Sherman Oaks-Based Cooperative Still No. 1 in Citrus : Sunkist Basks in Glow of Trademark Created in 1909

- Share via

The secret to Sunkist’s success in dominating the American citrus industry is largely in its name.

Devised by clever admen back in 1909, the “Sunkist” trademark, now stamped on each piece of fruit grown by members of the Sherman Oaks-based cooperative, has effectively turned plain old oranges, grapefruits, lemons and tangerines into brand-name products.

Through heavy advertising, Sunkist Growers has helped make people citrus-conscious. It was Sunkist that, with its “Drink an Orange” advertising campaign in magazines in 1916, introduced many people to Vitamin C.

And it was the Sunkist name on bottles and cans of orange soda that became a symbol of California life through “Good Vibrations” television ads featuring surfer music and beach volleyball.

Fruit Viewed as Better

“People hear ‘Sunkist’ and they think, ‘Hey, wow, sunshine,’ ” said John M. Grether, who farms 130 acres of lemons in the Ventura County community of Somis near Moorpark for Sunkist. “They also think a Sunkist fruit is better than anyone else’s.”

Sunkist says its surveys confirm that most people in the U. S. and Canada believe fruit stamped with its name is better than other fruit. So the company is focusing its advertising on the next consumer generation by advertising its fresh produce to children. But the name is also promoted through products licensed to other companies, such as the orange soda.

According to Foote, Cone & Belding, the advertising agency that has handled the Sunkist account for 77 years, 60% of citrus fruit in American stores has Sunkist stamps.

Competitors grouse that Sunkist has an unfair marketing advantage. They say that Sunkist, through its support of federal regulations on how much fruit reaches the consumer, is keeping too tight a control on the industry.

Sunkist Oranges Cost More

They also say the company uses its name to charge consumers more--and Sunkist readily acknowledges that its oranges cost at least two cents more apiece than anyone else’s.

“Most consumers are more interested in price than name,” said Steven W. Sutter, treasurer and secretary of Pure Gold, a citrus cooperative based in Redlands that also stamps its products with its name.

But, if the truth be known, the difference between one citrus fruit and another is mostly cosmetic.

Growers and marketers alike say that consumers want big, perfectly round, deep-orange-colored navels, for example. Oranges are waxed in packing houses just for appearance. Growers say they fear the Santa Ana winds, which bruise their fruit in the fall, almost as much as insect damage.

Industry experts agree that fruit from California and Arizona, where all Sunkist produce comes from, is more attractive. Only 10% of Florida citrus fruit appears unprocessed on store shelves, compared with more than 70% from California and Arizona. The rest is made into orange juice and other products.

Weather Makes Difference

Weather apparently makes the difference. Citrus fruit growing with hot days and cool nights tends to look better than produce raised in around-the-clock balmy weather, which is more the case in Florida and South America.

The California-Arizona region is also the only yearlong citrus-harvesting area in the world. The two states have 330,000 acres of citrus groves, 200,000 of which are owned by the 6,000 Sunkist growers. Citrus groves stretch from Sacramento to Yuma, Ariz.

Unlike other agricultural businesses, Sunkist remains fairly stable from quarter to quarter, cooperative President Russell L. Hanlin said. Of Sunkist’s mainstay, oranges, the Valencias are harvested in the summer and navels in the winter.

Nevertheless, some years are better than others. Sales for fiscal year 1983 dipped 8% from the previous year, to $644 million, then rose 16% to $748 million for 1984. In fiscal year 1980, sales were $654 million.

Growers contribute to the cooperative for administrative and marketing costs, advertising and a Sunkist capital fund. Rates vary from season to season, and a grower’s commitment lasts only a year.

Growers say they must weigh the charges against the benefits of the Sunkist network. A 40-pound carton of navels brings Sunkist about $8.50, and 55 cents of that goes into marketing and administrative costs. Another penny goes into the capital fund.

66 Members

The company has 66 member packing houses, where the fruit is graded, waxed and stamped. At the Sherman Oaks headquarters, 310 employees manage grower relations and the marketing network.

As a cooperative, Sunkist sells the fruit and returns to its growers the money that doesn’t go into overhead and its own income. In fiscal year 1984, Sunkist paid $545 million to its members, up 29% from the previous year. The company retained $4.8 million as income.

