of the Harvard Business Review have adorned the magazine rack in a conference room on his private jet, a customized Boeing 727.)

Thesis Was Business Plan

It was in his thesis at Harvard that Pharaon drew up plans for the business that would make him one of the world’s wealthier men.

He established the Saudi Research and Development Corp., known as Redec, an engineering and construction firm that plunged into the massive development projects in Saudi Arabia made possible by the increasing value of the nation’s oil reserves.

Often in joint ventures with foreign companies, Redec won contracts, worth more than $200 million each, to build new sewer systems in Jidda and Dammam, a storm-water drainage system in Mecca and a natural-gas gathering system in the country’s eastern provinces. Pharaon also began importing much of the cement used in Saudi Arabia.

Diversifying into enterprises as wide-ranging as food storage, hotels, insurance and computer services, Redec became a $2.5-billion-a-year conglomerate, by Pharaon’s estimate. In 1983, Pharaon said there were about 16,000 employees in the company, which has offices in London, Paris and Jidda.

‘Dabbling in Banking’

Pharaon also became the largest shareholder in the Bank of Credit & Commerce International, a Luxembourg-based bank with extensive interests in the Middle East.

Pharaon once called an American banking investment “dabbling in banking.” His “dabbling,” though, has prompted some high expectations for the banks he has targeted--with mixed results.

When he bought the Bank of the Commonwealth, he said he hoped that the bank would become a “catalyst” to promote more trade with Saudi Arabia, particularly among the bank’s major industrial customers. The bank’s chairman went a step further, saying that Pharaon’s goal was no less than “to establish Detroit as a major center for trade between the Middle East and the U. S. and generate a significant influx of investment capital for the bank.”

But Pharaon found the bank, which had a history of financial troubles, a bad investment. He sold his interest a year later, for the same amount he had paid.

Sold Stock

Pharaon’s ownership role in Main Bank also was short-lived. Although he made multimillion-dollar investments in Texas--in architectural engineering and construction firms based in Dallas and Houston--he sold his bank stock after 10 months, about the time he was buying Lance’s bank.

“I decided to concentrate everything in Georgia,” he said. “I divested myself of my other investments and decided to concentrate my banking activities in the States in that bank.”

Lance said he found Pharaon to be a businessman “able to quickly make a decision.” Others, however, have said that the same quality may have gotten the Saudi into the bad deal in Detroit.

A more modest acquisition than the Bank of the Commonwealth, the National Bank of Georgia was considered a consumer and small-business bank. This time Pharaon was reserved in his predictions of an increasing international focus for his bank.

Expanded Locally

“If you find you got more clients interested in domestic operations, why should you look at international?” he asked.

Pharaon, accordingly, expanded locally. He formed a holding company and bought three other banks with branches in Atlanta’s suburbs. He also eventually acquired all the outstanding shares of the Georgia bank.

Pharaon’s profile as its owner has contrasted considerably with his high-profile purchase of the bank. Perhaps in recognition of the ambivalent attitude of Americans toward Arab investments, an annual report never mentioned the name of the person it referred to merely as “the sole shareholder.” Pharaon also hired a Jewish member of the Atlanta City Council as a vice president.

Student of Botany, History

Pharaon has said that his other interests make it impossible for him to be involved in the “direct management” of such an investment. He did play an active role, however, in the design of the National Bank of Georgia’s new headquarters, built on the Chattahoochee River, which cuts through Atlanta. The native son of a desert land ordered additional terraces and a park atop the garage.

A student of botany and history, Pharaon spent several hundred thousand dollars on studies of the old Ford plantation at Richmond Hill, Ga., a small enclave on the Ogeechee River south of Savannah, before he renovated it for himself, his Greek-born wife and their four children. Each of the 146 live oaks on the property was catalogued and 150-year-old brick was purchased to restore the Greek Revival Mansion and Ford’s former laboratory, which now houses the headquarters of Pharaon’s North American operations.

Discusses Life Style

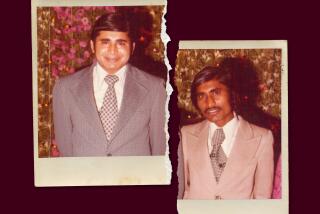

Pharaon is a plump, round-faced man with wavy, graying hair thinning at the temples and a Vandyke beard. He wears the traditional Arab robe and headdress in his homeland but conservative Western suits when on business out of the country.

As with many wealthy Saudis, Pharaon is not shy about discussing his life style, well aware of the curiousity of outsiders. He joked that the river alongside his part-time plantation would allow only “a small boat,” which for him meant one 55 feet long.

But Pharaon repeatedly fights against the notion that his wealth might be used foolishly, whether on a bank or one of the many questionable projects people push his way.

In 1983, Pharaon’s brother lost $14 million when a Lebanese businessman told him he could get $1 billion from Libyan dictator Moammar Kadafi for providing “strategic materials,” apparently parts for an atomic reactor. The man took Mezan Pharaon’s money, but produced no material and the deal proved an embarrassment to the Pharaon family.

A top aide to Ghaith Pharaon shook his head as he recalled the bizarre real estate deals and other proposals that come across his boss’s desk. They included one for Los Angeles. Someone once asked Pharaon to bankroll the $500-million construction of a duplicate of the Eiffel Tower in the city, the aide said.

That was one bargain Pharaon turned down.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.