During the first nine months of this fiscal year, sales were $630 million, up 10% from the same period a year earlier. Payments to members were $473 million, up 13% from the year before. The company retained $2.6 million as income.

But Hanlin says revenues for the period should have been higher. In an Oct. 8 letter to growers, Hanlin said last season’s lifting of federal limits on sales cost California and Arizona growers $10 million.

The limits, called prorates, were first enacted by Congress in 1937 to save family farms during the Depression. They determine the amount of produce that can enter the marketplace each week, to avoid gluts and to prepare for the possibility of shortages.

The prorate for navel oranges was lifted by the U. S. Department of Agriculture for the 1984-1985 season in February, midway through the harvest, which lasts in California and Arizona from early November until June. It had last been lifted in 1952.

No decision on prorates for this year’s crop has been made, according to the USDA.

Carl A. Pescosolido, an independent grower with 5,000 acres in the San Joaquin

Valley, has been the unofficial leader of the anti-prorate movement since the late 1970s.

Pescosolido says Sunkist uses the government limits to keep prices artificially high and maintain its market share. “Maybe it’s not the Sunkist name that has allowed it to maintain its position,” he said.

A thorn in the cooperative’s side, Pescosolido acquired the names of Sunkist growers over the summer, and has been soliciting them to protest the prorates. Sunkist’s Hanlin, in turn, accuses Pescosolido of having “set about discrediting a law he has repeatedly violated.”

Federal Suits

In fact, two civil suits filed by the federal government accuse Pescosolido of ignoring the USDA marketing orders. Pescosolido said the suits, which are pending in U.S. District Court in Fresno, are unfounded, and that they are part of a conspiracy to silence him.

Ken Wiseman, a former Sunkist farmer who manages Belridge Farms in Kern County, says the prorate system takes away any incentive to raise and sell more fruit. “The system preserves mediocrity,” he said. A wholly owned subsidiary of Shell Oil, Belridge Farms, with 20,000 acres, produces less than 1% of California’s citrus.

Fruit for export or processing into juice or other products is exempt from prorates.

Until the 1970s, American growers had a strong presence in the European market. But increasing transportation prices, along with higher European tariffs, have prompted growers to look more to the Pacific Rim for customers. Sunkist sends one-third of its produce abroad, much of it to Japan.

Pescosolido said Sunkist has hurt growers by licensing its name for such products as orange soda, which is marketed by R. J. Reynolds Industries, fruit rolls and chewable Vitamin C tablets. He said the growers suffer as consumers turn to those products rather than buying fresh oranges.

Growers Get Royalty

That’s not how Sunkist sees it. For one thing, a royalty is paid back to growers from the licensing of the Sunkist name, the company notes.

Stephan Blinn, a vice president for Foote Cone’s Los Angeles office, which handles the Sunkist account, said most of the advertising budget in the Sunkist name is paid for by licensees.

Sunkist said its fresh-fruit advertising budget is merely $6 million annually, with much of the money spend on commercials during Saturday morning cartoons. The targeting of children is “vital to maintain the quality image,” Blinn said. For example, advertisements show children asking their parents for Sunkist fruit instead of sweets.

The beach-scene image is perpetuated by Sunkist-licensee R. J. Reynolds and others. The Winston-Salem, N. C., company was a sponsor of last year’s Ocean Pacific Pro Surfing Championship in Huntington Beach.

Reflects on Products

Worldwide, more than 200 products with the Sunkist name are advertised at an annual cost of about $60 million, Blinn said. As long as the trademark comes across, it reflects back on all Sunkist products, he said.

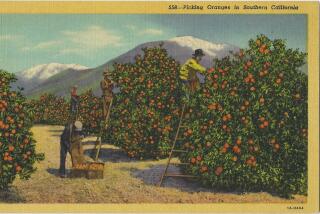

Sunkist has always emphasized its name, promoting the image of oranges “kissed by the sun” to winter-weary Americans. For example, a 1971 magazine advertisement promised “six months of California sunshine burst free when you open a Sunkist orange.”

The first Sunkist oranges came wrapped in labeled tissue paper. The wrapping was expensive though. In 1926, Sunkist unveiled a machine that could stamp oranges with a clear imprint along the curved surface.

But a machine for stamping lemons, which were more difficult to position, was not developed until the 1940s.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.